Improved international relations, technological development, growth in international trade, and development of reliable communication channels have led to rise in globalization. Globalization is the process through which regional economies integrate into a global network of trade; with globalization, multinationals and private companies are able to take advantage of enlarged global market. When venturing in international markets, companies need to be fully equipped with policies and strategies that will see them succeed in the global competitive environment; they have to make decisions that address local and international issues. With globalization countries have to manage their foreign direct investments (FDIs) and ensure the net effect of FDI inflows and outflows is beneficial to their economies. Effective management of FDIs programs leads to economical, social, and political welfare to both investing and receiving countries (Easson, 2004). This paper analysis foreign direct investment trends in the world.

Why firms invest overseas

Companies invest in foreign countries for a number of reasons; John Dunning has identified four main reasons that make companies to invest internationally, they are:

Market seeking

The success of a company depends on how well it is able to manage its customers; companies expand their operations overseas to find new buyers for their goods and services. When determining the foreign country to invest, the investing country has to determine the market situation in the country of investment. Investment may be triggered by the acknowledgement that their services and goods are unique than those offered by competitors in the foreign countries. With this recognition, the companies realize they can successful compete in the foreign market. In saturated industries, foreign investment is a management strategy that assists companies move from highly competitive areas to areas where competition is manageable. Red Ocean strategy focuses on organizations focusing on highly competitive markets mostly domestic markets. However with the opportunity offered by globalization, the firms are able to adopt blue ocean strategies that focus on selling once products in areas where competition is manageable. Another foreign investment motivator is the belief that investments overseas are more profitable than local investments. The belief works for the good of the organization while in other situations it’s not the case (Jackson, 2010).

Resources seeking

For an effective production, companies require variety of resources which include human, physical, financial, raw materials, and capital. Different countries have different levels of factors of production (land, labor, capital, and natural resources); organizations are likely to invest in those countries that have abundance of the resource that is most crucial for their production. For example in labor intensive companies, they are more likely to be situated in countries that have cheap labor and the workforce has knowledge on the production processes. Foreign direct investment in African, Asian, and Caribbean countries has been motivated by the existence of cheap labor in the countries.

Strategic asset seeking

Firms need to diversify the kind of assets they have; assets can be classified in form of physical assets, distribution networks or new technology. When such assets have been acquired effectively, the management is able to get higher returns from their assets. Foreign assets diversification is a risk management policy where companies establish partnership with other existing foreign firms. As a strategic move, companies establish international branches to assist them gain efficiency in their business operations.

Efficiency seeking

Sometimes organizations engage in foreign investments to seek and develop efficiency in their operations; reorganize their overseas holdings in response to broader economic changes. For example free trade agreements in different countries are likely to attract companies to invest in such countries as the market base is widened (Nocke & Yeaple 2007).

Cross border mergers and acquisitions

Since the 1990’s cross border mergers and acquisitions are on the rise, they have been facilitated by financial liberalization policies, regional agreements, and government policies. Cross-border mergers and acquisitions (M&A’s) have been used as business processes to expand market base across borders. The trend of M&A’s skyrocketed in the 1990’s when technological development in communication and technology were on high increase. In the 21st century, the number of firms undertaking M&as have increased as companies seek to remain competitive in the world challenging business environment

The main acquirers are from developed countries European Union (EU15) and the United States being the leading ones where they acquire companies in developing countries. Over the period covered in 2003 and 2005, the amount of mergers and acquisition that were done amounted to USD 465 billion from European Union (EU15) and the United States (the amount is 85% of the investment done during the time). The amount was an improvement from $252 billion reported in 1996.

In the last two decades, the area that has attained the highest flow in acquisition and mergers are in the manufacturing sectors; the specific industries are chemicals, machinery and equipment, petroleum, coal, rubber and plastic products, and food, beverages and tobacco. In the service industry one third of the acquisitions where on electricity, water supply, banking, insurance, and gas; the United States tops as the world most acquirer.

