Introduction

Islamic banking has grown steadily in the recent past. Past studies have noted that they have moved into other regions like Europe and the wider Asian region. For instance, Juan Solé observes that the Islamic banking system has expanded not only in countries with most Muslims, but also in other countries in which Muslims account for a small percentage of the populations, such as the UK, Japan, Syria, India, and in the Kyrgyz Republic (Solé, 2007). As a result, the Islamic banking system has influenced some conventional banks in Europe and other parts of the world. On the other hand, Solé also notes that Islamic banks have also adopted some practices of conventional banking systems in order to remain competitive (Solé, 2007). Currently, there are over 300 Islamic financial institutions in more than 51 countries. In addition, there are also more than 250 mutual fund systems, which are based on the Islamic principles of finance. The Islamic financial system has continued to grow at the rate of 10 to 15 percent every year, and financial analysts claim that this trend is likely to continue into the future.

Islamic banks use the Sharia law and legal systems of Islamic religion to grow their businesses and increase their performance and competitive abilities in the West and other non-Islamic countries. This research focuses on the Role of Islamic Financial Instruments in the Development of Conventional Banking Systems. It attempts to compare briefly conventional banking with Islamic banking. Yet, most importantly, it explores the influence of Islamic banking on some financial institutions in non-Islamic regions, especially Europe. In addition, it seeks to eliminate any doubts or misconceptions about the Islamic banking system and projects the future of banking systems influenced by Islamic financial products.

Literature Review

Scholars and professionals alike have observed the recent trends in the development of Islamic banking in the West (Institute of Islamic Banking and Insurance, 2012; MacLean, 2007; Sleiman and French, 2013). These trends in the developments of Islamic banking systems are true for various reasons. One must note that it has not been easy for the Islamic banking system to flourish in foreign countries or even in its countries of origin. However, notable changes have taken place. As a result, today, many conventional multinational banks have focused on providing Islamic banking services either independently or in collaboration with Islamic financial institutions in the respective Western countries (Khan and Bhatti, 2008).

According to a study by Owais Khalid in 2011, large international banks such as “Societe Generale, BNP Paribas, Deutsche Bank, and Standard Chartered have all entered the Islamic banking business” (Khalid, 2011). Khalid also observes that even “accounting, consulting, and audit firms like Ernst Young now offer audit services to Islamic financial institutions” (Khalid, 2011). In 2013, Sleiman and French reported that Islamic trade finance had started to attract major financial institutions from the West. Although Islamic trade finance is a small fraction of the global banking business, it has attracted these banks due to rapid expansions and growths associated with the wealthy Gulf economies (Sleiman and French, 2013). The Bank of America Merrill Lynch has expressed its interests in offering Islamic trade finance in the future. Merrill Lynch aims to focus on potential customers from the Middle East who have improved their businesses and transactions globally. Traditional banking institutions have acknowledged the need to set up Islamic units in order to provide banking services to Islamic clients. This trend has forced several multinational banks to focus on the Islamic banking system and sector.

Although the Islamic banking system has experienced rapid growth, banking professionals observe that Islamic banks are “relatively small and lack the expertise and large international networks of mainstream Western banks” (Sleiman and French, 2013). These limitations may hinder the rapid progress of Islamic banking systems. The Organization of Islamic Cooperation, “which consisted of 57 member states, conducted foreign trade that amounted to “$3.9 trillion in the year 2011” (Sleiman and French, 2013). However, only a small percentage of this trade received financing in accordance with the Sharia laws in Islamic banking. The Sharia-compliant trade finance was worth “only three billion USD as the Saudi Arabia-based International Islamic Trade Finance Corp had approved in 2011” (Sleiman and French, 2013).

This is a clear sign that the Islamic banking system is undergoing changes. It is also important to recognize that trade has increased tremendously between the Gulf nations and the Asian countries, particularly in the predominantly Islamic nations. As these trading activities increase and become complex, the Islamic banking system will require specialized trading units to manage global operations. The Kuwait-based Asia Investment has estimated that trading activities between the Gulf nations and emerging economies of Asia have reached a growth of 30 percent every year. The institution started trading with $20 million in the year 2012 (Sleiman and French, 2013).

