Introduction

Several privately held entities aspire to go public through an initial public offering (IPO). IPO is the first offering of a common stock of a privately held company to the public. IPO has two common benefits to the firm’s shareholders. First, IPO acts as a way of raising capital to the company. Second, any successful IPO is a means of creating wealth to shareholders of the company. Recent IPOs have raised billions of dollars to companies like Facebook, Zynga, Groupon, Vanguard Health Systems, and Pandora among others. They have also made many investors millionaires and generated considerable excitements between the public and media.

This essay looks at the theory and reasoning of companies that should IPO. In this regard, it looks at motives and reasoning for IPO as an opportunity to raise capital for growth and create a chance for later merger and acquisitions.

However, firms also recognize that IPO is expensive and involves difficult process. Therefore, managers and shareholders need to understand other factors that influence IPOs in order to improve decision-making and eliminate uncertainties that come with the process.

Reasoning for going IPO

Scholars have advanced many theories to explain the decision and reasoning behind companies’ choices to go IPO. A number of these theoretical arguments posit that markets are “efficient and that managers aim to maximize the firm’s value” (Brau and Fawcett 108). From this perspective, we can note that the main reason for firms to go IPO is to raise or acquire capital for funding future investments. In addition, IPO also provides opportunities to raise capital in “a way that minimizes the company’s weighted average cost of capital” (Brau and Fawcett 108). This argument originates from the pecking order theory or alternative theory. This theory posits that firms decide to go public in order to raise capital when other sources of cheaper capitals are no longer viable and fully exhausted.

Myers and Majluf observe that asymmetric lack of information cause companies to rely on a pecking order when making decisions for acquiring capital for new ventures. Firms prefer their internal funds because of risks with external sources of funds. A study by Nellie Liang and Jean Helwege concluded that companies did not follow the pecking order theory when seeking for capital through IPOs (Liang and Helwege 429). They also observed that companies, which were weak, tended to go for public bonds as the pecking order theory suggested.

Another motive for firms to seek for IPO is to give insiders a chance to cash out at the highest price possible. Firms may go public to enable them diversify the company. Brau and Fawcett found out that CFOs (Chief Financial Officers) believed that firms go public to gain access to public share for future acquisitions. This implies that companies consider IPO as a way of getting equity capital for expansion opportunities. This observation is consistent with the pecking order theory, which considers IPO as a source of low-cost equity for future investments. Barclay and Smith also note that equity is an “appropriate vehicle for companies with growth opportunities” (Barclay and Smith 8). They also concluded that most IPO firms had growth strategies. As a result, they wanted equity for growth and merger. Companies believe that publicly traded stocks provide better conditions for them to take part in merger and acquisition (M&A) because of capital from the stock market. This supports the idea of Donald DePamphilis who argues that IPO is the precursor to M&As (DePamphilis 101). DePamphilis notes that a company may decide to issue a part of its stock to “determine its value in anticipation of selling the entire subsidiary or enabling the subsidiary to use the publicly traded shares to make acquisitions” (DePamphilis 101). A number of CFOs also note that firms decide to go public in order to get support from the stock market. This strategy marks the first move towards an acquisition process.

IPO also enables the company’s insiders to gain their desire to cash out or raise capital. However, insiders also consider IPO as another way of acquisition. However, a direct acquisition can be better than IPO, but the IPO facilitates the acquisition. Insiders’ takeover does not offer many rewards like IPO. This is because acquisitions may reduce risks a company may face in the future.

There are also other approaches of raising capital, which managers can consider. These include private placements of equity. Private placement is not an expensive process like IPO. However, this may not raise significant capitals like the IPO.

Brau and Fawcett observed that firms that have never issued IPOs had different opinions about why other companies decided to go public. CFOs of these companies believe that the main reason for going public is to cash out and diversify the company. At the same time, CFOs of firms that have never gone public do not mind their companies’ market value or reputation. This is contrary to views of CFOs in publicly traded companies.