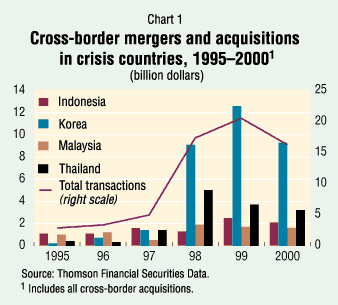

In East Asian countries mostly in Malaysia Indonesia, Korea, and Thailand; there was a sharp rise in mergers and acquisitions for the period between 1996 to 1999, from $3 billion to $22 billion; the investment them deepened to $28 billion in 2000. The rise can be attributed to economic growth in the countries that were attracting investors in the economy. See the chart below:

In the wake of global financial crisis, Cross-border mergers and acquisitions had been seen as best ways through which continuity of businesses in highly hit countries had; the method was seen to prevent potentially profitable assets from being wiped out during domestic financial crises. Global financial crisis has also created a room for mergers and acquisition of companies who are highly indebted, or the loss making ones.

FDI trends in various countries of the world

During the recovery from global financial crisis of 2007, foreign direct investments increased in 2010 to reach $1.24 trillion; despite the increase, the amount was 15% lesser that the amounts recorded in the pre-crisis stage. According to UNCTAD report of 2010, the world is expected to experience an increase in FDI TO &1.4-1.6 trillion in 2011. Of the amounts invested, half of the amounts were in developing and translation economies.

Since 2004, FDI have been experiencing constant growth, in 2004 the amounts were &717.7 Billions, in 2007 the figure rose to $1,833.3 Billion. In 2007, Saharan African countries have been the main beneficiaries of FDI programs; in 2007 a total of 33 countries received an average of $13 billion. With the growth in FDI, there was the growth of mergers and acquisition (M&A), according to UNCTAD, the value of mergers and accusations in 2007 were 1.637 Billion. In 2007, FDI investments in Africa were dominated by Nigeria, Egypt, South Africa and Morocco which received 5.4%. 5.3%, 3.7% and 2.3% of the FDI; the increase was favored by conductive business environment that the countries governments had been able to curve.

Global FDI rose marginally with about 55 in 2010 from 1, 185 billion Dollars recorded in 2009; this was at the time the world was picking from global financial crisis of 2007; the increase has created large disparity among the trend of the investment with developing economies taking strong positions as receivers of FDIs. In the year 2010, FDI flow in developing countries increased by approximately 12% (the investment rose by $574 billion). The increased investment is developing countries have been triggered by their fast economic development, improving domestic demands, and burgeoning effect. United States, China, Hong Kong, and Belgium were the leading FDI out flows in 2009 through to 2010; the countries had their investment mostly in developing countries. In Africa one of the continent that has enjoyed from FDI, there was a decline in FDI investment in 2008; the same was felt in West Asia which recorded $58 billion FDI flow. In 2010, the transitional countries of South-East Europe and Commonwealth of Independent States (CIS), recorded a decrease in the amounts of FDI flow they received in 2010. However the net effect of growth in transition countries was 24% reaching a record $62 billion in 2010; the trend and growth can be attributed to the believe that the countries are more secure than their counterpart. The main acquirers and merging companies were from countries like Chile, Brazil, and Colombia; this was at the time that the economies were enjoying an increased economic growth and political stability. FDI inflows in the pacific and Asian countries declined marginally in 2001 from US$ 134 recorded in 2000 to US$102 recorded in 2001; the trend was largely influenced by the situation of China, Hong Kong, and Malaysia that had massive outflow of US$62 billion (Razin, & Sadka, 2007).

Countries which are the most benefited by FDI and the impact of financial crisis in those countries

Asian countries are the leading foreign direct investments attractor, followed by Latin America, the Caribbean and Africa respectively. Globalization had an effect on international and domestic markets; different industries were experiencing a reducing gains and others experienced losses. In those countries that were enjoying a large number of FDIs they were not spared by the crisis. When the economic situation of the world is hard, people hardly are able to afford things for their various uses; when people fail to buy commodities, then business is on the decline.

During the economic crisis, there was reduced growth in infrastructures; this meant that the operating profits derived from such countries were reduced dues to the inefficiency of the economies. With reduced profits triggered by both increased operating profits and low markets, companies were finding themselves with no option other than suck they employees. When countries employees lose their jobs, it means that the economy suffers reduced living standards and cost of the labor in general reduces. Some losses that were incurred during the time have to be offset in future profits for taxation purposes; when this happens, the host country suffers lack of income and the economic development is affected.

