Executive Summary

For one and half year, the global economy has been experiencing an exceptional crisis for long term. Starting from the housing market of the USA as a crisis, it almost immediately spread out as a financial crisis of huge proportions in the mortgage market and by collapsing, the key organisations crosswise the financial sector and introducing disaster to property market payers who witnessed their life span savings to increase purchasing power and their lifestyles deteriorate to vestiges. At the end of 2008, the crisis has prolonged and manifests to drive into the depth and compass as a general economic recession through out the developed and less developed countries like Africa.

The African economies have been performing better than industrialised economies withholding an annual growth rate of 3.2% in the economic downturn. The less international capitalisation of these countries saved them from the sub-prime financial crisis of 2007. However, these economies eventually became ill due to the current economic crisis. The researcher analysed the impacts of the economic downturn on the African economies. The paper is highly relied on secondary data sources. The impacts of this economic downturn on banking sector have discovered as very low except the vulnerability of foreign owned banks playing around the Africa. The volume of external financing to these economies was only 4% of global external financing. The scenario existed due to the rise in external financing costs around the world. The home currencies experienced a high degree of depreciation due to the price shrinkages of commodities and loss in the foreign currencies reserves. Again, due to such price decreases, the future market of commodities also slowed down. The natural asset driven countries were the most affected ones. Nevertheless, the agro sector driven countries also faced illness in economic and financial performances.

The researcher recommended to the governments, foreign investors, and foreign development partners or donors to act effectively to rescue the continent from the economic downturn. Here, the first emphasis is to enable conjugal growth drivers e.g., export oriented industries, high value sectors etc. Moreover, there is a careful analysis of the Debt Sustainability Framework to enable these economies to sustain on their resource bases. The private investments must be encouraged through the development of infrastructure to rescue from the crisis. Furthermore, the governments should make their fiscal or macroeconomic policies more flexible to allow enough space for allocating resources to the infrastructure developments in the budgetary plans. The development partners or donors are advised to boost up flexibility by their aiding policies that should outfit to the conditions of the countries and assemble their definite necessitates. On the other hand, the banks are advised to move ahead to make appropriate financial strategies and enhance up financial and economic competences of these economies. The main aspect is to work in effect with foreign reserve deficit, decline in current account balance and external debt.

Introduction

Introduction

Historically the economic growth and performance of Africa prior to year 2007 was tremendous and outstanding (African Development Bank Group 2009, p. 4; Louis et al., 2009, p. 1; & OECD 2009. p. 1). Louis et al., (2009, p. 1) named the drivers of strapping economic augmentation, such as reforms of macroeconomic factors across the continent, as a persistent high demand for commodities around the globe, and increasing capital inflows and brawny growth of China. Since the African countries are not highly integrated into the world economy, these economies had not affected by the initial financial and economic crisis, but later as a form of recession, it affected these economies with hard pace (Moss & Fellow 2009, p. 2). However, the historical economic performance faced large shrinkage along with negative growth in some countries of Africa (i.e., South Africa). Such shrinkage was eventual results of the financial crisis geared by US financial system. Moss & Fellow (2009, p. 2) also stated that the GDP growth rate of Africa for 2009 was projected at below 2%, but, the researchers assumed that the real GDP growth rate will be almost zero for the year. The Africa’s growth drivers had been highly affected by the recession. Consequently, the economic and financial performances of Africa had a slump down. Louis et al. (2009, p. 1) mentioned that there was large decline in the demands and prices of commodities, baulk in the capital inflows to the continent, non-compliance of Foreign Aid promises (since most of the countries of the continent are highly depended on foreign aids), and the slowed down growth of China. Without a doubt, Africa, being one of the poorest areas, with a lofty meditation of the world’s least developed countries, has been experiencing an uneven lumber of the unfavourable consequences of the crisis at this time (African Union Commission, 2009, p. 2). Furthermore, remittances, the export earnings, private capital flows, together with foreign direct investment have been declining from 2007. On the other hand, capital outflows had shown a hastened growth. Consequently, the public and private segments are facing complexities in lifting funds for long-term investment, mainly in infrastructure development (African Union Commission, 2009, p. 2). OECD (2009, p. 1) further stated that the countries those are highly reliant on commodities export have been facing the hardest attack along with a 40% or more shrinkage in the growth rate in relation to the growth rate of 2005 and 2006. Nevertheless, at this time Africa has well structured to sustain the financial and economic crisis than ever before. Because, there are strong and effective macroeconomic policies, those have strengthened fiscal scenario along with a reduction in the inflation rate. Furthermore, the all-party debt-relief manoeuvres have advanced the debt saddle and relieved financing restraints (OECD, 2009, p. 1). Therefore, the research will devise to analyse the affects of the economic downturn on Africa, pursue the effective initiatives to sustain in the crisis, and formulate recommendations to the concerned group to rescue them from the crisis.

Background of the problem

Ghanim (2008) pointed out that the fall in sub-prime mortgage market of the US has generated grave liquidity trap in the US banking sector. The corresponding effect of US sub-prime mortgage market has influenced the international financial markets and spread out the liquidity trap and comparable financial dilemmas to Europe and later on Asia. It has resulted serious impact on the US investments and they moved their investment from the stock market to oil investment. Consequently, the oil price rose at the height range of the history. Next to those the most dangerous effects of becoming bankrupt has accelerated amongst the major players of financial institutions. As an outcome, the crisis spread out all over the corporate houses of USA and Europe and rest of the globe and end result as recession. The governments have extended their hands to overcome the situation with bailout bill and other rescue package, but the problem rooted for long run.

Osei (2009) stated that Ghana is essentially dependant on the developed countries like US and Europe for substantial economic growth even as for finance its national budget and development projects. The economy of most of the African countries has interlinked with US and Europe economy for foreign investment, export, tourism, as well as remittances. At the same time, African countries like Ghanaian imports of capital machineries to prolong their industrial production and construction industry. Due to global financial crisis African countries like Ghanaian has been loosing their export market and remittance flow. It has influenced job cut and driving to a pointed increase in unemployment as well as poverty in the Ghanaian economy as well as African.

