Introduction

There is a large volume of studies on the correlation between oil prices and macroeconomics variables. Most of these studies have discussed the important effects of oil prices fluctuations on economic activities in the emerging and developed countries. One important factor of using oil price changes as a cause affecting stock prices is that the value of stock in financial theory equals the discounted sum of expected future cash-flows. Therefore, those cash flows are affected by macroeconomic activities that can be influenced by oil fluctuations; hence, oil prices fluctuations can affect stock prices (Ciner, 2001).

The Gulf Region nations have about 54% and 40% of the world’s routine oil and gas reserves. In 2010, the Gulf Region produced more than 25.2 million barrels of oil every day, and 44.6 billion cubic feet of normal gas every day, representing more than 30% of the world’s oil generation, 15% of gas creation, and 32% of Liquefied Natural Gas (LNG) trades. As indicated by the international energy outlook projections, the world’s vitality utilization anticipates expanding by more than half by 2030, a normal increment of 1.6% per year. Oil, gas and coal will keep on supplying a great part of the energy utilized around the world. Worldwide demand for fluid energies is required to develop by just 1.0% per annum over this period, and the aggregate offer will decay from 34% (in 2008) to 29% (in 2035) (Ciner, 2001).

Motivation for the study

I will explore and study the possible relationship of oil price fluctuation on -stock markets in the six GCC countries during the period 2010-2014. The GCC offers a market that is dissimilar to the markets of the developed countries and other emerging markets because the GCC separates from the entire equity market of the world and is highly affected by the local political instabilities in the region.

Research Problem

There are two factors. Firstly, there is still few observational data on the correlation of oil prices with stock markets in the GCC countries, therefore the contributions of such linkage in these countries is so curious and compelling since the GCC markets in recent times have grown to become more fetching to the international shareholders and stockholders searching for global diversity benefits. Significant outcomes from the previous research also guide governments and regulatory authorization to make critical decisions when it’s needed to govern the stock markets and oil price behavior. Secondly, the aspects of observational data tied to the oil-stock market linkage in the GCC countries which aren’t stable. Certainly, they can be outlined by extremely oil-reliant economies and their stock markets by a small level of market movement, financial intensity, and lucidity.

Research Questions

- To display the relation between oil prices changes in stock markets using inflation as the dependent variable.

- To evaluate the long-term relationship performance between oil price and the stock market on GDP as the dependent variable.

- To evaluate the short-term relationship performance between oil price volatility and stock market On CPI as the dependent variable.

Research Objectives

- Studying the correlation between oil prices changes and stock markets against inflation rate.

- To analyze the effect of GDP on the stock market and oil prices on short-term performance.

- To analyze effects of CPI between stock markets and oil price on long term performance.

Hypothesis

- H1: The correlation of Inflation on the stock market and oil prices performance.

- H2: The effect of GDP on the stock market and oil prices in short run performance.

- H3: The effect CPI on stock market and oil prices in long run performance.

Significance of the study

The observed results from optimal weights and hedge ratios show that shareholders investments in the GCC markets may gain from the sum of the oil assets into a diversified portfolio of stocks. The hedging strategies are needed to maintain the oil risk, pointing to the facts that these markets are separated from the market movement, which help the global shareholders to gain from the sum of financial assets in diversified portfolios. Furthermore, it is also due to economic basics such as changes in market bias. Investors and financial market members can gain from results observed in this paper by recognizing the behavior of oil prices that help to find profitable trading opportunities and optimizing portfolio diversification. Finally, the importance of the results can benefit as well as the governments and regulatory authority to study and make important decisions when regulation of stock markets and oil price policies.

Literature review

The Gulf Corporation Council (GCC) was formed in 1981 and it consists of six countries are Bahrain, Oman, Kuwait, Qatar, Saudi Arabia and the United Arab Emirates (UAE). These countries share many similar patterns. Together, their production is about 20% of all world crude oil, regulates 36% of world oil exports and acquires 47% of reserves. Oil exports mostly affect the earnings, government budget revenues, and consumption. There are several studies about how oil prices affect stock market in GCC countries.