Timing IPO

Timing of IPO is crucial for firms intending to go public. Timing of IPO also has theoretical approaches to explain behaviors of firms that plan IPO. Life-cycle theory posits that as companies grow, it becomes “economical for them to gain external funding through IPOs” (Bulan and Yan 179). As a result, timing of IPO depends on the maturation of the company. This is the case of Facebook and its IPO. According to Shayndi Raice, most companies prefer exploring the option of IPO after achieving a revenue of $100 million in a financial year (Raice 1). Life-cycle theory shows that firms may decide to go for IPO when they reach “a point where they can gain access to equity fund for growth, and develop a liquid and public market for their owners” (Bulan and Yan 179). In this regard, the company’s growth and profitability influence the financial decision to go public. This is because promising growth opportunities show the level of investments a company needs and how it can fund it.

There is also an aspect of market timing when deciding to go IPO. According to this approach, the company’s insiders use their superior information in order to exploit a window of opportunity available in the market. In this approach, the market may over value shares or provide a full valuation of shares in order to eliminate dilution of the current value of the company. According to such firms, IPO is a way of eliminating market uncertainties, which result from bidding processes. However, it is worth noting that IPO process does not eliminate all uncertainties from valuation.

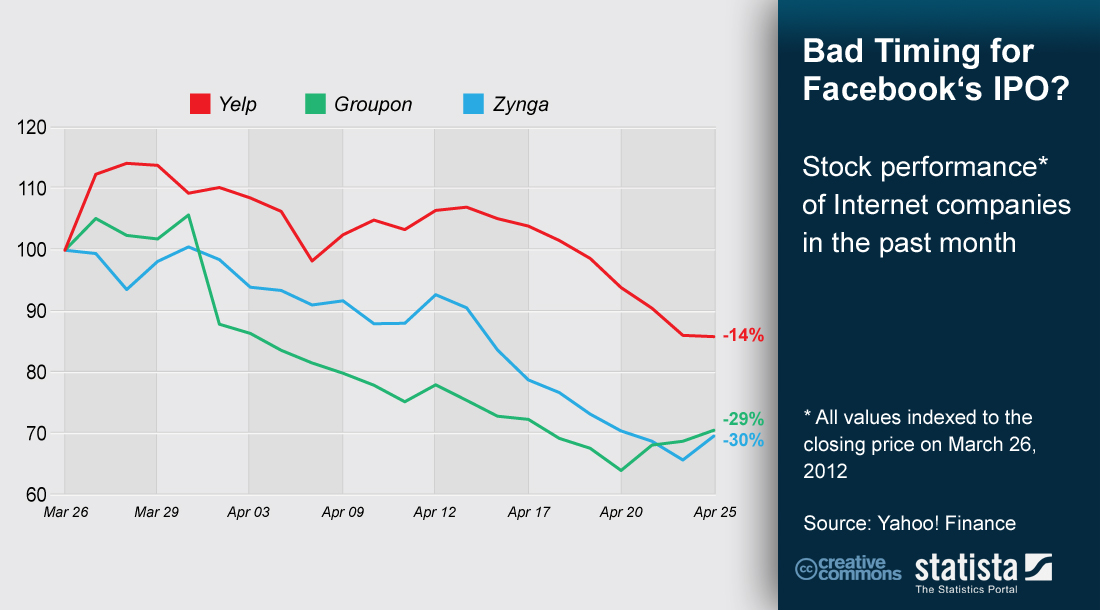

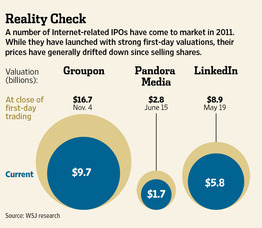

The Facebook IPO experienced controversies from the beginning. First, management was not willing to declare IPO timing. However, many market observers noted that it was wrong timing for the IPO. This is because of investors’ interests in the past IPOs involving Internet companies. According to Statista, Facebook IPO had the worst timing because of the market conditions at the time (Mohr 2012). Statista based its observation on performances of Internet companies during that period. For instance, Statista noted that Yelp, Zynga, and Groupon had shown poor trends in trading since the launch of their IPOs as shown in the below chart. However, Facebook had its own market niche. It notes that it is crucial to observe performance trends within the first three months in order to determine success of IPO.