One notable trend in the influence of the Islamic banking system on the West banks is that some of the Islamic banking institutions have strived to expand their Sharia compliant to Western banks by looking for strategic partnerships. For instance, the Dubai Islamic Bank has stated that it would form such a partnership with the “Deutsche Bank’s expertise in order to enhance transactions involving letters of credit across Europe” (Sleiman and French, 2013). The Dubai-based financial institution wants to cater to local clients, who have increasingly focused on international trade. The Bank of America also sees the strategic partnership as a viable alternative because trade flows have gained critical positions as they gain international perspectives. Hence, the need to provide trade finance activities to Muslim clients has received attention among Western banks.

The Standard Chartered Bank in the UAE offers Islamic banking services. The bank believes that the demand for “Islamic trade finance has grown because of its structure and religious permissibility” (Sleiman and French, 2013). These are attributes that provide convenience to the customer. Islamic trade finance relies on additional security from other assets like real estate. Hence, the system is less risky provides ownership to customers, as well as an ethical proposition for users. This has led to the growth of the system across many MENA-based global clients.

MacLean writes that one cannot easily comprehend the growth in the Islamic banking system (MacLean, 2007). He points out that the difficulty arises on whether the system relies purely on halal (a complete complaint with the Sharia law) or it operates as a kosher within another religious context. However, MacLean acknowledges the growth in the Islamic banking system across Europe. Moreover, he shows that financial analysts have predicted a clean growth rate of 20 percent in deposits every year. This shows that the Islamic banking system presents huge business for Western banks, and banks, which delay taking the opportunity, may miss out in the future. Various governments have expressed their interests in supporting Islamic banking systems in their countries. For instance, in the year 2007, the UK Prime Minister, Gordon Brown, noted that it would review its laws in order to accommodate the Islamic financial system in London. This was to make the country a ‘gateway’ for the Islamic financial system in Europe. Japan also showed interest in becoming “the first non- Muslim country to offer Sharia-compliant bonds while Malaysia had proposed substantial tax incentives in its 2007 budget for its Islamic financial sector” (MacLean, 2007). In short, Western banks have noticed that they do not need to be “Islamic in order to bank in accordance with Sharia” (MacLean, 2007). Instead, they only require “a board of religious scholars to approve their operations” (MacLean, 2007).

Data Collection

The study relied on several methods to gather data. These included the use of questionnaires with closed-ended questions, data search from the Worldwide Web, reviews of articles in databases, and trend analysis by using professionals’ and scholars’ projections on the role and growth of Islamic banking in the West, as well as its influences.

Treatment of the Study Data

This study focused primarily on quantitative data in order to show the impacts of the Islamic banking system on non-Muslim countries, especially in Europe. Data presented were mainly in descriptive forms by the use of charts, tables, and graphs.

Focus of the Study

What is the degree of influence of Islamic financial instruments on conventional banking systems?

The study established that there were significant influences of the Islamic financial instruments across major economies of the globe. For instance, most countries in Europe have adopted Islamic financial products to facilitate import and export business for their Muslim clients.

This table shows that Islamic financial institutions can coexist with conventional banks and remain competitive with similar products but structured under Sharia laws.

Presently, several large multinational banks and Malaysian banks have focused on offering Islamic derivatives.

Data from derived from (ATKEARNEY, 2012)

These derivatives are only for hedging roles, but they are not speculative instruments. Hence, banks cannot trade them.

What are the future (long-term) effects of the conventional banking system? (Collapse or prosperity)

The recklessness lending among conventional bank systems observed in 2008 had the potential of causing the collapse. However, a regulated conventional banking system may only prosper. One must understand this issue from the perspectives of risks that the conventional banking system faces. It is imperative to note that these findings do not focus on shadow banking activities, which are mainly unregulated.

(Mauro et al., 2013)

In most cases, the conventional banking system has a portfolio that has many loans, leases, and other credit facilities. These credit facilities are both potential for prosperity or collapse for the conventional banking system. They do not have real economic assets, such as real estate, to support. Hence, bad loans can affect the conventional banking system and cause its collapse, as witnessed during the 2008 global financial crisis. The conventional financial system can only gain prosperity through managing its portfolio with due regard to the future fluctuation in rates of interest, operational efficiency, and institutional profitability.

Is the conventional banking system benefiting some and harming others? In addition, will it backfire on the beneficiaries at some point in time?

From the study, the following data captured how conventional banking benefits some and cause harm to others. Moreover, most of the available data derived from the lesson of the 2008 global financial crisis showed that the conventional banking system could always backfire on the beneficiaries based on how well it is managed.