Empirical Linkage between Oil Price and Stock Market Returns and Volatility: Evidence from International Developed Markets by Mr. Khraief in the year of 2014

Recently, the relation between oil price and stock returns has come to be important to investors this might be due to the fact that oil prices have shown an exceptional volatility which has caused to an increase in the energy sector, as well as the whole economy and the financial markets. The oil price fluctuations have a great deal of attention of both financial investors and market participants because of two reasons. Firstly, they affect decisions made by suppliers and customers in strategic planning and long-term appraisals. Secondly, they determine shareholders decision in oil prices activities, portfolio allocations as well as risk management. Due to these changes, they will cause the ability to do accurate forecast the oil price changes which is of importance for decision making in the financial area.

The studies for the Japan and the UK are without important significance. Using a Vector Autoregressive (VAR) model over the period 1979-1990 found that day to day oil futures return presents no important effect on the broad-based market indexes such as the S&P 500. Three years later, there was a model that was developed for an unrestricted VAR model including monthly data on oil prices, stock returns, short-term interest rate and industrial production over the period 1947-1996 (Balaz & Andrej, 2006). A study of the effects of oil price shocks and oil price volatility on the real stock returns of the US and 13 European countries over the period from January 1986 to December 2005 (Ciner, 2001).

“The Relationship between Oil Price and Stock Market Index: An Empirical Study from Kuwait” by Dr. Ahmed Al Hayky and Mr. Nizar Naim

Oil price fluctuations can be used to predict the stock market returns on an international basis. The movement of the stock market on oil price shocks is different from one country to another as it depends on whether the country exports oil or imports oil and if the oil price fluctuations are due to demand and supply (Wang, 2013). The main focus in the previous studies was on the impact of oil price on the stock markets in the developed countries which are likely to be oil-importing countries have a negative relationship exists between oil price and stock markets. On the contrary, other studies have found a positive relationship between oil price and the stock market exists in the oil-exporting countries (Cologni & Matteo, 2008).

The GCC countries oil reserves are as follow; Saudi Arabia: 15.8 %, Kuwait: 6 %, UAE: 5.8%, Qatar 1.5%, and the rest for Oman and Bahrain. As in the British Petroleum (BP) Statistical Review of World Energy 2014 report; the GCC have the largest oil reserves in the world (a total of 30% of the world reserve), moreover, the GCC states produced 24 % of the world’s total crude oil production in 2013 and controls 36 % of the world’s Sovereign Wealth, which shows the critical role that the GCC countries can play in the global energy investment and production (Cunado & Fernando, 2005).

Return and volatility transmission between world oil prices and stock markets of the GCC countries by Dr. Mohamed El Hedi Arouri, Dr. Amine Lahiani and Dr. Duc Khuong Nguyen

The research is examining the probable relationships between oil price shocks and stock markets have only gained ground very recently, and the focus is substantially on a few net-oil importing developed countries. At the beginning researchers studied the reaction of four developed stock markets to oil shocks on the basis of standard cash flow dividend valuation model and find evidence of significant impacts of oil price changes on corporate cash flows in the US and Canada. But their results were not decisive for Japan and the UK. Consequently, vector autoregressive models (VAR) are often employed to explore the oil-stock market relationships. There was less importance to the small emerging markets, like the GCC countries where the relationships between oil prices and stock markets have an important indication for international markets and economic policies (Neaime, 2005).

First, GCC countries are large scale suppliers of oil in global energy markets, also their stock markets are possible to be affected by fluctuations in oil prices. Second, the GCC markets are different from the developed and other emerging countries which are broadly segmented from the international markets and also extremely sensitive to regional political circumstance. Lastly, the GCC markets represent areas for regional and world portfolio diversity. A well understanding of the effect of oil price shocks on stock markets may really guide shareholder for making correct financial decisions and policymakers for determining stock markets more effectively. In a more recent study, there was focus on the short-run relationships between oil prices and GCC stock markets using a nonparametric method and show some evidence of nonlinearities in Qatar, Oman, and UAE.