The influence of the Underwriter

Companies planning IPO cannot ignore the importance of underwriters. This is because past studies have linked IPOs success to successful underwriters (Brau and Fawcett 110). The underwriter has various functions during IPO processes. The most important role is to create interests and generate market visibility of the company’s IPO. In order to ensure that the IPO is successful, the underwriter must train the company’s executives and assist in “preparation of the prospectus so that it can meet conditions of SEC” (Brau and Fawcett 111). This process also ensures that the prospectus attracts investors.

The underwriter also has crucial function during the marketing stage, pitching, and the public show of the IPO. The underwriter has the responsibility of offering guidance to the company during this process. It must identify the response of the public and create portfolios of major and interested investors. The underwriter must also give the liquidity because of its role in the market. In this case, the underwriter must establish and maintain the strength of the stock and create momentum for the future performance of the company shares (Brau and Fawcett 111).

According to a study by Anna Kovner, underwriters matter in IPO processes (Kovner 2). Kovner claims that activities and monitoring of underwriters relate to underperformance of shares. This is because firms that do not value the importance and monitoring of underwriters perform poorly. These companies tend to have several insiders’ activities and are less opaque in their dealings. Kovner’s observation is consistent with past studies, which show that IPO underwriters monitoring of “post-IPO activities aim at preserving their reputation” (Kovner 2). Therefore, the process of monitoring post-IPOs goes beyond normal activities of equity analysis. According to Kovner, negative returns do not occur due to other functions of the underwriter related to market making and relationship management. Instead, returns are lower when the “underwriter’s affiliated funds hold higher percentages of clients’ shares” (Kovner 2). On the other hand, firms that have “a strong underwriter monitoring have low cases of abnormal returns even after regulating the underwriter’s lending activities, market-making, and investing” (Kovner 2). Kovner made this observation after studying underwriters monitoring at Merrill Lynch, Lehman Brothers, and Bear Stearns.

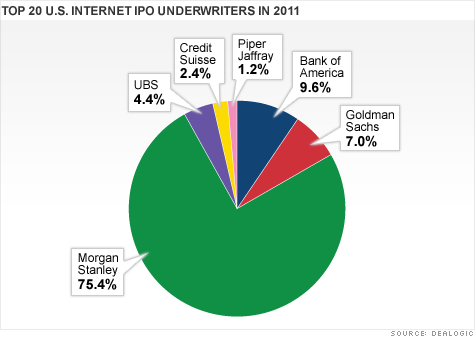

In the case of Facebook, the underwriter was Morgan Stanley. Douglas MacMillan, Lee Spears, and Serena Saitto provide accounts of how the company won the position of Facebook’s IPO (MacMillan, Spears, and Saitto 1). From all their observations, we can only rely on the record size of Morgan Stanley as an effective underwriter in IPOs of the US Internet companies. Facebook had the largest IPOs in the US history. As a result, the choice of the underwriter was crucial for success of the IPO given the role of the underwriter in the IPO processes. Statistics show that Morgan Stanley leads “by 20 percent of the market share based on IPOs from Internet companies in 2011” (MacMillan, Spears, and Saitto 1). At the same time, the company also leads other underwriters in IPOs of other American firms. This makes the company one of the most preferred companies in IPOs underwriting. Facebook could have settled for Morgan Stanley due to the role it may play in future acquisitions or debt offering. The company has impressive records based on IPOs of Google, Zynga, LinkedIn, Groupon, and other social networking companies like Renren of Chinese. Dealogic estimated that Morgan Stanley won all 75 percent of the IPOs in the US in 2011. It also noted that the company dropped its fees probably due to effects of the recession of 2008. The chart below shows the position of Morgan Stanley against other underwriters.

