Introduction

The economic dependence on oil-derived fuels has made global economies vulnerable to economic variability. This commodity has intrinsic price dynamism and hence the reliance on it as a major economic sustainer has proved to be a major macroeconomic challenge (Mina 384). The demand and supply of oil have historically shown a form of market instability. Such elasticity has induced greater than expected changes in economic conditions of countries and states that have been heavily reliant on oil and its products (Mina 385). Economic diversification and structural transformation continue to play critical roles in influencing the future of macroeconomic performance (Al-Tamimi, Alwan, and Rahman 10). Among the countries that attribute their tremendous success to oil and its products is the United Arab Emirates (UAE). With what is commonly referred to as the ‘oil curse’, questions as to whether the UAE can avoid a looming macroeconomic overhaul through diversification continue to be asked.

The UAE Economic Background

The UAE is the eighth largest oil producing country. The free market economy and the immense political stability have both contributed in giving the country a competitive advantage in the world economic sector. The rate of economic growth in this country has been high over the past decade, thanks to the increasing oil prices. Additionally, the growth is also attributable to the resurgence of its tourism industry, trading activities, and transport. The significant economic stability has also resulted from the reorganization of the debts owed by high profile companies.

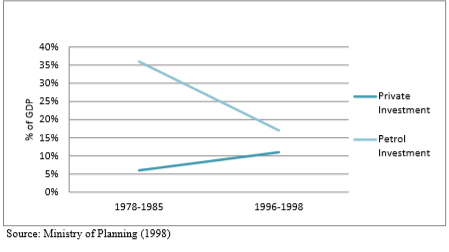

The period during the 1970s marked the duration when the UAE experienced high growth rate. This exponential growth then came to an abrupt halt in the 1980s when a downside trend of the oil prices subjected this economy to an inevitable decline. From then to just before the beginning of the 21st century, the economy experienced a series of fluctuations due to the rapid population growth experienced. The majority of investments during the 20th century centered towards private developments. Investments in petrol products depreciated during this period.

Five years after the 2010 economic dip, the Gross Domestic Profit (GDP) of the country had surged to approximately 419 US dollars as at the end of 2014. Comprising of the third largest Middle East economy, the GDP per capita is only inferior to that of Qatar. The country has experienced a tremendous GDP growth rate averaging to approximately 6% yearly. Important to note is that this progress in the recent years has been due to the steps taken to diversify the economy to avoid reliance on oil. Then, the rising oil pricing played a huge role in ensuring that this economy achieves the financial heights that it has gained.

Economic Indicators forecast overview

Lower oil prices are changing the economy of the UAE to achieve a particular outlook.

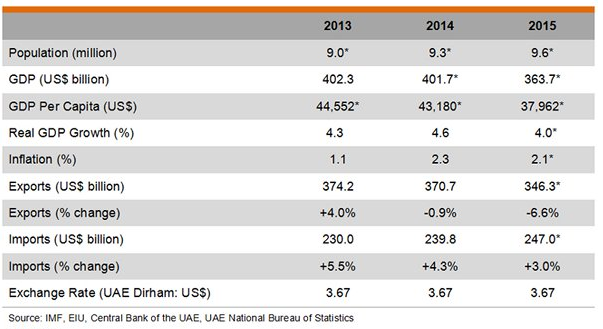

GDP/GDP per capita

The latest survey on the economic status of the UAE forecasts that the GDP will be at 3.8% this year. The decline of oil prices continues to slow economic growth. Also, the liquidity ratio for the banks is negatively affected. Some financial institutions are cutting down on investments and loans amid fears of financial losses through defaulting. Using an Autoregressive Integrated Moving Average (ARIMA), the past behavior of the UAE is used to give a forecast on the probable GDP per capita. The plunge of oil prices is not the sole cause of the sluggish economic growth. The output of oil is also likely to reduce slightly or flatten. The figure below shows the country’s market profile.