Oil price shocks and GCC capital markets: who drives? Whom? By Dr. Masih, 2014

Many empirical types of research have the topic of oil shocks and impact on economic variables, and all determined an evidence of oil price shocks having a causal relation to recessions, inflation and economic growth in emerging economies. Amongst some focus on GCC countries, we find research on the impact of oil price shocks on equity markets. The oil stock market link in GCC consider to be of great importance since GCC countries are major suppliers of oil in world energy markets, their stock markets are expected to be affected by fluctuations in oil prices. Oil and S&P 500 have an indirect impact on these markets while evidence of a direct impact of T-Bill rate was found. From a review of the literature, it is obvious that results of few studies on GCC markets and globally is different. Possible the results are difficult since GCC countries are heavily dependent on oil export with similar economic structures (Zhang, 2008).

Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries by Stavros Degiannakis, George Filis, Christos Floros

At the begging any increase in oil prices can cause an increase in costs, constraining profits and greater expand, which might cause a decrease in shareholders’ profit. Hence, any increase oil price will be led by a decrease in the stock prices. Many writers disagree that oil price has side effect on stock markets is an indirect effect and it is found through the macroeconomic indicators. For oil-importing countries might have oil price increase which will lead to increase in the cost of productions, as crude oil is one of the most important production factors (Cunado & Fernando, 2005).

The increased value will be transferred to the consumers, which will lead to decreased demand and, hence, consumer consumption will be high due to consumer prices. Lower expenditure will lead to a decrease in production, therefore, increase in unemployment. Stock markets would be negatively in such case. Nonetheless, I shouldn’t forget the fact that oil price shocks could affect stock markets and can cause risk to the financial world depending on the nature of the impact (demand-side or supply-side). In this case, stock markets would be positive to an oil price shock, which is a result from the demand side, and negative if the shock result from the supply side (Cologni & Matteo, 2008).

Summary

Many Types of research have studied the oil prices volatilities on the stock market in GCC countries, The GCC stock markets have higher volatilities, and this doesn’t mean they have the greatest returns. For example, Kuwait has the maximum returns followed by Oman. On the other hand, Saudi Arabia has the greatest risk followed by UAE. Overall oil price fluctuations are greater than stock market returns. Moreover, the negative returns are a result of the financial crisis. Furthermore, the studies that have been explored have used bootstrap panel integration technique to show the impacts of the oil price shocks on the stock market performance of GCC countries (Blanchard, 2007).

Research methodology

The methodology is the process of instructing the ways to do the research. It is, therefore, convenient for conducting the research and for analyzing the research questions.

Data

The Multiple regression models include the data that is collected from GCC stock market websites for the period of 2011-2014.

Sample and techniques

The main objective of this study is to find out how the oil price and stock price market are independent variables can affect the inflation as the independent variables. The short run GDP as dependent variable effects on the independent variables; nevertheless, in the long run, CPI has an effect on the same independent variables which are calculated by multi regression model and variable inflation factor to show the correlation among the independent and dependent variables and also to prove their importance.

Variables used in the Study

The Empirical model used here is to regress three equation: the first equation is for the short run on how the Gross domestic product (GDP) as the dependent variable affects the variables such as stock market price (SP) and Oil Price (OL).The second equation is for the long run on how Consumer price index (CPI) as the dependent variable can affect the same variables as stock market price (SP) and Oil Price (OL). The third equation is the correlation between Inflation (IN) as a dependent variable and oil price (OL) and stock market price (SP) as independent variables in the GCC countries.

- GDP= f (SP, OL).

- CPI = f (SP, OL).

- IN=f (SP, OL).

Data Analysis

The multiple-regression model is used to examine the impact of a group of variables on the stock prices of the firm. The dependent variables include macroeconomic, the macroeconomic variables used in this study include inflation, GDP per capita, the level of consumer price index. The study model expresses the share prices of the firm as a function of previous year’s share prices, annual average growth of inflation, per-capita GDP, Consumer Price Index. The data was for the period of 2011-2014.