Data showed that the conventional bank systems might crumble due to the reckless activities of the beneficiaries. In addition, the system also benefits only a few capitalists and causes harm to majorities. As a result, the impacts spread across several areas within public life.

- Conventional banking systems socialize risks and costs. On the other hand, they privatize profits. This suggests that nearly 99 percent of the population must deal with poor social and economic status, but importantly aid in the bailout when speculative investments go wrong. Meanwhile, the entire profits only go to one percent of the senior executives and others within the bracket.

- The collapse of the conventional banking system resulted in mass unemployment, underemployment, and mass poverty of nearly 25 million people. About four million were out of jobs for more than one year. Between the years 2006 and 2010, poverty grew by more than 27 percent. In addition, interest rose drastically on existing loans. Meanwhile, the system and the people responsible for the collapse of the system continued with their practices.

The study also noted that the conventional banking system had other penalties on defaulters, which included compounded interests and penalties for late payments. Interest is the focus of the conventional banking system as opposed to the Islamic banking system, which does not charge interests.

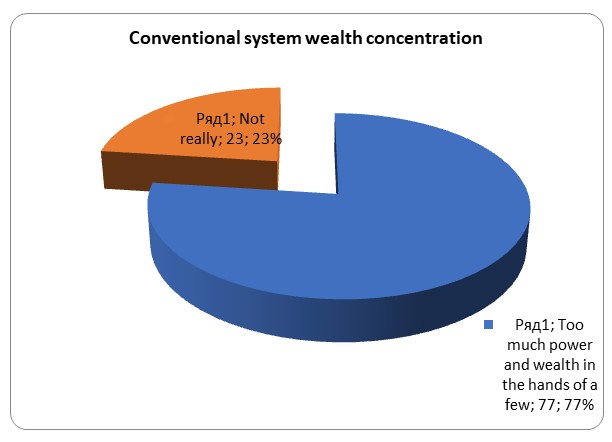

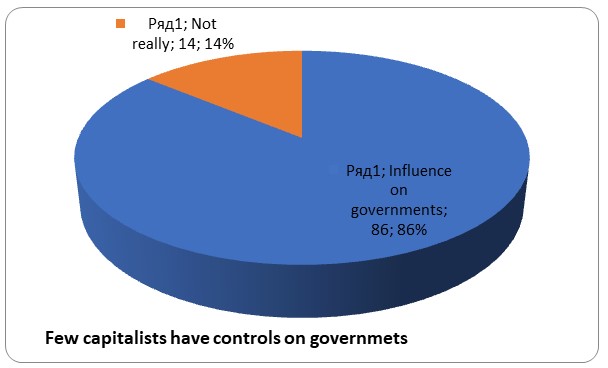

The study showed that majorities agreed that only a few people controlled the wealth and power generated by the conventional banking systems. In addition, it also indicated that capitalists, who benefit from the conventional banking systems and large corporations, had too many influences on governments.

Can Islamic banking solve the current global financial crisis?

From the databases and existing literature, most studies and opinions showed that the Islamic banking system could provide effective solutions for the current global financial crisis. For instance, one respondent claimed, “the Islamic financial system is the only alternative to the current and persistent financial crisis of today.”

Many professionals and Islamic banking scholars claimed that the current global financial crisis had opened several opportunities for the Islamic banking model. The supporters of the Islamic banking system asserted that the model could bring stability in the financial market based on the features identified in fig. 3.

Several sources of research data showed that the conventional banking system lacked collateralized debt obligations (CDOs). Hence, the global crisis that caused losses running into billions of dollars was inevitable. However, it could not have occurred under the Islamic banking model. They noted that the Islamic principles regarding the CDOs could have averted such reckless lending practices witnessed in the conventional banking system.

In addition, the Islamic bond has unique features in the mortgage market. Hence, it could have prevented a subprime mortgage crisis. Sources indicated that the conventional banking system relied on dubious rated collateralized debt systems to protect itself. However, the system proved its weaknesses as it resulted in a global credit crunch. According to respondents, a crisis involving mortgage loans is not possible and completely unthinkable in the Islamic banking system because Sharia law does not support such practices in the capital markets. It is like using debt to sell another debt in the conventional banking system. In the Islamic banking system, the rule is simple to guide banks, i.e., the bank cannot sell what they do not possess. Moreover, the Islamic banking system requires assets to back trading activities. However, in the conventional banking system, many banks did not require backing assets for some transactions. In other words, if the conventional banking model relied on the Islamic finance model for such huge transactions, then they could have easily prevented the crisis and its effects on the economies.