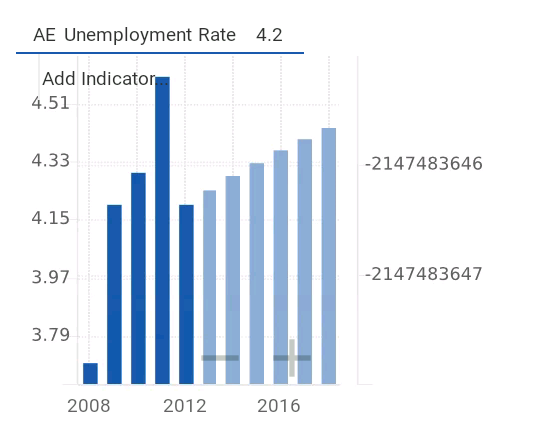

Unemployment rate forecast 2016

The unemployment rates in the UAE are expected to be on a rising trend due to the growing population of the country. A forecast shows that it is likely to go up to 4.33 by the first quarter of 2016.

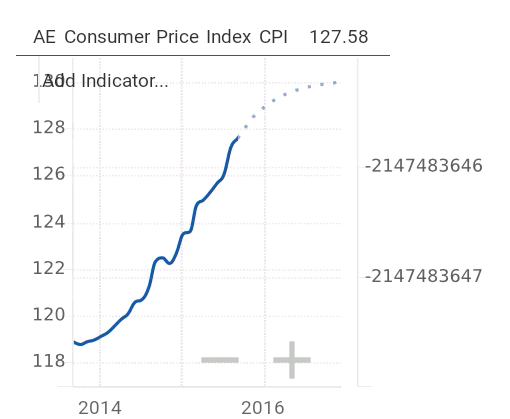

Consumer price index forecast 2016

The consumer price index is forecast to go up to approximately 128.6523 in January 2016. With an inflation rate forecast of 4.70, the consumer price index is expected to rise from the previous 127.9906.

Industrial production, electricity/consumption

The industrial production of the country is postulated to take an increasing trend. With the developments in economic stability observed in the country, electricity consumption are also expected to increase, and so is the rate of electricity consumption.

Export/import volume/ exchange rate

UAE’s exchange rates are expected to rise in 2016. With the increasing inflation due to the drop in oil prices, the currency strength against other major currencies is postulated to take a depreciating form.

Major economic challenges facing the country

Economic diversification

The domestic investment of the country ought to be diversified to address the issues associated with the declining oil prices. Innovation is pivotal in influencing the country’s future success with the rising competition from other oil producing countries and nations. The non oil sector of the country has received a major boost with a growth rate of approximately 8.3% as at the beginning of 2015. In as much as the contribution of the non-oil sector may be at 68. 6%, this is still a major challenge to reduce the excessive reliance on oil products. Employment rates are as well postulated to rise due to the diversification of the economy. The development of new sectors such as the real estate, transportation, and construction, and hospitality sectors have in particular formed a major boost towards the attainment of economic stability that is expected to stabilize even further by 2020. However, it will be challenging to build because the economy is presently strained. With a minimal GDP growth rate over the past five years, hitting these postulated limits is highly challenging. The economy is at the same time meant to sustain other developmental aspects hence unless alternatives are considered, economic failures are inevitable.

Falling oil prices and effect on government budget and sovereign fund

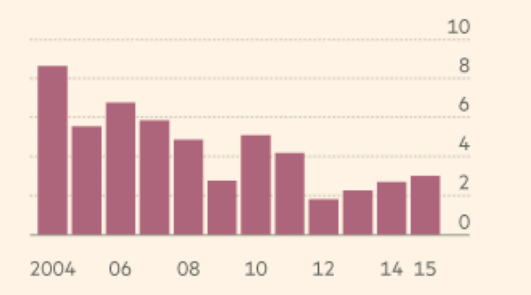

The falling oil prices have made government deposits to decline in banks by over 50 billion dirhams. The fall in the oil prices has had negative effects on the government. As such, the government has been forced to borrow from the banks to sustain the economic needs of the country. The declining oil prices have also made the GDP growth to take a declining trend since 2004 with the only rise observed after 2012. The rise is though minimal and unable to cater for the financial needs of the country. The cutting of budgets is inevitable as the government seeks to maintain an economic momentum. The liquidity of the banks will rise and as such the domestic debts will rise.

