Introduction

The modern day business environment is faced by various challenges that tend to hamper growth and expansion of the business. This in turn frustrates the achievement of the set goals and objectives. Business that are not able to manage their risks well may end up falling short of their expectations in terms of revenues and growth. Since businesses much as human beings, go through a life cycle of birth, growth, maturity, and decline, it is important for directors to craft a strategy that ensures survival of the business during the maturity stage.

One of the strategies employed by businesses at maturity stage is expansion and diversification. This involves expanding into new territories such as new regions and countries. Business strategies should however, not remain oblivious of the challenges that face businesses at their maturity stage (Brink, 2009). Some of these challenges include risks that they ought to manage in order to overcome them. This essay discusses the political and most prominent international risks that an organization will face in international diversification.

International diversification

International diversification is defined as the expansion of a business into a new country in order to increase its products presence in new markets. It is usually done in order to enhance growth. In doing this, the company is able to increase its sales and hence revenue. International diversification therefore ensures that a company grow in its revenues, stabilizes its cash flows, and also earns economies of scale (Richard, 2010). It is able to produce at a lesser unit cost.

There are however, challenges that face companies which are trying to venture into new countries. Most of these challenges often present various risks which need to be handled properly in order to ensure that organizations succeed in their pursuit of mission and vision achievement. The risks to be discussed are the political risks and economic risks. The paper will also discuss on the limits to expansion of the organization.

Political risks

Political risk is defined as a risk that an organization faces due to various happenings in the political front in the country that may be caused by frequent changes in government, some level of violence, conflicts or wars with other states, or a number of armed insurrections (Brink, 2009). In most cases, corporations cannot control/prevent this risk since it emanates from a remote factor.

Understanding the sources of political risks

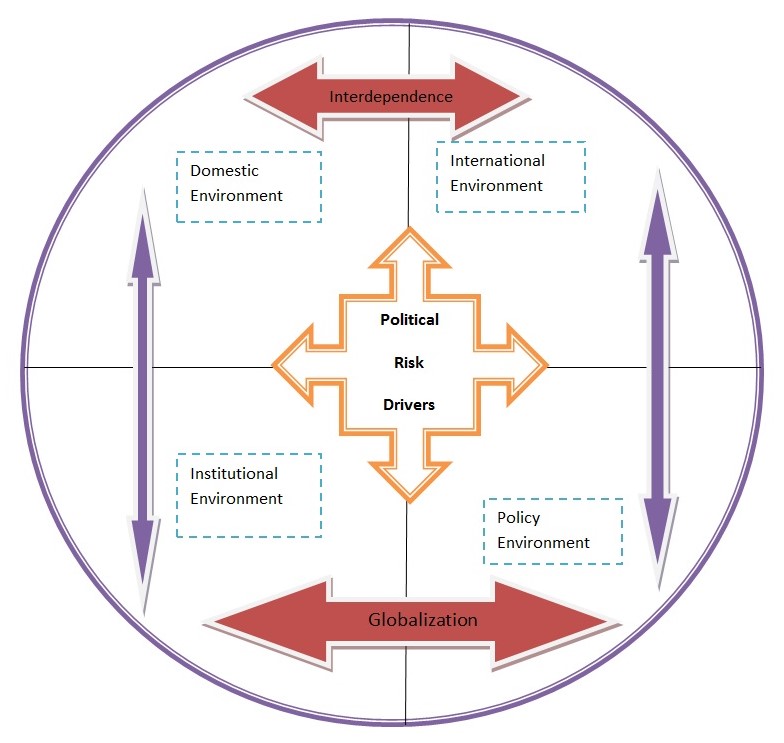

Political risk is usually measured by incorporating the right measures that encompass the political environment of a particular country. The diagram below shows the various drivers to political risk which include political activities in the domestic country and globalization. Globalization is always thought to be a driver of interdependence that catalyses the emergence of cross border commercial and non-commercial relationships between countries (Howell, 1994). This is more when the countries relate at an almost the same level. There are cases where a country plays a sovereign and a dominant role over the other in cross border activities. This emerges as a causal agent for political risk. The figure below diagrammatically presents this information.

It clearly posits that political risk is a function of many factors such as the domestic, international, institutional, and policy environment. All these environments are influenced by various happenings such as the frequent change in governments, conflicts or war with other states, and armed insurrections (Howell, 1994). Change in government brings about changes in policies and ideologies. Since the government is charged with the responsibility of formulating policies that affect the business environment, a change in government may result in a change in policy which may in turn cause a political risk. A war or an armed insurrection will directly catalyze the occurrence of political instability and hence pose the risk to the multinationals in the country.

