In the contemporary world, foreign direct investments (FDI) play a critical role in increasing the productivity levels of a host nation by enabling it to meet its domestic demand as well as the global demand for the goods and services that it is producing. Thus, FDI can be used as an index for measuring the confidence that investors have on a given nation or geographical region. Over the last several decades, China has greatly benefited from FDI. China is one of the largest nations in the world. The nation also has a high population that is growing at a tremendous rate. At the same time, the domestic market of the nation has been growing at over 10% for the last three decades. These factors have played a significant role in enabling the nation to attract inward FDI. In the last ten years, China has received over 20% of the global FDI in developing states. In 2008 alone, the nation received over $100 billion in terms of FDI. As a result, the nation has been experiencing an average GDP of 2.5% since 2008 (World Bank, 2013). This paper will thus focus on the factors that affect the flows of FDI into China, the factors that hinder FDI, the incentives and restrictions provided by the government and FDI trends over the last five years.

Factors Attracting FDI in the Nation

The cost of labor is a critical factor that determines the level of investment in a given nation. During the 20th century, most companies based their operations in Europe and in the United States. However, due to high labor costs, most of these companies moved their operations to developing nations such as China, India, Malaysia, and Singapore where they could get the same quality of expertise at a cheaper cost. It is due to its low labor costs that China has been successful in attracting and maintaining inward FDI since the late 1970s. Through educational programs, the Chinese government has ensured that its citizens are highly skilled. Therefore, the Chinese population is capable of offering high quality technical skills at lower wage rates as compared to many other countries in the world.

The transport system in China is effective and efficient. Since the late 1990s, China has been involved in extensive road construction projects that have expanded the road system of mainland China (USCBC, 2012). The National Trunk Highway System (NTHS) is one of the most extensive super-highways in the world, second to the highway system of the United States of America. Consequently, China has extensive railroads, water systems, and air travel services that cover the mainland as well as its islands. With such an effective transport system, China has been able to attract inward FDI over the years due to the reduced transportation costs that investors incur in transporting raw materials and finished products within and outside the country.

The Chinese domestic market has also been growing at an exponential rate for the last two decades providing a ready market for the goods and services that are produced within the nation. Given its sheer size and potential, the Chinese market is expected to grow further in the coming years. Foreign investors are thus targeting this vibrant market. Many multi-national corporations (MNCs) have expanded their operations into China to take advantage of this expanding market. With decreased costs and a ready market, investing firms believe that shifting and expanding their operations in China will have high rates of returns hence enabling them to achieve their short term and long-term goals and objectives.

Government Incentives

According to the USCBC (2012), a nation can only be successful in attracting inward FDI if it has put in place incentives that are favorable for the investors. Given its growth policies, investment promotions and the fact it is a growing economy with a potential domestic market, China is most likely to maintain its position as the leading FDI destination in the world (USCBC, 2012). Currently, China has effective taxation, land use, labor, and foreign currency exchange policies that are attractive to foreign investors. These policies have played a critical role in the massive investments by foreign firms in the coastal regions of the nation, its four economic zones, and its fourteen commercial cities (USCBC, 2012). Initially, these policies attracted investors in the automotive, telecommunication, and electronic industries. However, the success experienced by these early investors greatly attracted more foreign investors in other industries such as banking, real estate, ICT, and so on. According to the study that was conducted by Broadhaust et al (2012), these investments are part of a long-term global strategy of the investors who want to have control of the Chinese market in the long term.

Factors Hindering Flows of FDI to China

Despite the efforts that have been put in place by the Chinese government to increase inward FDI, there are factors that act as foreign investment barriers in China. Business crime is one of the main factors that act as a barrier towards inward FDI in China. Broadhaust et al. (2012) asserted that commercial crime is one of the most common criminal activities in modern day China. In 2007 for instance, an incident of business crime was reported in over 26.1% of all the business firms in China (Broadhaust et al., 2012). Most of these institutions were privately owned. In major cities across China, the rate of commercial crime is considered to be three times higher as compared to the rate of common crime. Through scrupulous activities such as fraud and intellectual property offense, firms across China lose billions of dollars every year. This trend greatly discourages investors from venturing into China.