Some countries made monetary and fiscal policies to rescue their countries from global financial crisis; some of the policies injured both local and foreign companies. For example there was much advocacy that to protect local industries countries should enact direct and indirect barrier to trade. When this was affected, the net effect was country that was not attracting FDI or when they invest, they suffer inefficiencies in the country. Foreign currency and balance of trade was one of the areas that were greatly affected by global financial crisis; when this sector of the economy is affected, it has a direct impact to foreign direct investments that largely depended on the sectors for their trade. Foreign exchange loss became the order of the day and the net effect was firms shying off from countries with unstable currency (UNCTAD, 2006).

Political risk and FDI

Countries are experiencing different levels of political risks that hamper development by international investors. In countries that have high risk of political risks, the investors fear that their businesses will be affected by political instability in such countries thus they tend to avoid investing there. Some countries that of late have shown substantial levels of political uncertainty include Somalia, Ivory Coast, Tunisia, Zimbabwe, Republic of Lao, and Afghanistan. These are countries that when an investor ventures in the market, his business may be eroded by the situation even before he is able to break even. This makes them shy off from such countries.

Countries with political uncertainties have limited technological and infrastructure development. Governments in such countries are more concerned on their political situation and level the national development at stake. With the conditions of the roads, communication networks, transport channels, and education systems, the countries can hardly attract foreign direct investors in their territories. There are different parameters that attract foreign direct investors; they include the economic development of the country and the state of peace in such countries; in the event that the countries have political uncertainties, then there will be less attraction.

Business and operational risks in countries with high political uncertainty are high; business risk means the chance that a business will not be able to attain its set goals and objectives as a result of factors outside the business. In political uncertain countries, there are chances of high external influence by political class through policies, decisions, and long term policies they have for the country. The state of the countries makes them high risk areas and foreign direct investments cannot find favorable business environment.

When investing in foreign country, there is much relationship between the relationship that the host country and the investing countries have. Those countries that have been able to maintain healthy political and economic relationships, then investments in such countries are always high. For example it has been noted that in most developing countries, the main investor is always the colonizer of the country (this trend is nowadays been challenged by the invention of China and other Asian countries). On the same note the reason why China is fast to invest in foreign country can be explained by the fact that the country is politically neutral thus every country feels comfortable working with the nation.

One of the main supporters of FDI in a country is the purchasing power that its citizens have; countries with political un-rivalry have their population with very poor purchasing power parity. The citizens are not learnt enough to offer reliable workforce to foreign direct investment companies. This results to poor business opportunities. In politically unstable countries, resources are not effectively utilized; this leads to high cost of doing business and lack of raw materials necessary for foreign direct companies. In politically unstable countries, there is a trend that repeats every time there is an election; it happens that there is ethnical crisis that threatens business. There is also the fear that when new government takes charge, it is likely to change policies operating in the country at the risk of foreign investments.

On the extreme, there is some political rivalry that tends to attract some foreign direct investments. This happens in countries that enjoy rich natural resources that have not been exploited because of the instability. Again in the event that a country is recovering from political uncertainty, it has the tendency of attracting foreign direct investors who find the countries are blue markets and have cheap factors of production. Such is the case that was experienced in Rwanda after the famous Rwanda genocide.

Problems and issues connected with FDI

Foreign direct investments are faced with a number of issues and challenges emanating from both internal and external factors. Internally the companies have the challenge of managing businesses across the board where they find people and markets that have different expectations that their home markets. Managing diverse human resources effectively is one major problem that FDIs have; contemporary international human resources management strategies are focusing on how they can be able to localize human resources policies and practices for the betterment of their organizations. When localizing human resources policies, it takes the forms of international coordination, global leadership development and management, cultural intelligence, and diversity management; the quality manpower to handle the localization or diverse human management is the challenge that FDIs have. When managing a diverse global human capital, multinationals (MNCs) have the mandate of facilitating production of work of difference cultural beliefs, social settings, with diverse views, thinking styles, personalities, and emotional intellectualism.

Foreign direct investors are facing the challenge of being political vehicles in their host countries; there are times that policies are made to affect them directly. When faced with such political rivalry, the companies are not able to get high returns and in some instances they have suffered losses as a result. High taxation, tarrif and non tariff barriers have also made doing business internationally a challenge to FDIs. Some countries are taking advantage of the international investors and charge them unreasonably high taxes and other levies (Coeurdacier, 2011).