Are there any banks that have integrated Islamic financial instruments within their banking systems? If so, are they growing or shrinking?

The study showed that a number of multinational financial institutions have already integrated some aspects of Islamic financial instruments alongside their banking systems.

Although data on the growth of Islamic financial models adopted by international banks are not readily available, the scramble among other banks to offer trade finance products to Muslim clients has grown significantly. This suggests that conventional banks with certain Islamic banking products have grown steadily. Moreover, they only provide such services to wealthy clients that seek overseas transactions. Hence, it is a rich unexploited market with huge growth potential.

These institutions offer Islamic financial services through their subsidiaries or Islamic windows, or Islamic units, which are mainly in the Middle East. Further, in the West, there are also other banks that have started to provide Islamic banking services to Muslim clients in such countries. Data showed that the growth of Islamic banking instruments in the conventional banking system was promising and likely to grow steadily.

Are there any non-Islamic countries or regions that are encouraging the implementation and spread of the Islamic banking system?

According to data gathered, there were several non-Muslim countries that promoted the spread and implementation of the Islamic banking model. England, Singapore, Malaysia, Ireland, France, Indonesia, India, and Germany, among others, have expressed their support for the Islamic banking model. For instance, there are Middle East banks that have opened branches in London and Birmingham (British Islamic Bank and Islamic Bank of Britain). In addition, such conventional banks have also opened Islamic units to serve Muslim clients in their respective countries.

Are there any hybrid financial products that are conventional yet influenced by Islamic banking?

Data showed that some of the Western banks had adopted hybrid instruments to market for both Muslim and non-Muslim clients. They mainly focus on short-term debt instruments to offer to their clients. They provide such products under the Participating Growth Bill (PGB) as a part of innovative hybrid financial services.

Data Analysis and Discussion

This study aimed to show the role of the Islamic financial instruments in the development of the conventional banking system, particularly in Europe. Hence, data analysis and discussion focus on the findings on specific areas related to the study questions.

From the study results, one can observe that the Islamic financial model has grown significantly in the last 30 years. As a result, it has influenced the global financial system, particularly the conventional banking system. Data from Ernst & Young on the World Islamic competitiveness report 2011 – 2012 indicated that the Islamic banking system had grown steadily despite the global financial crisis.

The degree of the influence of Islamic financial instruments on the conventional banking system of Europe has been recognized and captured through various texts (Solé, 2007). The Islamic trade finance model has appealed to many conventional multinational banks of the West, which include ABN AMRO, Standard Chartered Bank, Citibank, HSBC, Goldman Sachs, and Kleinwort Benson, among others (Khan and Bhatti, 2008). As a result, these banks have established Islamic windows, Islamic units, or Islamic subsidiaries with the aim of providing export and import financial services to wealthy traders from the Middle East who have focused on international transactions. In addition, these banks have set up their offices in both their home countries and across the Middle East. In addition, some countries already have standalone Islamic banks to provide services to Muslim clients and other non-Muslim customers who prefer the Islamic banking model.

The study noted that Western countries like the UK, France, Ireland, Germany, and Luxembourg had expressed their desires to sell the Islamic Sukuk. In addition, other countries like India, Malaysia, Turkey, Singapore, and Japan are at advanced stages of implementing regulations that would facilitate the adoption of Islamic banking instruments to most consumers.

Sukuk has become the most preferred Islamic banking instrument among non-Muslim countries. In addition, Multinational banks have also focused on offering Islamic derivatives to consumers. This practice is mainly common in the Asian region. The Islamic derivatives on offer in these financial institutions include “forward-rate agreements, cross-currency swaps, and equity-linked structured products” (ATKEARNEY, 2012).

The future of the conventional banking model remains uncertain due to instability and constant fears of another global financial crisis. Mauro and colleagues (2013) noted that the conventional banking system experienced challenges related to credit risks, interest rates volatility, capital structure, operational risks, and market risks, among others. According to Mirakhor, the Western world banking system was responsible for the global financial crunch of the year 2008 (Mirakhor, 2009). The author observes that the conventional banking system relies on credit and interests to sustain it. However, this system of banking brought about several social issues because the system is unsustainable. In this regard, credit risks and market risks are the major threats to the conventional banking model (Mauro et al., 2013).