Empirical Results

Performance of the GCC countries

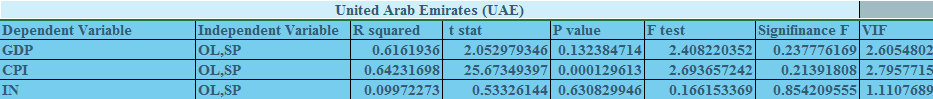

The R² analyze how the variance of the data is explained in this model. It is also known as the coefficient of multiple determinations for multiple regressions. It is useful because it gives the proportion of the variance of one variable that is predictable from the other variable also It’s a measure that allows us to determine how certain one can be in making predictions from a certain model/graph. The R-squared of GDP is 0.61; this indicates a moderately strong correlation between the oil prices and stock prices. The t stat of GDP is 2.05; this means if the observed t had been equal to or greater than 2.05, we would have been able to regard the result as significant at or beyond the.025 level.

The lower p-value indicates that the coefficient is valid. The p-value of GDP is 0.13; this means 1.3% chance that the result occurred only as a result of chance. The F ratio of GDP is 2.408; this means that the regression results are valid. A small Significance of F confirms the rationality of the regression analysis. For example, if Significance of F = 0.0 there is only a 3% chance that the regression output was merely a chance occurrence VIF of GDP is 2.605 this means that the standard error for the coefficient of the independent variable is 2.605 times as large as it would be if that independent variable were uncorrelated with the other independent variables. The T-test is a statistical test of two population means. A two-sample t-test studies whether two population means are dissimilar or similar used when the variances of two normal distributions are unknown and when an experiment uses a small sample size. Variance Inflation Factor (VIF) and Tolerance are two measures that can guide a researcher in identifying MC. Before developing the concepts, it should be noted that the variance of the OLS estimator for a typical regression coefficient.

The R-squared of CPI for UAE is 0.64; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 64% of the independent variables explained the dependent variable. The t stat of CPI is 25.67; this means if the observed t had been equal to or greater than 25.67, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.000 reflects the viability of the coefficient. The F ratio of CPI is 2.693; this justifies the results of the regression analysis. A small Significance of F (0.2139) confirms the rationality of the regression analysis. VIF of CPI is 2.795; this means that the standard error for the coefficient of the independent variable is 2.795 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of IN for UAE is 0.099; this indicates a weak correlation between the oil prices and stock prices. It also indicates that 9.9% of the independent variables explained the dependent variable. The t stat of IN is 0.5332; this means if the observed t had been equal to or greater than 0.5332, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.6308 reflects the viability of the coefficient. The F ratio of IN is 0.1661; this justifies the results of the regression analysis. A higher Significance of F (0.8542) confirms the rationality of the regression analysis. VIF of IN is 1.1107; this means that the standard error for the coefficient of the independent variable is 1.1107 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

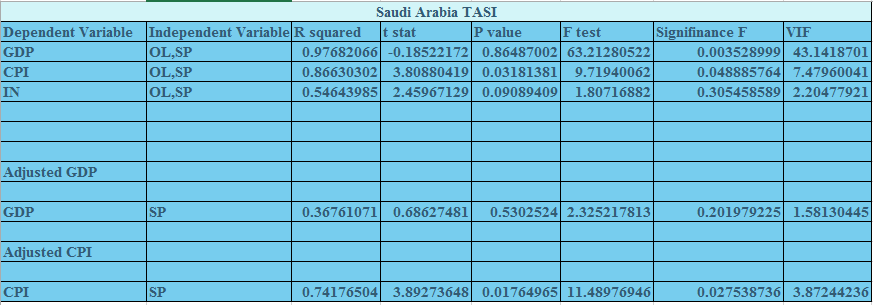

The R-squared of GDP for Saudi Arabia is 0.97; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 97% of the independent variables explained the dependent variable. The t stat of GDP is -0.185; this means if the observed t had been equal to or greater than -0.185, we would have been able to disregard the result as significant at or beyond the.025 level. The higher p-value of 0.86487 reflects the viability of the coefficient. The F ratio of GDP is 63.212; this justifies the results of the regression analysis. A small Significance of F confirms the rationality of the regression analysis. VIF of GDP is 43.141; this means that the standard error for the coefficient of the independent variable is 43.141 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of CPI for Saudi Arabia is 0.86; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 86% of the independent variables explained the dependent variable. The t stat of CPI is 3.808; this means if the observed t had been equal to or greater than 3.808, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.0318 reflects the viability of the coefficient. The F ratio of CPI is 9.719; this justifies the results of the regression analysis. A small Significance of F (0.0488) confirms the rationality of the regression analysis. VIF of CPI is 7.479; this means that the standard error for the coefficient of the independent variable is 7.479 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of IN for Saudi Arabia is 0.54; this indicates a moderately weak correlation between the oil prices and stock prices. It also indicates that 54% of the independent variables explained the dependent variable. The t stat of IN is 2.459; this means if the observed t had been equal to or greater than 2.459, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.0908 reflects the viability of the coefficient. The F ratio of IN is 1.807; this justifies the results of the regression analysis. A lower Significance of F (0.3054) confirms the rationality of the regression analysis. VIF of IN is 2.204; this means that the standard error for the coefficient of the independent variable is 2.204 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