Gross investment/ budget/public debt/ income distribution

One critical factor regarding Gulf governments including the UAE is that they have low levels of debt. In addition, they are renowned for their ability to undertake fiscal reforms with a view of offsetting the debt as well as the declining revenues (Al-Tamimi, Alwan, and Rahman 13). The UAE has been in the forefront through the removal of fuel subsidies. The country has in the recent past considered other alternatives for reform as a way of increasing government revenue and servicing the debt (Al-Tamimi, Alwan, and Rahman 16). These reforms touch on corporate and taxation. These reforms are critical amid plunging oil prices as they play a vital role in reducing fiscal vulnerability as they enhance intergenerational equity. The removal of energy subsidies gives the government a chance to reconfigure its spending on offsetting the debt.

UAE Economic Resilience

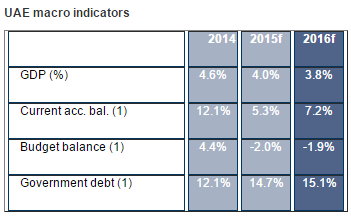

The UAE has strong economic buffers against the plunging oil prices. Its resilience to the shocks of oil prices implies that macroeconomic indicators such as the GDP, government debt, unemployment rates, and the budget situation remain unchanged. The figure below shows the UAE macro indicators of economic resilience amid falling oil prices.

Slow Economic Growth

Lower prices have continued to erode the enduring fiscal and external surpluses for the country. In the context of global economic stagnation and volatility in the emerging market economies, the UAE experiences a slow economic growth that is projected to increase to approximately 4.6 percent by 2020. The oil sector will hopefully moderate under the prevalent global surplus supply. The slow economic growth owes to several factors. First, the tourism industry has plummeted as oil prices keep dropping and the appreciation of the appreciation of the U.S dollar. The real estate segment has slowed down with vacant rates reaching 25% in Dubai and Abu Dhabi. The retail markets for the real estate had grown rigorously until mid-2014 but began a downward growth later that year. The lower prices have resulted in the falling demand for residential houses.

Income Distribution/Education and Employment

The education system presents a key challenge to the UAE government (Berument, Ceylan, and Dogan 119). It is responsible for the production of skilled human labor that is highly needed by the private sector. In its diversification strategies, the UAE needs to reform the education system to equip its citizens with prerequisite skills required by employers (Anshasy 120). The current labor market in the UAE is worrying as the country relies heavily on expatriates. As the country diversifies into other economic segments including food processing and real-estate business, the dependence on foreign labor will adversely affect its economy (Berument, Ceylan, and Dogan 149). Given the continual falling on oil prices, which has been the chief source of government revenue and a major employer, the country needs to reform its education system. Reforms will endeavor to prepare the UAE nationals to innovate and take up vital roles in an attempt to reduce overdependence on the vulnerable oil industry.

In an attempt to reduce the foreign labor dominance in the UAE, the government has undertaken decisive measures. First, through active labor market programs the government intends to implement the UAE nationwide strategy to employ over five thousand job seekers every year (Al-Tamimi, Alwan, and Rahman 10). The programs aim at offering support for the national employee a given period. Financial incentives to employers can boost the employment rate in the country (Dargin 1). The support for national employees training is a positive initiative that will ensure that local labor force increases.