FDIs are facing the challenge of how to deal with customs rules and legislations in different countries; although the World trade organization (W.T.O.) came up with a harmonized tariff classification code (HS. Code) its use has been challenged. HS. Code gives the rate of duty which countries should be changing on imports from other countries however some countries have refused to adopt it or have some hidden charges limiting flow of FDIs. Doha round of talk’s failure was a challenge to the flow of FDIs; the failure seemed to give a leeway to use tariff and non-tariff barriers to protect their ones economy. Global financial crisis is another challenge that FDI face as countries protect their domestic economy with the aim of helping their domestic companies’ outcome the challenges. Another challenge facing the flow of international business and by extension FDI is terrorism along water and airlines; in case of an attack, the company has its operating tools held by the terrorists and it cannot supply to its customers when required. High competition with other companies in the same line or other countries investing in the same county in the same line is another challenge that specific FDI have. Businesses in the same line of business (selling similar/same products) or businesses trading in substitute goods and/or services are likely to limit the flow of business in the international arena limited the flow of FDIs.

The other challenge facing FDIs is the cost benefit analysis of the investments; there have been much debates that some sectors that host countries attract FDI s are not profitable or they take very long period of time before they mature. On a national level, the weights and benefits of inward and outward direct investments have been agued to cancel out and in some nations the negatives have outweighed the positives. There have been augments that FDI benefits individual firms as the firms retain the profits; the augment is supported by the notion that FDIs create that they are meant to assist in the development of foreign countries. The notion that FDI are to benefit the individual firms operating them is a challenge to the investing companies; they get negative perception from the people limiting their business growth (Charles, 2011).

FDIs are affected by protectionism policies in different countries; protectionism policies are aimed at protecting an imposing country’s economy from control of international economies. The moves have the aim of creating a haven to the local industries; on the other hand free trade policy is trade where government tariff and non-tariff barriers don’t exist that raises competition in economy thus challenging foreign direct investments. When protectionism policies are enacted international companies who operate through FDIs are affected; they cannot trade freely. When trading barriers are enacted, they have an effect on flow of international trade. The flow of FDI is pegged on strength of international trade that countries have; those countries that have low participation in international trade face low FDI’s.

FDI’s are facing the challenge of poor management; when operating across board, it has been suggested by management gurus that local managers can do better. The challenge that FDIs program face is lack of experienced personnel who can handle their volume of work. In the event that they engage the service of experts, the cost of hiring the experts is high creating more challenges to the organizations. Slowed economic growth coupled with political instability is another challenge that FDIs have. FDIs lack strong institutions like banks and insurance in the host countries to effectively manage their large scale transactions (Barney, 2007).

Conclusion

The global foreign direct investments shown consistent growth from 2002 to 2007; in 2007, the amount of investments reached record high of $1,833.3 Billion in 2007. The increase was favored by sustained economic development in the world, marked decline in political instability, increased globalization, commodity prices boom, and increased mergers and acquisitions. In 2008 and 2009, the investments decreased probably because of the effects of global financial crisis experienced during the time; recovery was seen in 2010. European Union (EU) received approximately two thirds of world’s FDI inflow while developing and countries in transition receive most of the FDI’s. Merger and acquisition methods are the most preferred method of foreign direct investment; the main challenge of FDI is political instabilities in both inflow or/and outflow country.

References

Barney, J. B. (2007). Gaining and sustaining competitive advantage. Upper Saddle River: Pearson Prentice Hall.

Charles, W.L. (2011). International Business: Competing in the Global Marketplace. New York: McGraw-Hill.

Coeurdacier, N. (2011). Cross-Border Mergers and acquisitions Financials and institutional Forces. Web.

Easson, A.J. (2004).Tax incentives for foreign direct investment. Boston, Kluwer Law International.

Jackson, J. (2010). Foreign Direct Investment: Current Issues. Web.

Nocke, V. & Yeaple, S. (2007). Cross-Border mergers and acquisitions versus greenfield foreign direct investment: The role of firm heterogeneity. Journal of International Economics, 72(2), 336-365

Razin, A. & Sadka, E. (2007). Foreign Direct Investment: Analysis of Aggregate Flows. New York: Princeton University Press.

UNCTAD. (2006). World Investment Report 2006 – FDI from Developing and Transition Economies: Implications for Development. New York: Wisley.