Many critics of the conventional banking system have portrayed it as the cause of the global financial crisis. On this note, they have asserted that the Islamic banking model is the best alternative for the unsustainable conventional banking system (Mirakhor, 2009). According to Chapra (2010), the current conventional banking system lacks market discipline. As a result, it facilitates irresponsible and “excessive lending, high leverage and ultimately the crisis” (Chapra, 2010). This is a continuous process in banks, which eventually leads to poor asset prices and economic failure. On the other hand, the author observes that the Islamic banking model has a risk-sharing strategy that eliminates these market and credit risks. In addition, the system offers credit primarily for the “purchase of real goods and services and restrictions on the sale of debt, short sales, excessive uncertainty (gharar), and gambling (qimar)” (Chapra, 2010). These practices can provide financial discipline in the global market, avert any possible financial crisis, and create financial stability.

However, some studies have suggested that the Islamic banking system has not gained adequate ground to support the global banking system and lacks the expertise for complex global financial transactions (Chapra, 2010; Sleiman and French, 2013). Further, Chapra observes that the system has gained a small fraction of the global financial market share, and in case it operates perfectly under Sharia law, the model may not be able to have any significant impact on the global financial market. Although the conventional banking system has instituted reforms to avert any possible future global crisis, the stopgaps may not be effective because of the rising private and public debts. On this note, the Islamic banking system requires massive reforms. Muslim countries must present the system in a rational manner to allow the public to understand its superiority. Moreover, they must also eliminate the system’s negative association with funding terrorism activities (Christofi, 2007). Overall, the resilience and growth of the Islamic financial system have led scholars and professionals to conclude that the system could offer a solution to the global financial turmoil (Kassim and Majid, 2009).

Unlike the Islamic banking model, the conventional banking system relies on capitalist ideologies. This suggests that the system only benefits a few and causes harm to majorities. In addition, the system collapses at some point in time, and this is when the government bailout is critical for the system. According to Mirakhor (2009), the conventional banking model does not rely on ethical principles and creates both social and economic challenges for the masses. Hence, the Islamic banking model is the best alternative because it relies on “ethical financing principles and promotes the welfare of everyone” (Mirakhor, 2009).

Multinational banks have embraced Islamic financial instruments within their banking systems. The study findings suggest that these institutions are growing as the Islamic financial system gains a global market share. This study supports previous studies and documented evidence, which show that some of the multinational financial institutions use a Participating Growth Bill (PGB) as “an innovative hybrid financial vehicle for short-term debt instruments” (Haghtalab and Nodeh, 2012). In addition, these banks also use the concept of Islamic bank units, subsidiaries, or windows to provide such hybrid financial services to both Muslim and non–Muslim clients. In this regard, conventional banks have established distinct units, windows, or subsidiaries to offer such services.

There are banking regulators and the Sharia board to ensure that Islamic financial institutions adhere to banking regulations. These regulations extend to multinational banks, which run subsidiaries, windows, or units for Muslim clients. Ernst & Young conducts audits for these institutions to ensure that they comply with the regulations and professional practices (Khalid, 2011). Many Western countries and Muslim nations have recognized window operations because of these professional practices. Today, conventional banking institutions consider window operations as successful systems in several markets. Moreover, they have gained considerable growth in the UAE and Saudi Arabia. This confirms that conventional financial institutions, which have adopted hybrid products or window operations, have experienced steady growth. About “11 percent of the Sharia-compliant assets in the UAE and nearly half of the total banks’ asset base in Saudi Arabia” (Nazim and Shakeel, 2011) are under window operations. Conventional multinational banks have understood the implications of Sharia laws on Islamic window models. As a result, they have applied such requirements in their strategies, product developments, operational processes, risk management strategies, and corporate governance practices. Islamic derivatives have become popular among Western banks. However, ATKEARNEY reports that derivatives are full of controversies in Islamic finance (ATKEARNEY, 2012). Some Islamic banking professionals and officials believe that derivatives are not compatible with the Sharia principles due to deferment of obligations to later dates. This is tantamount to selling what one does not have or debt exchange without any accompanying assets. Hence, the practice reflects the prohibited gharar, which involves speculative investments. Such controversies have made derivatives appeal to a small segment of Muslim clients (ATKEARNEY, 2012).