Inflation Rate/Exchange Rate and Foreign Direct Investment

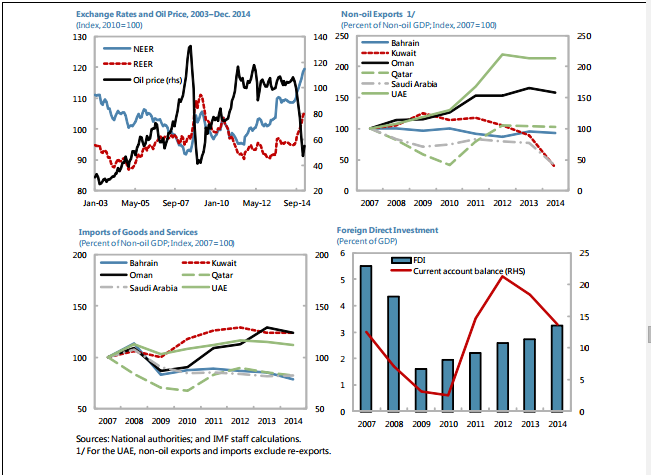

The gross foreign inflows to the banking sector and foreign direct investment (FDI) have been steady since 2014. This observation represents a positive aspect of the country’s economic resilience and the safe-haven position. It also gives a key insight into the country’s competitive environment. The core drivers to increased inflation rate have been the appreciation of the U.S dollar, the increase in real estate prices, particularly increases in rents. Inflation rate reached 4.3 percent in June 2015. There has been an upward adjustment of thee electricity and water tariffs, increased costs for education and other services (Anshasy 120). The effects of the appreciating U.S dollar are well-manifested in the increased inflation rate since other sectors such as clothing and food contributed close to zero percent to the inflation. Moreover, the real effective exchange rate (REER) appreciated by close to 3.3% in 2014 and approximately 8.9% in the first quarter of 2015 relative the previous year’s average level, owing to the appreciation of the U.S dollar.

Volume Trade with China, South East Asia, and Other UAE Countries

In the wake of falling oil prices, the UAE trade volumes have shown consistent stability. This stability is attributable to various factors including limited import substitution, reliance on hydrocarbon exports that are valued in U.S dollars, and the flexible utilization of foreign labor (Aslanoğlu and Deniz 22). It is worth noting that the standards for payment packages including salaries and wages for the foreign workforce are determined internationally. This phenomenon helps to limit the impact of exchange rates on the country’s trade volumes (Aslanoğlu and Deniz 22). A remarkable exportation of nonhydrocarbon, whose share of the nonhydrocarbon gross domestic product has risen markedly over the last 10 years, has been noted.

Currently, the oil industry accounts for only one-third of the country’s GDP (Anshas 120). The main factor that shapes the present economic situation in the UAE is diversification. Trade reports indicate that the country’s non-oil exports increased thirtyfold by the year 2010. This report strongly demonstrates that with the declining oil prices, the UAE economy remains unshaken (Anshas 120). The establishment of the two dozen free zones across all sectors is a major impetus for the country’s non-dependence on the oil industry (Dargin 1). The free zones play a crucial role in attracting foreign direct investment, generating employment, and earning foreign exchange (Berument, Ceylan, and Dogan 149).

Given the strategic location of the country, between East and the West, the UAE is a major gateway to trade with the neighboring regions and countries. These trade partners include the Middle East, which is a major network that links Asia with the Mediterranean and North Africa (Aslanoğlu and Deniz 22). This strategic location has made trade between the UAE and the region and the rest of the world increase exponentially. Table below shows a summary of trade dealings between the UAE, the emerging economies of China and India and the rest of the world. India is the largest trade partner for the UAE, with its political and cultural ties dating back to over a century ago. In fact, the Indian community represents the largest expatriate’s population in the UAE (Aslanoğlu and Deniz 22). The UAE trade volumes with other countries in the region and the rest of the world remain highly stable amid oil price deterioration. The Table below provides a summary of top trade partners for the UAE.

Recommendations for Macroeconomic Policies amid Falling Oil Prices

Various recommendations can be provided for the UAE economy to deal with plunging oil prices. Despite the most praised safe-haven status of the UAE economy and minimal reliance on the oil industry, the long-term effect of further oil price decline remains uncertain (Berument, Ceylan, and Dogan 149). Despite its 1% contribution to the country’s GDP, the oil sector presents a major employer and source of income for many people. Lower oil prices are eroding the fiscal and external surpluses and causing the U.S interest rates to escalate (Anshas 120). This situation could make things a bit tough for the UAE economy insofar as financial conditions are concerned (Berument, Ceylan, and Dogan 148).