Rationale for the Research

GNA1 (2009) reported that the global financial crisis have harassed the Democratic Republic of Ghana with need for a hypothetical restructure of the Ghanaian economy as the country has duel core threats and opportunities from the downturn caused by the US and European developed countries.

Osei (2009) addressed that Ghana may not be a simple observer of the financial downturn, but as an integral part of African and international macroeconomic organ, it already evidenced a downfall indication from recent economic where Ghana has seriously preoccupied the economy being negatively posed.

Anon (2009) mentioned that the Europeans and USA are historically exploiting in Ghana as well as all over Africa. They are continuously intervening in Africa to exploit this resourceful part of the globe. IMF and World Bank keep their efforts to uphold the interest on the western countries rather ten the interest of the national governments of Africa. From sixties the African governments are protesting against studies of IMF and World Bank as their studies present huge gap with the empirical data. Thus, to overcome these gaps, there are needs of some impartial study.

Consequently, it is essential to evaluate the current political economy and its challenges created by the global financial crisis mandatory for enhanced study of policy responses and to recommend the government to drive for sustainable economic growth. Thus, this paper keeps its efforts to put together with a critical assessment and an approach for local policy makers to enable the country to break away from recession and create benefit from the global financial crisis.

The further research regarding the study topic should include the performance of the measures undertaken by various countries, the impacts of foreign aid to eliminate the financial crisis, the effects that bailout plans of industrialised countries had on African countries, and the effectiveness of IMF and AfDB.

Research Question and Objectives

- What are the major reasons behind the economic downturn in Africa?

- How does the economic downturn impact the African economies? Or what are the impacts of the economic downturn on the African economies?

- What are the measures to be undertaken to rescue the economies from the economic downturn?

Scope and Limitations of the Study

The main objectives of this research are to evaluate the Impact current financial crisis in Africa as an interregnal in part of credit crush in USA and recommend a new and unified economic plan to sustain with the competitive advantage and accomplish the development in comparison with traditional economic activity. As part of author’s responsibility as a Financial Management professional , the author is accountable for exploring and rising new ways of working to ensure the advanced sustainability and in doing so addresses the needs of African government, people and development partners.

The excellence of this research has varied evidently in different stage. A number of qualitative studies have occupied a diminutive figure of participants as well as the assortment was not at all random. For illustration, a distinct cross sectional study interrogates with only three government officials and development workers of Africa. As to look upon to the unfortunate number of financial managers, in good turn of logistical constraints, just there is a sampling interviewer has taken on to straighten out the research data. The data pulled together from the broad-spectrum survey has collected over time since an inadequate involvement of respondents. Consequently, the scope of the research questions and listen them carefully was also very so often limited.

On the other look, in nastiness of the volatility all studies have demonstrated comparable outcomes. It is worth mentioning that all the findings prolong with each other robustly irrespective if the studies have carried out by resources of qualitative or quantitative disclosers. The unstructured composition of the open-ended assessment questions and substantial free-form responsibility initiates the panorama for misapprehension of the answers as well as generates the likelihood of excessively broad gathering of the responses among the comparable factor categories. The outcomes have pooled into expected factors as shrine in the Findings section of this paper.

Furthermore, the given deadline is also another notable limitation for this study. A larger response rate from the officials Africa would have advantageous, reasoning more methodical and random sampling understanding has assigned to the development worker’s surveys. Even so, from the steadfast spirit of the results, this researcher may confused that a more complicated sampling plan or more inclusive research design would escort to very much diverse conclusions.

Literature Review

African Union Commission (2009, p. 2) reported that the current economic downturn is the most sombre thing that has distressed the globe after the World War II. Tanzanian President Jakaya Kikwete said that the greatest danger veer for African countries was the economic downturn (Laishley 2009, p. 1). Maswana (2009, p. 7) stated three distinct dimensions behind the economic downturn worldwide. The financial downturn took place due to the mortgage turmoil in the 2007 that resulted financial meltdown in 2008 in the US. In 2007, it has just considered as a financial crisis. However, later on in 2008, it instituted itself as global recession. As a result, there is a development crisis at Africa in 2009. Mr. Strauss-Kahn argued that the lowest growth rate ever for the African countries would not only stagnant the standards of living but also would deepen poverty for a long time (Prout 2009, p. 1).

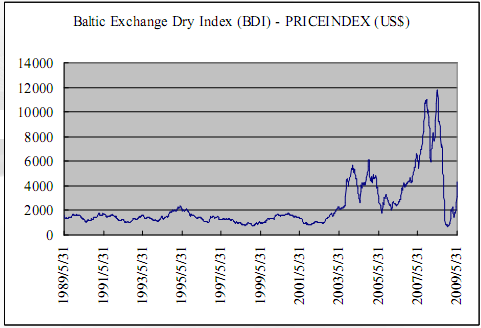

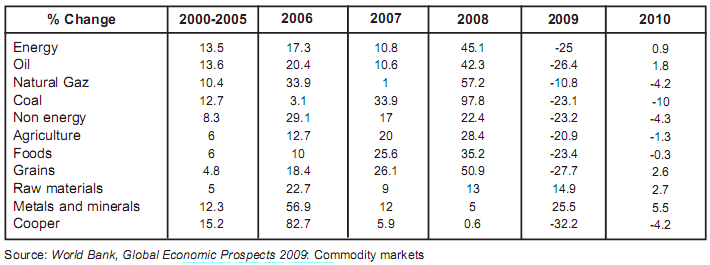

Maswana (2009, p. 7), further identified that, firstly, the structural vulnerabilities of the crisis are global saving imbalances (i.e., US’s current balance deficit was 6% in 2008 which was being blessed with investments from Asian countries and money from oil exporters). The second thing is low interest rates (the lowest interest rates in the US’s 30-years history, hence who never borrows had the chance to borrow). The triggers and transmissions included the default of sub prime mortgage borrowers. When oil prices increased in 2007, the stopple of lending due to fear of default increased further loan defaults in 2008, and the lack of confidence spread from MBS to ABS (i.e., the creation of contagion effect). Hence, there was an agitated trade of currencies, bonds and other financial instruments resulting 44% of firm profits in US in 2008 by making the situation more complex (Maswana 2009, p. 7). One more reason in this regard was the rumble in commodities price (Maswana 2009, p. 7). Since the financial markets were not performing well, the investment went to commodities such as oil, agricultural goods etc. thus increasing the commodity prices.

