Stock valuation has been a vital factor when determining investment decisions in the economy. Most of the companies have their stock traded publicly, and General Motor Company is no exception. GM Company was founded in Michigan in the early 20th century. General Motors Company (GM) is concerned with designing, manufacturing, and marketing trucks, crossovers, automobiles, and cars across the world. Indeed, GM is one of the leading motor vehicle industries.

The organization markets a specific brand of vehicles including Cadillac, Buick, Daewoo, Chevrolet, Vauxhall, and Holden among others. In addition, the company transacts trucks and cars to various dealers across the globe including renting cars to companies, leasing them to customers, and governments. Consequently, GM offers mobility solutions, connected security and safety, and information and communication services.

Although the company performs magnificently, it has relied on its subsidiary company, General Motors Financial Company, in an attempt to realize a high revenue outlay. The strategy is achieved through the imminent automotive lease products and financing services through the dealership of GM in the new automotive and connection with various sales with prime and sub-prime credit covers of the bureaucratic covers.

Value investors normally set a number of vital rules for how and when to buy the stock or securities. Indeed, where the status of a company changes, the value investor is supposed to sell the stock. As such, it is a disciplined approach based on defining and seeking value and keeping the position as long as the company keeps meeting the criteria (Hirschey 78). Focusing on selection criteria, an investor analyzes the short-term and long-term effect the stock will have on the economy.

In the short term, prices change based on company popularity, fads, rumors, and overreaction to all news. This chaos tells an investor that trading in and out of positions is a difficult game because one needs to time decisions on both sides with near-perfect precision. The swings in price are not consistent, and the chaotic nature of the short-term market points to the importance of the long-term perspective. In the long term, stock prices tend to move in line with the company’s earnings. As such, in the case of GM, past earnings trends are determined to ascertain the going concern and future implications of an investor’s investment (MacAfee 39).

On the other hand, from a growth investor perspective, the biggest reason to be leery of a growth-by-acquisition strategy is even simpler. GM usually posts many merger-related charges and often winds up restating their financial results, which means the results of the company can be observed in all the merger-related confusion. In the case of unscrupulous management, it can easily create fog by inclining to constant acquisitions to artificially juice the results.

As such, this financial tinkering can take a long time to come to light because of it is buried in the necessary financial rejiggering that comes with any sizeable acquisition. This scenario was felt in Enron’s case where the investors were given the wrong information on the growth of the company. Consequently, based on the investor growth perspective, the true growth rate of the underlying business may be impossible to figure out, especially if management is evasive about giving out information on the firm’s organic growth rate (Brigham 42).

Differences between Value Investors’ perspective and growth investors’ perspective

Ideally, when an investor is focused on the growth of securities, the core objective is to realize capital appreciation within the stipulated timeframe. Growth stocks normally outperform the investments that grow at a slower rate.

For instance, stocks like income stocks tend to grow faster as the gains can be reinvested in an attempt to increase their growth viability rather than distributing the gains to the shareholders in terms of dividends. Growth securities are always volatile. However, various ways have been instigated to minimize the volatility effects of the stock portfolio through shopping or analyzing the growth of numerous stocks rather than an individual stock portfolio. Diversification will be enjoyed by the investor though there is no guarantee of profit or loss from the investment.

In the case of value investor perspective, the investor only focuses on the investments with low prices compared to factors such as current assets, sales, and earnings, and the GM’s book value. These investments portfolio is not only volatile but is considered as a bargain in the stock market. An investor focusing on value might, in a clear scenario, reject blue-chip stock due to the high price per share associated with the stock (Besley 56).

The consideration is not on the price per share but the value of the stock traded in the stock market. Though GM may have steady growth and guaranteed stability, the focus will be on the value of the shares traded. Unlike growth investors, value investors capitalize on the purchase of stock in a given company, which has a bargain price or the price is temporarily out of favor with an expectation that there would be an increase in the price of the stock after a short period.

This will be fostered by the market changes as it will push the prices up in the stock market. Most mutual funds tend to avoid picking specific and diversified stocks. It is recommended that before investing in any stock market portfolio—whether as a value investor or growth investor—consideration should be vested on associated risks, objectives, expenses, and fees including available prospectus of the company.

Dividend Discount Model (DDM)

General Motors have been performing immensely in the stock market. According to the financial information provided by the company on the stock portfolio, the company’s financial stability is magnificent, as the company realized a high revenue outlay in the period ending 2011. In determining the value of the stock for GM, the dividend discount model (DDM) will be sued for the analysis, as the dividends forecasted will be discounted to their present value. This will enable the investor to ascertain whether to invest in the company’s stock or not to invest.

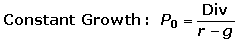

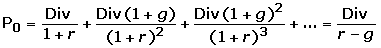

In a normal scenario, where the growth is constant, the value of the stock price is given as;

GM’s stock analysis;

Annual Dividend = $1 annually

Dividend Growth rate = 3%

Expected Return rate = 5%

Therefore;

P0 = $1 / (5% – 3%) = $50

The stock is overvalued therefore the investor should not buy the stock. However, the dividend discount model cannot be an effective way to determine the valuation of the stock prices, as in some cases expected rate of return might be lower than the dividend growth rate. This implies that a negative value will be arrived at, making it difficult to come up with an informed and decisive decision.

Works Cited

Besley, Scott. CFIN2 + Course mate Printed Access Card, London: Cengage Learning, 2011. Print.

Brigham, Eugene. Fundamentals of Financial Management, London: Cengage Learning, 2007. Print.

Hirschey, Mark. Tech Stock Valuation: Investor Psychology and Economic Analysis, New York: Academic Press, 2008. Print.

MacAfee, Peter. Intermediate Financial Management, London: Cengage Learning, 2010. Print.