Difference Between Debt and Equity Funding Options

Equity funding involves retailing a share of a company’s equity in exchange for capital. For instance, the owner of XYZ Company might decide to give up 15% of the company’s ownership and sell it to an investor to raise capital for its expansion. After that, the investor possesses 15% of the firm and has an involvement in decision-making. Ideally, debt financing is borrowing funds and paying them back after some time with interest.

For instance, the most common type of debt funding is loans. The main merit of debt financing is that the lender has no share or control over the corporation. While debt funding may sometimes bring constraints to the company that could stop it from benefiting from opportunities outside, equity financing has no extra monetary weight. The company has additional finances to capitalize on the business and other openings.

Primary Equity Funding Mechanisms

Some of the key market equity funding mechanisms available to corporates include the following:

- Public issue. Issuing shares to the public is the most popular mechanism of raising equity funds which means acquiring funds directly from the general community through IPO (initial public offer). The shares are listed on a securities exchange market for tradeoff drive, and provisions are made, bestowing to submissions received.

- Offer for sale. An Offer for Sale is a system whereby marketers in public companies can sell their stocks and transparently decrease their capital through the bidding market for the exchange.

- Private placement. When a corporation sells its securities to a small group of investors, the process is known as a private placement. Shares are sold at a price that may or may not is linked to the market value.

- Right issue. The rights issue entails offering new shares to the existing shareholders on a pro-rata basis. Stakeholders are offered more shares at a reduced price from the prevalent market value.

- Tender method. A tender is an application by an investor to the stakeholders of a public-operated corporation with an offer to sell their shares at a specified worth in a given time. To tender is to ask for bids for a venture or make a formal offer.

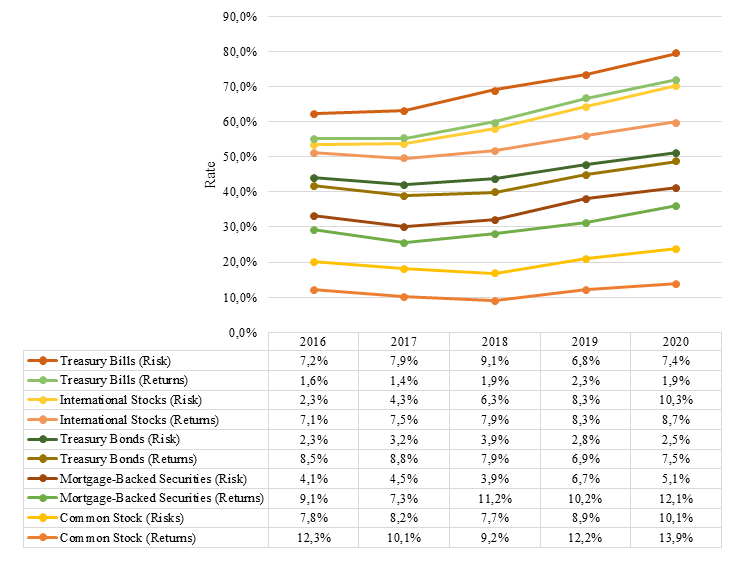

Historical Relationship Between Risk and Return of Securities

The selected returns include common stock, mortgage-backed securities (MBS), treasury bonds (T-bond), treasury bills, and international stocks. Generally, riskier investments attract more returns and vice versa. Figure 1 illustrates the historic risk-return relationship of the selected securities over five years (2016 to 2020).