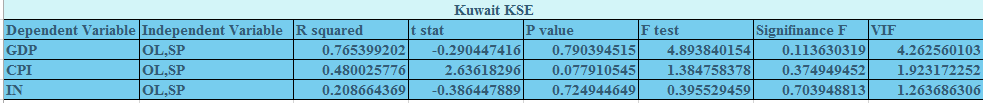

The R-squared of GDP for Kuwait is 0.76; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 76% of the independent variables explained the dependent variable. The t stat of GDP is -0.29044; this means if the observed t had been equal to or greater than -0.29044, we would have been able to disregard the result as significant at or beyond the.025 level. The higher p-value of 0.7903 reflects the viability of the coefficient. The F ratio of GDP is 4.893; this justifies the results of the regression analysis. A small Significance of F (0.1136) confirms the rationality of the regression analysis. VIF of GDP is 4.262; this means that the standard error for the coefficient of the independent variable is 4.262 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of CPI for Kuwait is 0.48; this indicates a moderately weak correlation between the oil prices and stock prices. It also indicates that 48% of the independent variables explained the dependent variable. The t stat of CPI is 2.636; this means if the observed t had been equal to or greater than 2.636, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.0779 reflects the viability of the coefficient. The F ratio of CPI is 1.384; this justifies the results of the regression analysis. A small Significance of F (0.3749) confirms the rationality of the regression analysis. VIF of CPI is 1.923; this means that the standard error for the coefficient of the independent variable is 1.923 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of IN for Kuwait is 0.208; this indicates a weak correlation between the oil prices and stock prices. It also indicates that 20.8% of the independent variables explained the dependent variable. The t stat of IN is -0.3864; this means if the observed t had been equal to or greater than -0.3864, we would have been able to disregard the result as significant at or beyond the.025 level. The higher p-value of 0.7249 reflects the viability of the coefficient. The F ratio of IN is 0.3955; this justifies the results of the regression analysis. A higher Significance of F (0.7039) confirms the rationality of the regression analysis. VIF of IN is 1.2636; this means that the standard error for the coefficient of the independent variable is 1.2636 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

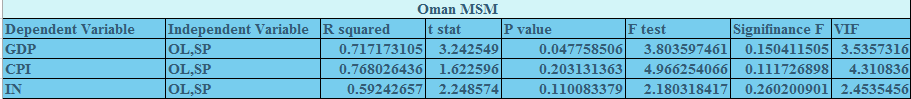

The R-squared of GDP for Oman is 0.71; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 71% of the independent variables explained the dependent variable. The t stat of GDP is 3.242; this means if the observed t had been equal to or greater than 3.242, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.0477 reflects the viability of the coefficient. The F ratio of GDP is 3.803; this justifies the results of the regression analysis. A small Significance of F (0.1504) confirms the rationality of the regression analysis. VIF of GDP is 3.535; this means that the standard error for the coefficient of the independent variable is 3.535 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of CPI for Oman is 0.768; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 76.8% of the independent variables explained the dependent variable. The t stat of CPI is 1.622; this means if the observed t had been equal to or greater than 1.622, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.203 reflects the viability of the coefficient. The F ratio of CPI is 4.966; this justifies the results of the regression analysis. A small Significance of F (0.1117) confirms the rationality of the regression analysis. VIF of CPI is 4.31; this means that the standard error for the coefficient of the independent variable is 4.31 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of IN for Oman is 0.59; this indicates a medium correlation between the oil prices and stock prices. It also indicates that 59% of the independent variables explained the dependent variable. The t stat of IN is 2.248; this means if the observed t had been equal to or greater than 2.248, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.1100 reflects the viability of the coefficient. The F ratio of IN is 2.180; this justifies the results of the regression analysis. A lower Significance of F (0.2602) confirms the rationality of the regression analysis. VIF of IN is 2.453; this means that the standard error for the coefficient of the independent variable is 2.453 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