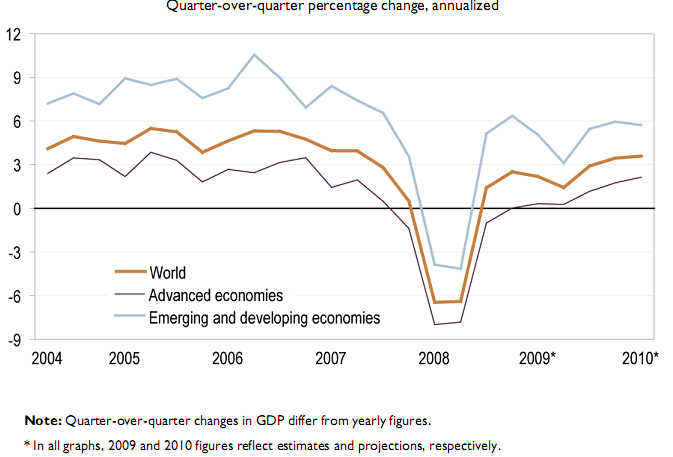

The presence of high scale commodity prices and contraction of export resulted severe afflictions on developing countries. IMF (2009, p. 1) stated that the global economic growth would contract by 1.4% in 2009. The developing countries have been in much deeper problem than that of industrialised countries. This is because; industrialised countries have already managed their own rescue programs by their own and/or by borrowing from the international financial markets. However, the developing countries are feeble with holding less resilient economic systems (i.e., insufficient sources of capital) in the economy (Arieff et al., 2009, p. 1). The following is the picture of stagnant global GDP growth in the last year.

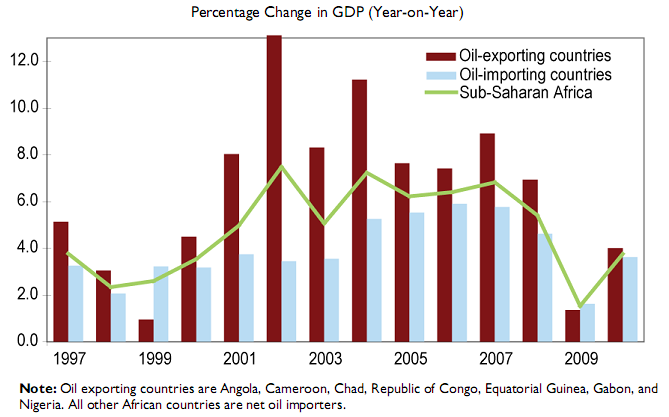

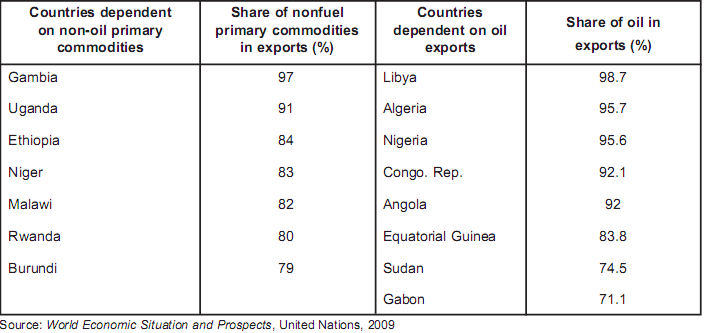

Since, there were no “toxic assets” (e.g. home mortgage), the developing countries were thought to be the non-affected economies. BBC News (2008, p. 1) described that the few researchers assumed the African countries were sheltered from the global economic downturn but these countries would be soon affected by contractions on investment, aid, and remittance. However, in September 2008, the financial crisis became a world recession and by surprising all, it hurt the developing countries in African as well (Arieff et al., 2009, p. 2). It was assumed that the large and financially equipped countries were first to be hit by the crisis through strong financial markets (e.g. Egypt), oil exporters (e.g. Nigeria), and mining based countries (e.g. South Africa) (African Development Bank Group 2009, p. 6). The World Bank announced African economies as the most vulnerable in the financial crisis and in a same way IMF announced that the growth rate of Africa would be 1.5% in 2009, a decrease from 6% per annum (Africa Progress Panel 2009 & IMF 2009). AfDB (2009) reported that the world recession further decreased the poverty alleviation success of the continent where at least 7% annual growth rate is must. On the other hand, the high unemployment rate was going to raise further (Arieff et al. 2009, p. 2). Arieff et al. (2009, p. 4) stated that the due to the sturdy growth of industrialised countries and quick-tempered growth of new giants (e.g. India and China), the African countries have been getting an increase in their export income. For this reason, the FDI to these economies almost doubled between 2003 and 2007 (UNCTAD 2009). The net private cash flows (i.e., FDI, remittances etc.) have assumed to be quadruple in the period of 2000 to 2008 (Oxford Analytica 2009). On the other hand, the oil exporter and oil importer countries had been pursuing more than 5% growth rate in the GDP. However, these things utterly distorted due to the attacks of the recession.