The study noted that many non-Muslim countries, including European countries, had contemplated and advocated for the adoption of the Islamic banking system. These findings support previous studies by other researchers on the Islamic banking system (Solé, 2007). European countries like the UK, Germany, Ireland, France, and Luxembourg have considered the Islamic financial system. Specifically, Gordon Brown had advocated for the introduction of the Islamic banking system in the UK (Christofi, 2007). The former premier wanted to make the UK a financial hub for Islamic baking in Europe. Although the progress is slow in most of these countries, there are positive indicators that they would eventually embrace the system because many of them have expressed their desires to sell Sukuk. Countries in Asia, such as Malaysia, Singapore, Indonesia, India, Turkey, Japan, and the Kyrgyz Republic, among others, have also implemented and strived to make the region an Islamic financial hub. One must also recognize that the Islamic banking model has grown in some of the non-Muslim African states like Kenya, South Africa, Ghana, and Nigeria, among others. This proves that the Islamic banking model has gradually spread outside the Middle East.

It is difficult to identify pure hybrid products in the conventional banking system because most banks tout their products as purely Islamic Sharia-compliant in order to attract Muslim clients. Some studies have indicated that customers would be skeptical about a conventional financial institution, which offers Islamic financial instruments and its interest-based products. This has been a subject of discussion among Islamic finance scholars (Yaquby, n.d). Customers may consider such products or strategies as a ploy to exploit them for commercial purposes. The issue has been how can a conventional bank can assume to sell both interest-based and Sharia-compliant products simultaneously.

Yaquby notes that some scholars have asserted that this situation is not permissible under Sharia principles for finance for several reasons (Yaquby, n.d). First, the conventional banks do not adhere to “Sharia law and financial principles in with regard to their statutes and incorporation” (Yaquby, n.d). Second, it would be impossible for conventional banks to have charters that comply with the windows, funds, or subsidiaries. Still, some scholars have also claimed that funds from such conventional banks may be from prohibited sources. This raises the issue of investing unlawful funds through Islamic financial institutions. On this note, some Islamic financial scholars have argued that the main aim of conventional banks is to compete with Islamic financial institutions and unfairly exploit Muslim clients (Yaquby, n.d).

On the other hand, some scholars have refuted such claims by noting that any competition in the market would only favor the fittest, efficient, and suitable financial model. In other words, such competition may provide direct advantages to Islamic financial institutions, which must strive to provide efficient and quality products to the market. This would be the result of competition (Yaquby, n.d).

Other scholars also argue that conventional banks may transform themselves into fully-fledged Islamic banks. However, they can only do this if the practice is viable and has met all conditions required under Sharia principles of finance. Currently, no practical example exists to substantiate such a claim. Most importantly, one must recognize that all multinational financial institutions, which offer financial services to Muslims under windows, must meet all the conditions for Islamic financial institutions (IFI). Moreover, the bank must satisfy requirements when managing such funds. Hence, it is permissible under Sharia law if only the conventional bank meets all conditions of the IFI.

Findings and Implications

The study established that the Islamic banking industry has experienced significant growth in the recent past. In fact, many past studies had documented that the industry grew by at least 20 to 33 percent per annum. This rate was twice that of the conventional banking industry. As a result, the bank has expanded to other areas outside the Middle East, in which it has played a significant role in influencing the development of the financial instruments of conventional banks.

In Europe, the bank has attracted support from the UK, France, Germany, Ireland, and Luxembourg. These countries have expressed their desires to promote Islamic financial instruments, especially Sukuk, in their countries.

Many multinational conventional banks have formed Islamic windows, units, or subsidiaries in order to provide financial services to Muslim clients. As a result, these institutions have experienced significant growth through these strategies. Specifically, they have focused on trade finance services and Islamic derivative instruments. Window operations are successful in the Middle East and Europe because conventional banks are flexible and can manipulate their products, strategies, operations, budgets, risk management, and corporate governance to accommodate such new products.

The study also shows that the Islamic financial model could replace the conventional and avert any future financial threats because the model relies on ethical principles, sound investments, no interests, and risk-sharing practices. This makes it suitable for global financial transactions.