Coupled with the high volatility of stock markets and the low banking system liquidity the financial situation could even get worse in the coming years (Dargin 1). First, the UAE macroeconomic policy mix should center on gradual fiscal consolidation as it maintains the peg and easing the liquidity management. This policy can go a long way to reducing the fiscal vulnerability as it enhances intergenerational equity. Credit growth can be supported by strengthening the liquidity management (Berument, Ceylan, and Dogan 149). Second, consolidation policy is implemented there is a need for a rationalized spending framework that takes into account the quantity spending cuts in a bid to prevent damaging the country’s long-term growth (Al-Tamimi, Alwan, and Rahman 10). For instance, the government spending should focus on improving infrastructure necessary to support the on-going diversification and economic expansion.

Of much importance is the alignment mega-projects’ implementation with the anticipated demand (Dargin 1). Controlling the public sectors wage bill is of paramount importance. Other consolidation strategies include reducing energy subsidies and other government transfers. Moreover, structural reforms in the UAE should strive to diversify the economy and accelerating the private sector-led job creation for the local employment needs.

These reforms can be achieved through encouragement of further FDI, improving certain tenets of the country’s business environment and most importantly transforming into the know-ledge based economy that is the hallmark of the twenty-first century (Al-Tamimi, Alwan, and Rahman 18). The government should focus on easing access to funds for startups and small and medium-sized businesses (SMEs) (Anshas 120). Implementing this recommendation can realize additional job creation thereby solving thee unemployment menace in the country (Anshas 120). Restructuring the national education system will also ensure that the outcomes supply the local economy with the skilled labor force.

Conclusion

The sluggish global economic growth presents the greatest fears to many countries. The shocks witnessed in plummeting oil prices pose numerous economic implications for the oil producing countries including the United Arab Emirates. However, the emerging economies in the Gulf region continue to create paradoxical impressions in the minds of global economists. Particularly, the economic resilience recorded in these countries, which are the world’s major exporters of energy products continues to attract increased world’s attention. The paper has discussed in great detail the economic situation of the UAE in the midst of declining oil prices. The paper has revealed that the country’s economy is highly diversified such that oil price shocks have little macroeconomic impacts. Their trade in non oil products has given the country safe-haven status that buffers the economy from the shocks global oil prices. The paper provides in-depth analysis of major economic indicators and well-extrapolated charts indicating the country’s resilience despite the falling oil prices. The government can undertake structural reforms including redirecting spending to infrastructure, education, and creating an enabling environment to attract additional FDI. These reforms can endeavor to further diversify the economy as well as easing access to finance for innovation and business startups.

Works Cited

Al-Tamimi, Hassan, Ali Abdulla Alwan and Abdel Rahman. “Factors Affecting Stock Prices in the UAE Financial Markets.” Journal of Transnational Management 16.1 (2011): 3-19. Print.

Anshasy, Amany. “Oil Revenues, Government Spending Policy, and Growth.” Public Finance and Management 2.1 (2012): 120. Print.

Aslanoğlu, Erhan and Pınar Deniz. “Oil Prices Once Again: The Link towards Middle East Economies.” Topics in Middle Eastern and African Economies 15.2 (2013): 22. Print.

Berument, Hakan, Nildag Ceylan and Nukhet Dogan. “The impact of oil price shocks on the economic growth of selected MENA countries.” Energy Journal 31.1 (2010): 149. Print.

Dargin, Justin. “Oil Production and Consumption: Strategies for the UAE.” Emirates Occasional Papers 82.1 (2014): 1. Print.

Mina, Wasseem. “External commitment mechanisms, institutions, and FDI in GCC countries.” Journal of International Financial Markets, Institutions, and Money 19.2 (2009): 371-386. Print.