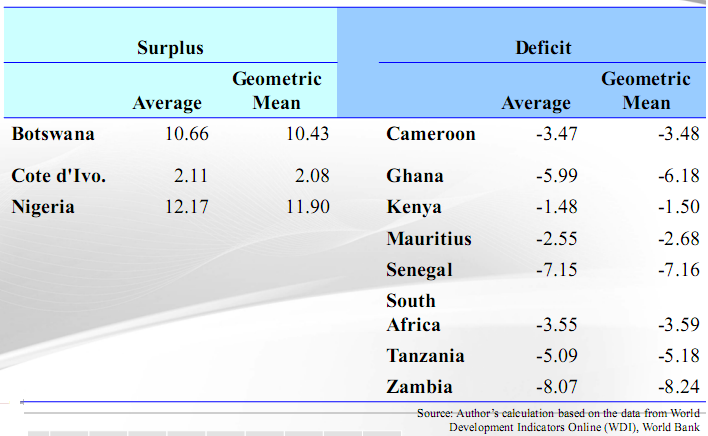

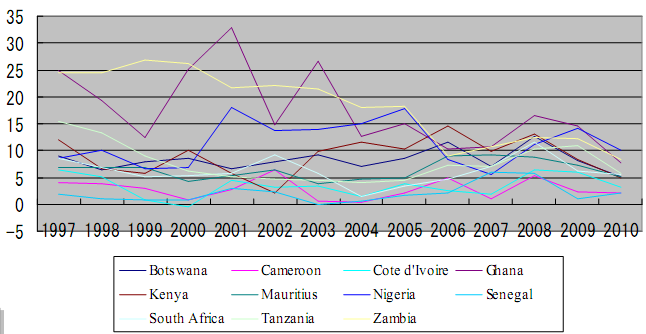

The economic growth rate of Africa was 5.1% in 2008, a.09% decrease from 2007. The oil-exporting countries grew by 5.9% in 2008 in contrast with 4.3% of non oil-exporting countries. This happened because of the historical growth of oil-export. The oil-exporting countries contributed 56% in the continent’s GDP, a 64% contribution to the annual GDP growth rate in 2008. Due to the high fuel prices and less cash inflows, the growth of non oil-exporting countries had slumped. Traditionally, the oil-importing countries had demonstrated a -.5% fiscal deficit whereas the oil-exporting countries announced 7.7% fiscal surplus. In contrast, by the implication of long-term government policies and high private developments, many countries such as Botswana, Nigeria, Rwanda, Tanzania etc. have considered as improving their financial strength and position. The inflationary attack was also a stupendous one. The inflation rate in Africa in 2008 was 10.7%, which was 4.3% larger than that of 2007 (excluding Zimbabwe with 11 million per cent). The current account surplus in oil-exporting countries increased to 15% in 2008, but the current account deficit of oil-importing countries increased to -1.8%. The gross domestic investment rate of Africa was almost 22%, which was not sufficient to survive in the present economic condition. In 2009, the pictures became more frustrating (Economic Report on Africa, 2009, p. 1-6).

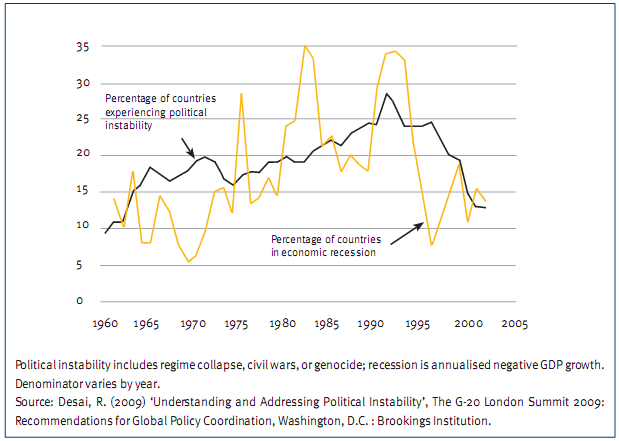

Othieno (2009, p. 1) has stated different kind of impacts of the economic downturn. He told that, historically, recession and political instability is quite closely related. He saw that the fragile countries are more prone to such crisis. Consequently, either violent (e.g. riots) or non-violent policy arguments, coiled into volatility, may take place. Several such instabilities took place due to the price hike of foods and fuels in Burkina, Faso, Cameroon, Mozambique, and Niger. Moreover, the crisis further induced the criminal activities (e.g., nautical piracy in the Horn of Africa accredited intensity of scarcity and towering charges of living). Therefore, the IMF declared the names of the most susceptible 25 countries (of which 22 were African countries) in March 2009, and decided that there would be a $25 billion additional funding requirement for the nourishment of these nations (Othieno 2009, p. 1).

The volume of exports and imports also has been contracting from 2007 up to the date. On the other hand, the private cash inflows declined by creating the unfeasibility to compensate the current account deficits. The remittance amount directed to the African economies was lower in 2009 than that of 2007 along with very poor intra country remittance flows. The contraction in the intra country remittances took place due to the non-intermittent job losses and estoppels of extraction activities around the continent. The FDI inflows to the African countries also have demurred with exception only in South Africa. The budget plan contraction took place due to the tremendous price fall of commodities. However, the intimidating aspect is that if the economic downturn runs apace further in future, all of these countries will experience both budget deficit and current account deficit. The highly contracted sectors of these economies include the textile, mining, and tourism.

The most impacted areas in the world recession are banking system, financial markets, commodity markets, capital flows, cash flows, reserves and government budgets, FDI, and several other sectors e.g., tourism.

Methodology

Research Methodology

Marshall & Rossman (1999) expressed that the research methodology usually devises the specific processes and techniques for specific research purpose. However, the research methodology usually works as a compass to guide the research activities throughout every phase of the study. Zikmund (2008) stated that such research designs usually include three kinds of research methods, namely, exploratory research, descriptive research, and causal research. When the research topic or concerned study is obvious to the researchers, a descriptive research is usually used (Ghauri & Gronhaug 2005, p. 187). The exploratory research uses further clarification of the particular research subject and objective. On the other hand, the causal research pursues seeking out the causal relationship between various researches variables. Yin (1984) argued that the research validation usually determines which of the above research method to be use in a particular study. Here, the researcher used descriptive research method since the topic of the study has already clarified. Zikmund (2008) argued that the descriptive research usually ashore on the relative insights of the research topic. Therefore, the researcher collected enough data resources from various perspectives to build insights about the research topic and meet the foundation of the descriptive research.