However, there are major implications for the Islamic banking model. First, many scholars claim that the current Islamic banking model cannot support the global banking industry because it lacks the resources and adequate expertise to manage the complex transaction involved. Second, the Islamic financial institutions must deal with skeptical customers outside the Middle East who believe that conventional banks should not and cannot offer Islamic window services because they lack Sharia principles in their charter to provide such services. In addition, the issue of Islamic derivative financial instruments has remained controversial, especially in the Gulf region, because others consider it as the prohibited gharar, which involves speculative investments. Yet, conventional banks practice it. Third, although the Islamic banking model has resulted in the creation of hybrid, successful financial instruments, there is no clear distinction between these products and specific Islamic financial instruments. This has created skeptical customers too, who believe that conventional banks want to exploit market opportunities and reap commercial benefits from Muslims. Future studies should explore these research implications.

Recommendations

- Islamic financial model must create a global appeal by eliminating any doubts and fears among customers that the model supports and finance terrorist activities.

- The model must establish credibility in its relationship with conventional banks. It must make customers appreciate the unique differences which make a conventional model differ from its model. Once customers understand such issues, they would also understand the rationale behind window services and Islamic derivative instruments that conventional banks offer.

- The Islamic banking model has the potential to replace the conventional system in order to avert a possible global financial crisis in the future promote effective risk management, risk sharing, and equal distribution of profits. However, Islamic banking model scholars must develop strategies to allow the model to support complex global transactions. At present, the system cannot support global financial systems.

- For effective competition, Islamic banking instruments should be competitive, diligent, efficient, and effective in both products and services. In addition, it requires technical expertise and resources to run effectively.

Conclusion

The study concluded that role of Islamic financial instruments in the development of conventional banking systems is evident in the scramble among large conventional banks to offer Islamic financial instruments through window services. Moreover, many European countries have supported and implemented some rules to facilitate the provision of Islamic banking services, especially Sukuk. The study also established that the Islamic financial model could replace the crumbling conventional banking system because it is resilient to the financial crisis, interest risks, market risks, and credit risks. However, the system must develop its resources and instruments to appeal to the global market rather than a small segment of the market. Finally, future studies should explore some fundamental research implications, which this study has raised, such as the controversies surrounding window services in conventional banks, Islamic derivatives, the distinction between hybrid financial instruments, and skeptical customers.

References

ATKEARNEY. (2012). The Future of Islamic Banking.

Chapra, U. (2010). Global Financial Crisis: Could Islamic Finance Solve the Problem? Web.

Christofi, H. (2007). Islamic Banking in Britain.

Haghtalab, H., and Nodeh, V. H. (2012). Marketing of Financial Services by Islamic Banking Institutions in Iran. International Conference on Management, Humanity and Economics, 106-109.

Institute of Islamic Banking and Insurance. (2012). Islamic Banking in Europe: A Survey. Web.

Khalid, O. (2011). Rise of Islamic Banking in Western Europe. Web.

Khan, M. M., and Bhatti, M. I. (2008). Islamic banking and finance: on its way to globalization. Managerial Finance, 34(10), 708-725.

Kassim, S., and Majid, S. (2009). Islamic Finance: A Growing Industry. Web.

MacLean, A. (2007). Islamic Banking: Is It Really Kosher? Web.

Mauro, F. di, Caristi, P., Couderc, S., Maria, A. Di, Ho, L., Grewal, B. K., Masciantonio, S.,…Zaher, S. (2013). Islamic Finance in Europe: Occasional Paper Series NO 146 / 2013. Frankfurt am Main, Germany: European Central Bank.

Nazim, A., and Shakeel, A. (2011). Islamic banking: Can conventional banks offer Islamic products.

Sleiman, M., and French, D. (2013). Western banks eye growth in Islamic trade finance. Web.

Solé, J. (2007). Introducing Islamic Banks into Conventional Banking Systems Working Paper.

Yaquby, S. N. (n.d). Shariah Requirements for conventional banks. Web.

Research Questions

- What is the degree of influence of Islamic financial instruments on conventional banking systems?

- What are the future (long-term) effects of the conventional banking system? (Collapse or prosperity)

- Is the conventional banking system benefiting some and harming others? In addition, will it backfire at the beneficiaries at some point in time?

- Can Islamic banking solve the current global financial crisis?

- Are there any banks who have integrated Islamic financial instruments within their banking systems? If so, are they growing or shrinking?

- Are there any non-Islamic countries or regions that are encouraging the implementation and spread of the Islamic banking system?

- Are there any hybrid financial products that are conventional, yet influenced by Islamic banking?