The idea of underpricing

The IPO underpricing occurs when “the offer price is lower than the first day market closing price” (Brau and Fawcett 111). Karlis notes that a high price of IPO on the first day has a significant influence on the public and media. Conversely, people in investment circles believe that such high prices of IPOs are discrepancies, which may result from a flawed auditing process of the underwriter or investment bank (Karlis 82). Such people believe that investment banks are agents of the issuing company and any increase in price can favor them.

Under ideal circumstances, “stock prices should match the per share present value of the discounted future earnings of the company, theoretically paid out as dividends” (Karlis 83). Such speculations rely on the industry performance and the anticipated growth of the firm after the IPO. There are factors that may influence the initial pricing of a company’s IPO. Consequently, theorists have provided accounts of underpricing in IPOs.

The Principal-Agent theory looks at the relationship between the company issuing IPO and the investment bank. This theory posits that the issuing company has no knowledge of its own value. As a result, it must depend on external auditors and underwriters in order to determine its true value. Therefore, the company issuing IPO, auditors, and underwriter decide on IPO processes and the contract. The contract depends on the value of firm issuing the IPO. However, the contract price must meet some conditions to “satisfy underwriters’ expectations on returns” (Karlis 84). The price must also be low enough to enable “the underwriter act in the best interest of the firm” (Karlis 84). This implies that the company must leave adequate returns for the underwriter so that it can act in the best interest of the company and provide all information. This process creates uncertainties about information the underwriter provides. Therefore, we can see how this relationship may lead to underpricing based on the report the company may get from the underwriter.

Another theory that attempts to explain underpricing in IPOs is the Adverse Selection Theory. This theory focuses on both the informed and uniformed investors. Informed investor relies on the true value of the company when making investment decisions. On the other hand, uninformed investor lacks information and makes random investment. This investor relies on information from the underwriter. According to this theory, an informed investor can ignore poor IPOs by relying on the value of a firm. Conversely, uninformed investor may make investment and lose or get returns. If such an investor loses money, he will probably not take part in future IPOs. Therefore, underpricing ensures that such investors participate in IPOs and create the necessary demands for shares. This theory also relates to rational expectation theory about efficient market conditions supported with adequate information. A study by Brau and Fawcett demonstrated that most CFO attributed underpricing to lack of “perfect information and uncertainties in the market” (Brau and Fawcett 111).

Firms may also engage in underpricing to create a “grandstanding IPO” on the first day of offer as a strategy for attracting investors through publicity and media exposure. This shows that underpricing may relate to the size of the issuing company.