Research Approach

Mibenge & Okoye (2007) settled several type of research approaches including deductive, inductive, qualitative, and quantitative research approach. The quantitative research applies when the research topic is fully clear and theory building thereby is easy. Here, theories have tested quantitatively through inferential statistics tools (Anon. 2009). The qualitative research held on assuming that the reality is quantitatively measurable and decipherable from staying apart (Quantitative and Qualitative Research, 2009). Therefore, the research approach uses survey, experiment etc. to form the case and order approach to justify or evaluate hypotheses (Zikmund 2008). On the other hand, the qualitative research approach is planned to perform exploration of any process of something happening, to conceptualize the happening, and to find out answers of qualitative questions (e.g., why, when, who etc.) (Zikmund 2008). The data sources used in this kind of research are usually non-structured; hence, the researchers shape the structure for the qualitative data. He also added that the useful research tools of qualitative research include in-depth interviews, ethnographic studies, case studies etc. The confidence of the research comes from the comparison between the research findings and the findings previously done by other researchers.

There are several characteristics of qualitative research such as having focal point on natural situations, having concentration on the connotations and good understandings of the settings, giving emphasis on the process of the settings, and building the research block on inductive analysis (Cohen, Manion & Morrison 2007, p. 41). To ensure the validity of qualitative researches, the researchers must confirm the use of unobtrusive methods, respondent substantiation, and triangulation (Miles & Huberman 1994 p. 78). The researchers should use unobtrusive method of collecting data so that the natural settings have not hampered. The respondent substantiation is required to ensure the credibility of the research findings and researchers’ explanations about these findings. On the other hand, the triangulation in this respect means the validation of the research by using several methods of exploring an issue (Cohen, Manion & Morrison 2007, p. 41-55). The research study at hand is highly based on the previously published data resources. Such kind of research is specifically known as descriptive research. More concisely, the research approach used in the study is both historical and documentary research.

Secondary Research

Zikmund (2008) stated secondary research as an approach of collecting existing data. It is ordinarily a mean of conceptualization about relative scenario held in the past. Hill & Kerber (1967) argued that the research usually build insights from precedent resources to facilitate hypotheses construction. The secondary research is used here to form the ground of the research process (e.g. literature review), analyse the actual situations (e.g. the impacts of the economic downturn in Africa), and form recommendations (e.g. what to do to rescue the Africa from the crisis). The researcher collected different research papers, articles, and journal articles related to the study. The extraction of data has done by targeting specific secondary data sources such as AfDB, AfDF, World Bank, IMF, BBC News, OECD, etc.

Historical and Documentary Research

Borg (1963) defined historical and documentary research as the methodical and objective position, assessment, and amalgamation of confirmation with the aim of setting up particulars and sketch end notions about past events. The data is mainly get from personal observations or from observations of others. The first act of the approach is to devise an area of interest where to work or build the hypotheses. Then the compilation, organization, confirmation, corroboration, examination etc. take place along with taxing the hypothesis. The easiness of finding out the recurring drifts is the benefit of using the approach. However, such kind of research sometimes has the burden of inadequacy of required information (Cohen et al., 2007, p. 191-192). Mouly (1978) stated five basic characteristics of historical and documentary research that includes a highly and adequately clarified problem, an exceedingly available and objectively verified data resource to build the required solution, an analysis of the data dependency, an objectively interpreted solution, and a presentation of study excellence. Cohen et al. (2007, p. 192) stated three essential steps in the research approach, specifically:

Choice of subject

The subject of the research has selected effectively to set further conclusion about the economic downturn in Africa. Gottschalk (1951) settled four questions to ensure the effectiveness of the subject of choice, those to be precise, includes the place of the occurrence, people who are involved, time of events occurrence, and human activities related with the events. In this research, the place of the occurrence was Africa, a wide-range people of the economy were involved in the occurrence, the events took place between the period of 2007 and 2009, and financial and economical activities were involved in the event.

Data collection

The data set used in such type of research was fully in existence. Cohen et al., 2007, p. 191-192) expressed that there can be two types of data, explicitly, secondary data (already exists) and primary data (only to either supplement or further clarify the matter of interest). The secondary data was extensively in use within this study. The researcher collected the data mainly from internet resources. There were a number of papers and articles similar to the topic as well.

Evaluation

The evaluation of historic information refers to the historic criticism and the data obtained by the evaluation is the historical evidence. Cohen et al. (2007, p. 191-192) mentioned that there are two criticisms, namely, external and internal criticisms. The external criticism has the aim to define the genuineness of the data sources obtained. The researcher, in this aspect, collected data from very authentic sources (e.g. IMF, AfDB, Word Bank etc.) and hence, the genuineness of the collected data is incontestable. The internal criticism has the aim to define the genuineness of the data obtained. Since the data collected was well enough to carry out the research, the data has necessarily vested with the research topic.

As the researcher does not have any scope of doing content analysis, so no quantitative tool has used in this study. Rather, the researcher tried to comply it with general notions about the event and its impacts.

Results and Analysis

Analysis: Impacts of the Economic Downturn in Africa

Collapse of banking system

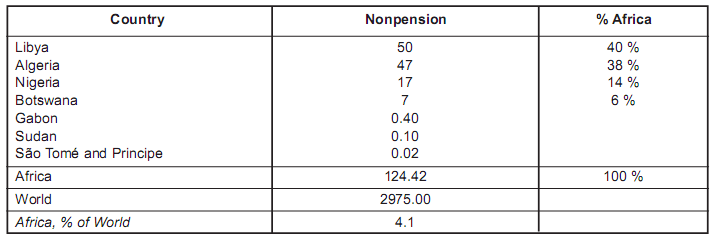

The banking system of the Africa is quite isolated from all other financial systems of the world. Consequently, the banking system had no affect on the financial crisis of 2007. The external financing (i.e., bond issuance) is low in Africa comparing with the emerging economies around the world. The financing amounted only 4% of total global external financing in 2007. The African banking assets constituted only 87% of global banking assets in 2007, which was a lower value than other emerging economies. The reason behind the Africa’s endurance in the sub-prime crisis of 2007 was its low financial integration. Particularly, the African countries do not deal with complex bonds/derivatives, and besides, these nations use less external financing (e.g. having stock capitalisation). However, the collapse scene resulted due to the presence of foreign banks in different African countries. In some countries e.g. Mozambique, Madagascar etc., the foreign countries’ capital share reached almost 100%. These banks had headquarters mainly in France; Portugal etc. those faced tremendous crumple in their stock and revenue performances in the economic slowdown. Moreover, the African financial sectors were highly dominated by the banking sector where the performance of the financial markets was not noteworthy, rather non-existent in some cases. However, the commodity price hike encouraged accumulation of reserves and thus created less sovereign funds in several African countries (e.g. Libya, Algeria) whilst strengthened the same in some other countries e.g. Botswana, Nigeria etc. (Louis et al., 2009, p. 2-4 & ADB & ADF, 2009, p.1-2).