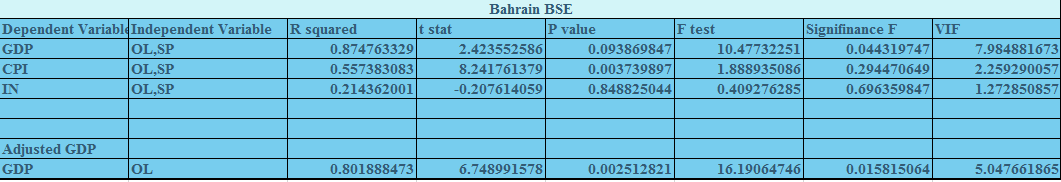

The R-squared of GDP for Bahrain is 0.87; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 87% of the independent variables explained the dependent variable. The t stat of GDP is 2.243; this means if the observed t had been equal to or greater than 2.243, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.09386 reflects the viability of the coefficient. The F ratio of GDP is 10.477; this justifies the results of the regression analysis. A small Significance of F (0.04432) confirms the rationality of the regression analysis. For example, if Significance of F = 0.0 there is only a 3% chance that the regression output was merely a chance occurrence. VIF of GDP is 7.984; this means that the standard error for the coefficient of the independent variable is 7.984 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of CPI for Bahrain is 0.557; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 55.7% of the independent variables explained the dependent variable. The t stat of CPI is 8.241; this means if the observed t had been equal to or greater than 8.241, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.0037 reflects the viability of the coefficient. The F ratio of CPI is 1.8889; this justifies the results of the regression analysis. A small Significance of F (0.2944) confirms the rationality of the regression analysis. For example, if Significance of F = 0.0 there is only a 3% chance that the regression output was merely a chance occurrence. VIF of CPI is 2.259; this means that the standard error for the coefficient of the independent variable is 2.259 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of IN for Bahrain is 0.21; this indicates a medium correlation between the oil prices and stock prices. It also indicates that 21% of the independent variables explained the dependent variable. The t stat of IN is -0.2076; this means if the observed t had been equal to or greater than -0.2076, we would have been able to disregard the result as significant at or beyond the.025 level. The higher p-value of 0.8488 reflects the viability of the coefficient. The F ratio of IN is 0.4092; this justifies the results of the regression analysis. A lower Significance of F (0.6963) confirms the rationality of the regression analysis. For example, if Significance of F = 0.0 there is only a 3% chance that the regression output was merely a chance occurrence. VIF of IN is 1.273; this means that the standard error for the coefficient of the independent variable is 1.273 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

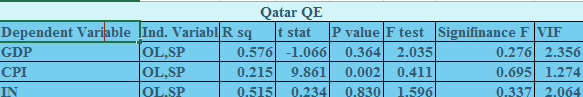

The R-squared of GDP for Qatar is 0.576; this indicates a moderately strong correlation between the oil prices and stock prices. It also indicates that 57.6% of the independent variables explained the dependent variable. The t stat of GDP is -1.066; this means if the observed t had been equal to or greater than -1.066, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.364 reflects the viability of the coefficient. The F ratio of GDP is 2.035; this justifies the results of the regression analysis. A small Significance of F (0.276) confirms the rationality of the regression analysis. For example, if Significance of F = 0.0 there is only a 3% chance that the regression output was merely a chance occurrence. VIF of GDP is 2.356; this means that the standard error for the coefficient of the independent variable is 2.356 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of CPI for Qatar is 0.215; this indicates a weak correlation between the oil prices and stock prices. It also indicates that 21.5% of the independent variables explained the dependent variable. The t stat of CPI is 9.861; this means if the observed t had been equal to or greater than 9.861, we would have been able to disregard the result as significant at or beyond the.025 level. The lower p-value of 0.002 reflects the viability of the coefficient. The F ratio of CPI is 2.035; this justifies the results of the regression analysis. A medium Significance of F (0.695) confirms the rationality of the regression analysis. For example, if Significance of F = 0.0 there is only a 3% chance that the regression output was merely a chance occurrence. VIF of CPI is 1.274; this means that the standard error for the coefficient of the independent variable is 1.274 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