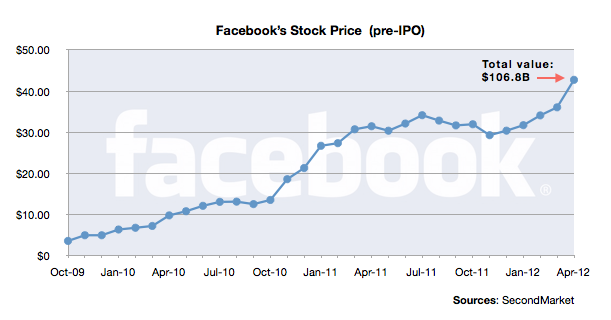

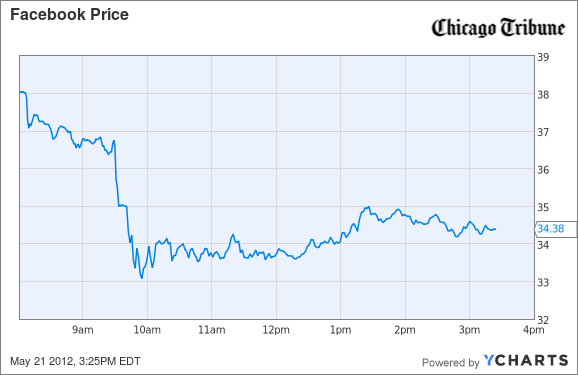

Not all companies engage in underpricing. Facebook IPO has several issues including overpricing. Facebook had overpriced its IPO. Many investors noticed that Facebook IPO share prices were too high. The share price of $35 overpriced the company 70 times against Facebook earnings of 50 cents per share. In addition, the share price also overpriced it 18 times against the projected revenue of five billion dollars. According to behavioral finance, such overvaluation of the IPO price could have occurred because of many investors over confidence in the company’s shares. The charts below show trends of Facebook share prices before and after the IPO.

After the IPO

After the IPO, firms undergo several changes. For instance, they must face the fierce competition in the market in order to maximize shareholders’ returns. Some firms achieve success after the IPO. Other firms are unable to “compete in the market effectively without inflow of capital that a stock offering provides” (Karlis 84). According to Karlis, “many Internet companies which issued IPOs are yet to return any profit after their IPOs” (Karlis 84). This shows the uncertainties and minimal efficiencies in markets.

Successful IPOs may sound lucrative for firms. However, some firms prefer to remain private. Such firms do not want to lose decision-making authorities to shareholders and regulating bodies like SEC.

Unfavorable conditions in the market may also deter firms from going public. For instance, the US recession of 2008 created unfavorable conditions that affected many companies and investors. The Internet companies demonstrate the effects of unfavorable conditions on returns and profitability.

Conclusion

This essay shows that the theory and reasoning for companies that should IPO differ significantly based on several factors. First, firms believe that IPOs are the cheapest sources of capital for future expansions and investments. IPOs also raise the value of the firm for potential merger and acquisition.

Timing of IPO also plays a significant role in decision-making processes. Studies show that IPO timing comes with the maturity of the company and revenues that a company can generate with a financial period. Still, timing of market conditions also influences IPO decisions.

From the study, we can note that the role of underwriter is important for companies that intend to go public. Underwriters control the value of the company based on their auditing processes. Consequently, set the IPO pricing. This can lead to underpricing or over pricing of the IPO. Scholars and CFOs agree that pricing generally depends on information and uncertainties in the market. This study also shows that IPOs are not always successful in terms of returns and profitability.

References

Barclay, Michael and Clifford Smith. “Another Look at the Evidence.” Journal of Applied Corporate Finance 12.1 (1999): 8-20. Print.

Brau, James and Stanley Fawcett. “Evidence on What CFOs Think About the IPO Process: Practice, Theory, and Managerial Implications.” Journal of Applied Corporate Finance 18.3 (2006): 107-118. Print.

Bulan, Laarni and Zhingpen Yan. “Firm Maturity and the Pecking Order.” International Journal of Business and Economics 9.3 (2010): 179-200. Print.

DePamphilis, Donald. Mergers and Acquisitions basics: All you need to know. Burlington, MA: Elsevier, 2011. Print.

Karlis, Peter. “IPO Underpricing.” The Park Place Economist 8 (2008): 81-89. Print.

Kovner, Anna. “Do Underwriters Matter? The Impact of the Near Loss of an Equity Underwriter.” SSRN 3 (2010): 1-50. Print.

Liang, Nellie, and Jean Helwege. “Is there a pecking order? Evidence from a panel of IPO firms.” Journal of Financial Economics 40.94 (1996): 429-458. Print.

MacMillan, Douglas, Lee Spears, and Serena Saitto. “Morgan Stanley Facebook Role May Cement IPO Lead for Third Year Running.” Bloomberg (2012): 1-2. Print.

Mohr, Andy. Timing of Facebook IPO. 2012. Web.

Raice, Shayndi. “Facebook Targets Huge IPO.” Wall Street Journal, US Edition (2011): 1-2. Print.