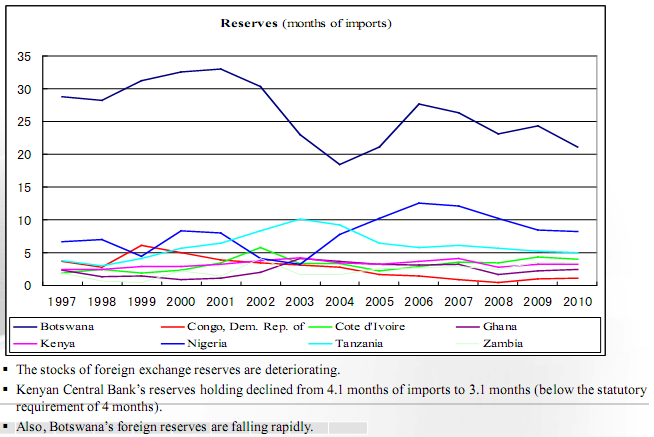

The presence of such reserves helped the countries to avoid the exchange rate loss in the crisis. However, there is no enough data available on the profitability of these reserves, but it has assumed to be drip because of the oil price shrinkage (Marais 2009, p. 1 & ADB & ADF, 2009, p.1-2).

Deterioration of various markets

The economic slowdown that took place very rapidly has several distinct affects. These are:

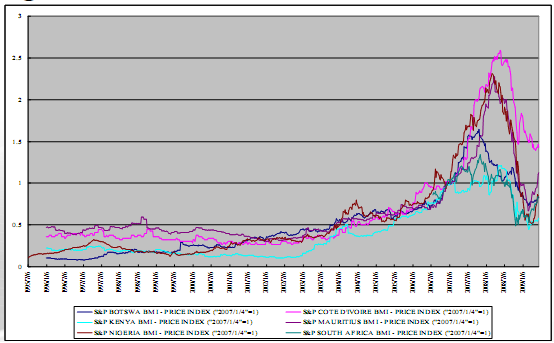

Impacts in financial markets

As stated earlier, the African financial sectors had no affect by the sub-prime crisis but there were signs of price hike of stocks and trek in risk premium. The infectivity and interdependence considerably influenced the African financial markets. In some countries e.g. Egypt, Nigeria, the impacts were more widespread than that of developed countries (e.g. Portugal, France, UK etc.). The over estimation of stocks’ prices and the escape of portfolio investment were responsible for the crisis in the highly liquid financial market. The investors of Africa (more succinctly Nigerians and Egyptians) faced a loss of half value of their investment. However, the scenario was more deteriorating than that of America, France etc. (Moss 2009, p. 10 & ADB & ADF, 2009, p. 3). In South Africa only, the price of assets drastically had a fall. The Jalash index had fallen by 46% between 2008 and 2009 (Maswana 2009, p. 13).

Mounting the autonomous debt spreads

Although the costs of external finance in international financial markets were increasing in 2007 but the spreads thereof were modest before the financial crisis. Tunisia was the victim of the impact at its first effort to sell its bond in the Japanese financial market. Nevertheless, the Japanese restrictive policies enforced the Tunisia to increase its offer by 25 basis points. The financial crisis soared up the costs of external financing in the international financial markets for the growing economies, briefly for African countries. The sovereign debt spreads increased by almost 250 basis points from October 2008 for the rising economies. In the JP Morgan promising countries equity index, the spreads increased by almost 800 basis points in 2008 (Marais 2009, p. 1 & ADB & ADF, 2009, p. 3).

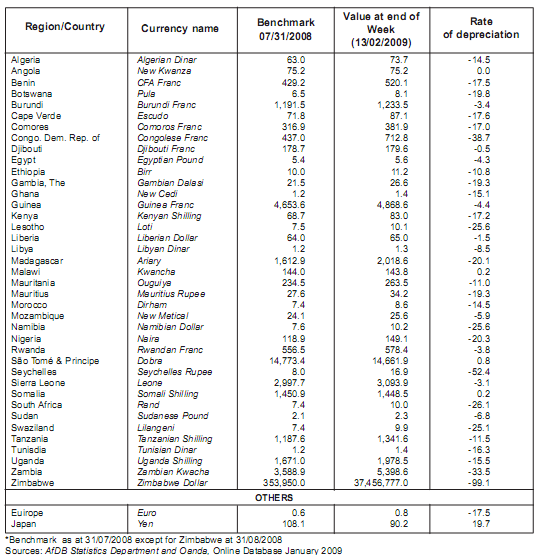

Explosive nature of exchange markets

The economic downturn resulted in volatile currency states at different countries. Such depreciations of currencies occurred mainly due to the hike in commodity prices and low foreign exchange reserves. Therefore, the exchange rates of home currencies had fallen almost 50% against USD in some countries (e.g. Zambia) (Louis et al., 2009, p. 5-6 & AfDB & AfDF, 2009, p. 3).