The R-squared of IN for Qatar is 0.515; this indicates a medium correlation between the oil prices and stock prices. It also indicates that 51.5% of the independent variables explained the dependent variable. The t stat of IN is 0.234; this means if the observed t had been equal to or greater than 0.234, we would have been able to disregard the result as significant at or beyond the.025 level. The higher p-value of 0.830 reflects the viability of the coefficient. The F ratio of IN is 1.596; this justifies the results of the regression analysis. A lower Significance of F (0.337) confirms the rationality of the regression analysis. For example, if Significance of F = 0.0 there is only a 3% chance that the regression output was merely a chance occurrence. VIF of IN is 2.064; this means that the standard error for the coefficient of the independent variable is 2.064 times as large as it would be if that independent variable were uncorrelated with the other independent variables.

Hypotheses testing

UAE

- H0: the oil and stock prices do not affect GDP of the UAE; H1: the oil and stock prices affect GDP of the UAE. The p-value (0.13) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect GDP of the UAE.

- H0: the oil and stock prices do not affect CPI of the UAE; H1: the oil and stock prices affect CPI of the UAE. The p-value is less than 0.05; therefore, we accept the alternative hypothesis that the oil and stock prices affect CPI of the UAE.

- H0: the oil and stock prices do not affect IN of the UAE; H1: the oil and stock prices affect IN of the UAE. The p-value (0.6308) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect IN of the UAE.

Saudi Arabia

- H0: the oil and stock prices do not affect GDP of the Saudi Arabia; H1: the oil and stock prices affect GDP of the Saudi Arabia. The p-value (0.86487) is greater than 0.05; therefore, we accept the null hypothesis the oil and stock prices do not affect GDP of the Saudi Arabia.

- H0: the oil and stock prices do not affect CPI of the Saudi Arabia; H1: the oil and stock prices affect CPI of the Saudi Arabia. The p-value (0.0318) is less than 0.05; therefore, we accept the alternative hypothesis that the oil and stock prices affect CPI of the Saudi Arabia.

- H0: the oil and stock prices do not affect IN of the Saudi Arabia; H1: the oil and stock prices affect IN of the Saudi Arabia. The p-value (0.0908) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect IN of the Saudi Arabia.

Kuwait

- H0: the oil and stock prices do not affect GDP of the Kuwait; H1: the oil and stock prices affect GDP of the Kuwait. The p-value (0.7903) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect GDP of the Kuwait.

- H0: the oil and stock prices do not affect CPI of the Kuwait; H1: the oil and stock prices affect CPI of the Kuwait. The p-value (0.0779) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect CPI of the Kuwait.

- H0: the oil and stock prices do not affect IN of the Kuwait; H1: the oil and stock prices affect IN of the Kuwait. The p-value (0.7249) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect IN of the Kuwait.

Bahrain

- H0: the oil and stock prices do not affect GDP of the Bahrain; H1: the oil and stock prices affect GDP of the Bahrain. The p-value (0.09386) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect GDP of the Bahrain.

- H0: the oil and stock prices do not affect CPI of the Bahrain; H1: the oil and stock prices affect CPI of the Bahrain. The p-value (0.0037) is less than 0.05; therefore, we accept the alternative hypothesis that the oil and stock prices affect CPI of the Bahrain.

- H0: the oil and stock prices do not affect IN of the Bahrain; H1: the oil and stock prices affect IN of the Bahrain. The p-value (0.8488) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect IN of the Bahrain.

Oman

- H0: the oil and stock prices do not affect GDP of the Oman; H1: the oil and stock prices affect GDP of the Oman. The p-value (0.0477) is less than 0.05; therefore, we accept the alternative hypothesis that the oil and stock prices affect GDP of the Oman.