Lack of judicial independence is another factor that has hindered the flow of FDI to China. China has an independent Supreme Court that is expected to operate without interference from other organs of the government or the public. However, there are rulings that have been made by the Supreme Court that are deemed to be biased especially to foreign investors. This greatly reduced their motivation to invest in the nation. For instance, the automotive industry has been greatly affected by the rulings that have been made by the Supreme Court. Given low labor costs, efficient transportation systems and a vibrant domestic market, several automotive industries have expanded their operations into China. However, the Supreme Court has failed to effectively implement copyright laws to the latter. In 2007 for instance, BMW sued a Chinese car manufacturing company, Shuanghuan for manufacturing the CEO, a car that was believed to have been a clone of BMW’s X5 (Martinez, 2008). Despite the claims that BMW put against Shuanghuan, it was ruled that the CEO indeed was not a clone of the X5 and thus its production should continue. This ruling greatly hindered foreign investment in China due to the fear of emergence of counterfeit goods that might act as a cheaper alternative for the domestic as well as the international market hence reducing the sales and overall profitability that investors might enjoy.

Restrictions towards FDI

Despites the efforts that the Chinese government has put in place to attract and maintain FDI in the country, it has emerged that opportunities for foreign investments within the nation are not equal. This trend is quite common across various business sectors within the Chinese economy. Despite the effects that this trend might have on foreign investment, very little has been done by the Chinese government to resolve these issues. In 2011, the Foreign Investment Catalogue failed to address this issue (USCBC, 2012). According to the USCBC (2012), over 17% of companies declined or pulled out of investing in China due to the restrictions that have been imposed by the Chinese government. According to these companies, discrimination in market access was the main problem that they were facing. Thus, in the course of their operations, these companies faced many difficulties in obtaining licenses and stiff competition from locally based firms. Most of the investment firms also complained of unfair treatment as compared to local firms since most of the rules, regulations, and policies favored domestic firms over foreign ones. As a result, inward FDI in industries such as agriculture, automotive, banking, and transportation have failed to reach their potential due to such restrictions.

Role of FDI in Economic Development, Trends, and Amount

FDI is an essential component to the success of any economy. In developing nations and emerging economies such as China, FDI plays a critical role in enhancing exports, hence improving the balance of payments. In 2011 for instance, foreign investment enterprises contributed to 30% of the national output and 22% of the annual profits earned in the nation (World Bank, 2013). At the same time, the operations of foreign companies in China have led to the employment of 10% of the Chinese workforce. In addition to technological spillovers, foreign companies are also responsible for the high level of economic development of over 10% per annum that the country has been exhibiting for the last three decades.

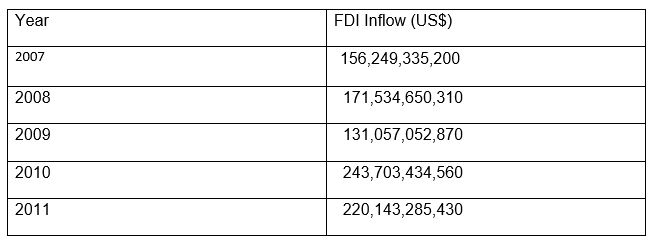

Since 2007, most of the FDI into China have been in the manufacturing sector (over 60%) (World Bank, 2013). Other sectors that attracted high amounts of FDI include real estate, transport, and communications. With regards to manufacturing, a lot of investments were made in labor-intensive manufacturing companies such as textiles, furniture, and food processing. However, technological companies such as telecommunication and automotive industries also received considerable amounts of investments during this period. From these trends, it is evident that foreign investors are attracted to China due to its low labor rates. The table below shows the amount of inward FDI in China for the last five years (World Bank, 2013).

Why Invest in China

China is a nation that has great opportunities. With proper pricing and marketing strategies, its huge population is a potential market for almost any product or service. At the same time, the Chinese government has put in place incentives and favorable policies that guarantee that foreign firms operate in an effective and efficient manner. Consequently, the government is in the process of modifying some of its policies to overcome the barriers that foreign companies face while operating in China. Therefore, I would invest in China to take advantage of the low labor and transportation costs, ready market, favorable policies, and high chances of making profits.

References

Broadhaust, L, Bourhours, B, and Bourhours, T 2012, ‘Business and the risk of crime in China’, The British Journal of Criminology, vol. 2 no. 3, pp. 15-22.

Martinez, N 2008, Shuanghuan’s Chinese X5 lookalike to be sold in France despite German ban. Web.

USCBC 2012, Restrictions on foreign investments. Web.

World Bank 2013, Foreign direct investment, net inflows (BoP, current US$). Web.