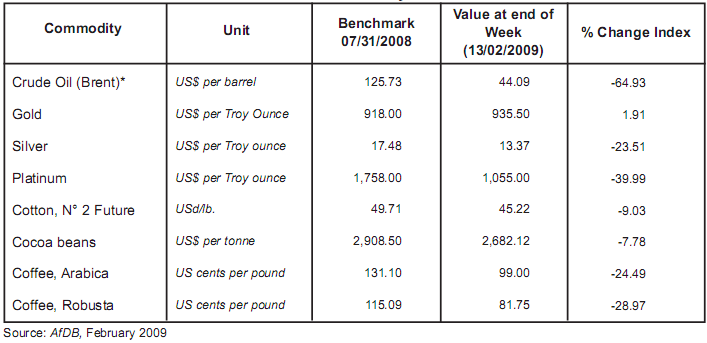

Swamp of commodity prices

The recent growth of Africa is attributable to the export of commodities. The industrialisation in India and China helped the soar-up of commodities and hiked the commodity prices. The commodities future markets’ expectations had destroyed by the economic downturn, hence, prices and demands of commodities swamped. For example, the crude oil’s prices dropped by 65% between 2008 (September) and 2009 (January) (Louis et al., 2009, p. 7-9 & Africa Progress Panel. 2009, p. 17).

The countries (e.g. Zambia, Botswana, Nigeria) those rely on natural resources (e.g. copper, oil, and diamonds) were highly affected in the financial crisis. For instance, Zambia experienced a decline in the export earnings and foreign currency reserves. By the end of 2008, the foreign currency reserves that were generated by mining activities dropped by 30%. On the other hand, the export growth rate in Burkina Faso dropped to 3.5% in 2008 from 6.9% in 2007 due to the decline in cotton production and lint cotton export. Furthermore, a smaller quantity of production of agro products and less export of these products supplementary deteriorated the scenario (Louis et al., 2009, p. 7-9 & AfDB & AfDF 2009, p. 4).

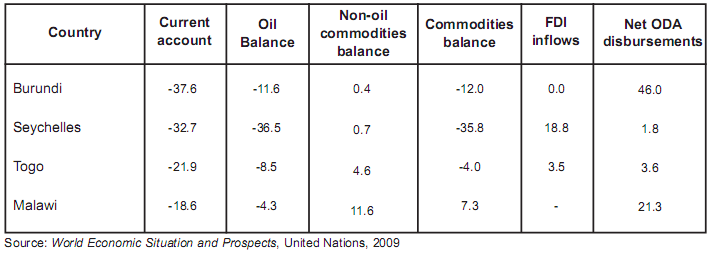

The undesirable impacts of the crisis on the export and resource inflows have reversed the scenario of recent growth in the African economies. The consequences include waning reserves, decreasing or eliminating profitability of some oil fields with high extraction costs, deterioration of FDI in extracting industries, diminution of Government competence of funding etc. By the crisis, there were a gigantic impinge on the non-oil producers (e.g. agricultural and mineral products) as well. The agriculture and food had also seen a 20% decline in export revenues. Yet, the countries (e.g. Burundi, Togo, Malawi, and Seychelles etc.) had believed to have a positive impact on external account balance due to the swamp in the prices of primary commodities on the ground that these countries have large deficit balance due to the oil-import schedule (Louis et al., 2009, p. 7-9 & ADB & ADF, 2009, p. 4).

These countries have a high deficit laid between -37.6% (Burundi) and -18.6% (Malawi). Such deficits have financed by the high capital investment. However, since the FDI became limited, it was difficult for these countries to rescue themselves from such deficit account (Louis et al., 2009, p. 7-9 & Laishley, R. 2009, p. 11).

Economic downturn in Ghana

Critical Geopolitics of Ghana

Acxiom (2004) noted that Ghana, the colonial Gold Coast ruled by the British imperialist for more than centuries became independent in 1957. In pre-colonial era Ghana was a number of independent kingdoms and gone through a colonial rule for at least four centuries. The natural resource of Ghana has enriched the country with minerals like gold, aluminum industrial diamonds, manganese, and petroleum have contributed a tremendous prospect as well as attracted the multinationals. There is also a great prospect of the country with its agriculture. However, it is the largest cocoa produces of the world, but it is also remarkable player in the global market for its timber. The UK, USA, Japan, and other European countries are the trade partner of Ghana. The country is in use the constitution of 1992 as a multiparty republic with a presidential form of government with a parliament of 200 seats where the legislatures elected for four year per term.

From its independence, the country could not be free from the western intervention, military intervention, still the country going through political unrest, arms struggle all that caused from the conflict of national interest with the multinationals. Ghana has huge foreign debt; imports have shortened; and most dangerously, the state has taken scheming interests of westerns owned mining as well as timber firms.

Financial Crisis Impact on Trade and Growth

Velde (2009) stated that the portfolio investment flows of the both developed and less development countries have experienced a theatrical drop in 2008 with uneven huge outflows as well as a momentous go down in equity markets of the countries. The Bank of Ghana (2008) has reported that tapering credit conditions and FDI condition has seriously injured the normal growth of the country.

The Bank of Ghana (2008) also added that the export values of the country has been dilapidated with a fall of 25% of its export In 2008, the garment export values in have already plunged terrifyingly by on an average of $250 million per month which has evidenced to $100 million in the month of January 2009.

Bank o f Ghana (2007) pointed out that the remittance inflows; there is strapping presentation all over 2008, and in third quarter, the inflows jump down to US$ 450 million which was $508 million in 2007. Mostly, the remittance for total exports has evidenced with am augment of 22% growth for export proceeds documentation by 2006 as well as 2007.

Velde (2009) pointed out than that, the global financial crisis has turned into an economic crisis for the majority countries. The effects on domestic economies would have insinuation for at the same time there were the need for reconsideration in context of traditional policies, which incorporated the government interventions through financial assistance and procedures to protect the domestic industries.(Velde 2009, pp. 294))

Poverty eradication & financial sector of Ghana

To discuss the impact of economic downturn in Ghana, it should consider the co-relationship between poverty eradication and financial sector of Ghana. Quartey (2005, p. 3) argued that from the late 1980s, Ghana has mobilized domestic resources by adopting liberalization policy, as a result, its GDP savings ratio has reached 7.4% by 2000, the M2/GDP ratio enlarged from 0.195 in 1996 to 0.321 in 2003. Despite these improvements, the government has failed to inspire private investment to drive the financial system towards the desired point of growth, for example, the percentage of GDP has decreased, and private savings in Ghana remain low.