- H0: the oil and stock prices do not affect CPI of the Oman; H1: the oil and stock prices affect CPI of the Oman. The p-value (0.203) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect CPI of the Oman.

- H0: the oil and stock prices do not affect IN of the Oman; H1: the oil and stock prices affect IN of the Oman. The p-value (0.1100) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect IN of the Oman.

Qatar

- H0: the oil and stock prices do not affect GDP of the Qatar; H1: the oil and stock prices affect GDP of the Qatar. The p-value (0.364) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect GDP of the Qatar.

- H0: the oil and stock prices do not affect CPI of the Qatar; H1: the oil and stock prices affect CPI of the Qatar. The p-value (0.002) is less than 0.05; therefore, we accept the alternative hypothesis that the oil and stock prices affect CPI of the Qatar.

- H0: the oil and stock prices do not affect IN of the Qatar; H1: the oil and stock prices affect IN of the Qatar. The p-value (0.830) is greater than 0.05; therefore, we accept the null hypothesis that the oil and stock prices do not affect IN of the Qatar.

Conclusion

There are two components. In the first place, there is still a couple of observational information on the relationship of oil costs with securities exchanges in the GCC nations, accordingly the commitments of such linkage in these nations is so inquisitive and convincing subsequent to the GCC markets lately have developed to end up additionally bringing to the universal shareholders and stockholders searching for worldwide assorted qualities advantages. Huge results from the past exploration likewise direct governments and administrative approval to settle on basic choices when it’s expected to represent the securities exchanges and oil value conduct. Besides, the parts of observational information fixing to the oil-securities exchange linkage in the GCC nations which aren’t steady.

As of late, the connection between oil cost and stock returns has come to be vital to speculators this may be because of the way that oil costs have demonstrated an excellent unpredictability which has brought on to an expansion in the vitality part, and in addition the entire economy and the budgetary markets. The oil value vacillations have a lot of consideration of both budgetary speculators and business sector members in view of two reasons. Firstly, they influence choices made by suppliers and clients in vital arranging and long haul evaluations. Besides, they decide shareholders choice in oil costs exercises, portfolio assignments and in addition hazard administration. Because of these progressions, they will bring about the capacity to do exact conjecture the oil value changes which are of significance for basic leadership in the financial sector.

Who will benefit from this study

The supporting systems are expected to keep up the oil risks, indicating the truths that these business sectors are isolated from the market development, which help the worldwide shareholders to pick up from the total of monetary resources in differentiated portfolios. Moreover, it is additional because of financial basics, for example, changes in business sector inclination. Speculators and financial market individuals can pick up from results saw in this paper by perceiving the conduct of oil costs that discover gainful exchanging opportunities and advancing portfolio expansion. At long last, the significance of the outcomes can advantage the governments and regulatory authority to study and settle on critical choices when the direction of securities exchanges and oil value arrangements.

Recommendations

Much of the study has dwelt on the oil prices affecting the stock market in the gulf countries. Future research should explore more on the related macro-variables in the GCC that contributes to the changes in the oil prices and the variations in he stock market.

References

Balaz, P., & Andrej, L. (2006). Oil and its Position in the Process of Globalization of the World Economy. Politicka Ekonomie, 54(4), 508-528.

Ciner, C. (2001). Energy Shocks and Financial Markets: Nonlinear Linkages. Studies in Non-Linear Dynamics and Econometrics. 5(1), 203-212.

Cologni, A., & Matteo, M. (2008). Oil Prices, Inflation and Interest Rates in a Structural Cointegrated VAR Model for the G-7 Countries. Energy Economics, 30(1), 856-888.

Cunado, J., & Fernando, G. (2005). Oil Prices, Economic Activity and Inflation: Evidence for Some Asian Countries. Quarterly Review of Economics and Finance, 45(1), 65-83.

Neaime, S. (2005). Financial Market Integration and Macroeconomic Volatility in the MENA Region: an Empirical Investigation. Review of Middle East Economics and Finance, 3(1), 231-253.

Zhang, D. (2008). Oil Shock and Economic Growth in Japan: A Nonlinear Approach. Energy Economics, 30(2), 2374-2390.