Managing political risks

Since political environment is often a remote factor to a business, it is usually impossible for a business to exercise control on political risks. There are however means and ways that a business can explore in order to reduce the effects of perils that result from political risks. There are Pre-investment and post investment policy options that a company can explore in order to effectively manage a political risk. The pre investment policy options are risk avoidance, insurance (risk shifting), and structuring the investment. The post investment policies that could be adopted are planned divestment, short-term profit maximization, and developing local stakeholders.

Economic risks

Economic risk is basically defined as a risk that a business endeavor will be unsustainable economically and thus, unsuccessful. Before any project is undertaken, economic risk is usually evaluated to establish whether the project’s economic risk outweigh the expected benefits. The main perspective of an economic risk evaluation is the cost-benefit analysis of any business venture (Baxter, 1967). If the revenues and thus, the profits from the project fall short of the cost, then the venture will run at a loss and leave the stakeholders at a worse state than they were before undertaking the business venture.

Understanding and measuring economic risks

An international investor should articulate the fine details that dictate the economic environment of a particular geographical region before deciding on whether to invest in that region or not. This is important since the factors that may result in economic risk are usually market oriented and an understanding of the market trends such as consumer behavior, taste and preferences, competition, and so on.

It is of paramount importance that the management understands the nature of the business environment that faces the organization in order to plan well and ensure that all the economic risks are managed well. One problem with economies is that they do not follow a pattern that can be mapped with certainty. This means that it is very hard to predict the market that a company will operate in for as short a period as five years.

Measuring and managing economic risks

Since a risk has been defined as a possibility of an adverse effect on an endeavor, risks can be measured using a probability approach method where a certainty coefficient is allocated to a possible expected outcome. For instance, there is a 75 % certainty that a project expected cash flows will be realized. In such a case, the 75% of the expected revenues must be able to cover the cost of doing the business so that if the risk occurs, the business venture will still be a viable endeavor (Howell, 1994).

There are various ways of managing economic risks. One of the ways of doing so is through pre-investment policies such as proper market study and analysis. This ensures that a firm obtains all material information regarding the new market before it ventures into the intended business. This also provides a basis for trend analysis for the market that is useful in the future when the firm is already into the market. Market study involves studying the consumer behavior which entails tastes and preferences, consumption patterns, product loyalty, and the ease of product adoption.

Another way of managing economic risk is through risk allocation. This is done in order to spread the risks and ensure the different stakeholders assume responsibilities in areas where their ability to manage the risks is high. In so doing, the various stakeholders ensure that the best of their interests is protected through ensuring that they carry out their responsibilities in order to ensure that the business is a success.

Limitations to expansion

An organization intending to expand into international markets should always be ready to face some challenges. The challenges present limits to which the international diversification can be realized. One such limit could be a history of tense relations between the country of origin and the target country. In cases where there have been tense relations more so on diplomatic matters and ideologies, a company could be unable handle the challenges due to the past conflict experienced by the countries and this may present a challenge to the company.

The second factor that presents a challenge to international diversification is the divergence of interests between the organization and the domestic government. An organization venturing into a business where it intends to supply some goods for instance public goods may find itself being in conflict with the government more so when it comes to pricing strategies. Governments may want to dictate and set price caps on some goods that are considered public goods and/or services at the expense of the company. This may affect the profitability of the company and therefore present a limit to diversification.

When an organization’s pricing strategy is in conflict with a government interests, the organization’s strategy becomes null and void to the extent of the conflict and the government’s interests reign supreme over the organization’s interests. This may present a challenge and thus a limit to international diversification.

Incompatible businesses

While international diversification always presents an opportunity to grow and stabilize the earnings, the organization diversifying should be careful to ensure that the products offered are not in conflict with the already existing ones (Richard, 2010). A clear market study should be done to ensure that the business is compatible with the existing businesses and products. If this is not the case there is a higher risk of failure since the consumers will tend to be hostile to the products being offered.

Conclusion

It has been seen that while international diversification is a desirable expansion strategy to many businesses, the management of an organization should not remain oblivious of the numerous risks and challenges that face international diversification. The organization should therefore carry out adequate risk research to identify the risk profile for the new markets. This will ensure a proper management of risks and increase the possibility of success in the new market

References

Baxter, D. N. (1967). Leverage, Risk of Ruin and the Cost of Capital. The Journal of Finance, 395-403.

Brink, C. (2009). Measuring Political Risks: Risks to Foreign Investment. New York: John Wiley.

Howell, L. (1994). An Introduction to Country and Political Risk Analysis. The Handbook of Country and Political Risk Analysis, 1-19.

Richard, L. (2010). Applying Demographics to Business Strategy. The Impacts of Demographic Trends on Your Business”, 11-34.