Quartey, P. (2005, p. 7-10) also added that like other developing countries it should require economic and structural reforms because IMF & World Banks control its economy, provides policy-advice as well as financial assistance. For example, the Bank of Ghana introduced universal banking and it rationalized the minimum reserve necessities for banks, as well as the central bank changed monetary policy. However, global recession has raised numerous questions pertaining to IMF functions, such as, whether its resources are adequate to cope up the situation, whether rescue package creates any moral hazard or not, whether the contagion of financial crises can be stopped successfully, and whether it can changes the economic policy and whether it can increase accountability or not.

However, according to the survey report of The Afrobarometer, 40% Ghanaians are satisfied with their national financial system, government financial performance, improvements in health care sector, and their personal living standards. On the other hand, the poverty level has declined in 2008 due to the impact of global recession and inequality between rural and urban areas.

Role of Foreign Direct Investment in Ghana’s Economy

Abdulai (2004, p. 2-7) mentioned that FDI has considered as a main motivation to financial growth in developing countries because it deals with lack of financial resources and it contributes for the growth factor of a country’s growth by influencing manufacturing improvements, contribution to technological affairs, scoping the productive employment and generation of greater exports. Inward FDI represents the ending position of a nation’s outsider monetary liabilities owned by foreign investors with personal or indirect channels in global affiliates while outward FDI represents the ending conditions in the similar manner but in affiliate boards. The USA, UK, and European Community are major contributors of FDI for causing many development activities in developing nations like Ghana although the scope and it is one of the significant sources of revenue for this country.

Abdulai (2004, p. 8) also stated that FDI is very much effective for the overall development of any country for which some environmental reformulations is essential, such as- regional construction and integration with local investment, level of competition in that specific sector, sectored capability for adopting new offers and approaches, organizational variables and finally, the business investment programs. The above figure shows the total FDI Flows for the fiscal year 1969 to 2003 of Ghana. Besides mining sector, manufacturing, tourism, building, and construction were also important area for investment but in 2008, FDI has decreased dramatically for global financial crisis as the contribution of developed countries like US and UK was minimal.

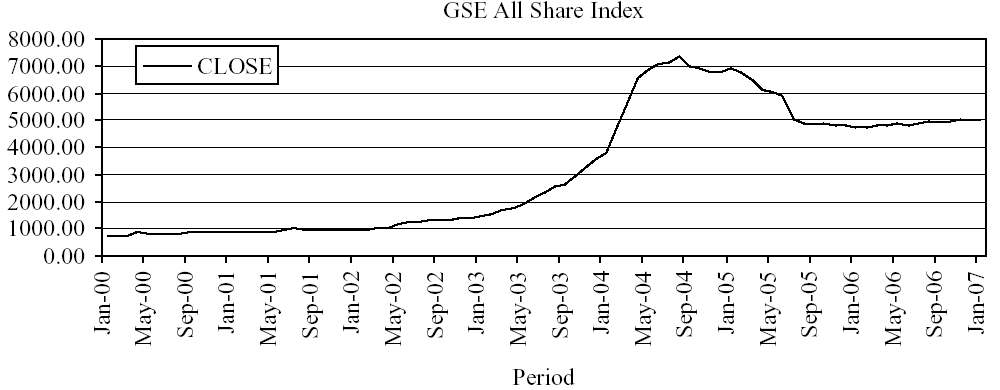

Stock market indicators in Ghana

Kyereboah & Agyire (2008) disclosed that due to the financial downturn in Ghana the interest rates from bank saving have an unpleasant effect on the Ghana Stock Exchange performance and predominantly give out a most significant interruption for the economic growth of Ghana. Meanwhile the inflation rate has evidenced a negative effect on the performance of stock market. Consequently, it would require enough time to overcome the dilemmas of financial downturn the charisma of an interval period; when the investors benefit due to exchange-rate fall and local currency decline.

There are thirty-three listed companies in the GSE2 including two corporate bond and another two fixed interest state bonds. Due to financial downturn, the listed companies go down surrounded by their manufacturing, mining, energy, as well as financial sectors. Some of the companies have evidenced to meet their listing requirements such as capital adequacy, performance with profitability, offering shares, distribution of dividend, as well as management efficiency. In 2002 to 2004 GSE have the benefit of an optimistic run and the exchange has considered as the global best-performing market with a year return of 144% and evidenced a 30% in global index when USA demonstrated 26% and Europe 30%.

GSE (2009) reported that the decline in share prices as well as the skinny quantities traded shares has seriously influenced the turnover due to financial downturn. In the 1st quarter of 2009, there were sixty-three trading sessions the total trade volume has reported GH ¢ 13.78 million for the number of shares traded was 17.32 million, when in the 1st quarter of 2008 it was GH¢ 51.39 million for the number of share 83.25 million. GSE (2009) also pointed out that within the same period of 2008, there were very a few numbers of government bond traded, but there were no trade of single corporate bond.

GSE (2009) also added that even though the collision of the global financial downturn has anticipated to influence the Ghanaian economy very negatively from 2007- 2008, but in this year it is still a upward optimist outcomes from the stock market which possibly provide the opportunities of wealth generation for both existing and net investors in Ghana’s stock market. The financial analytics and consultants believe that the stock market of Ghana would be gear up in its previous form very soon within the end of 2009.

Current Macroeconomic indicators of Ghana under Financial downturn

Hansen &Headey (2007) mentioned that the scenarios of the macroeconomic management in least developed countries of Africa, as if Ghana is especially interesting due to aid impact. In Ghana, there is a wide assortment of studies anticipated to measure the long and short-term returns from foreign aid. In short-run measure, the effect of foreign aid on institutional and policy issues has very negligible impacts on key macroeconomic. Hansen and Headey (2007) added the content of IMF 2005’s study on Ghana, pointed the comparison with few African countries, and recommended for considerable institutional improvements to on the rise a more predictable econometric practice in order to increase the capabilities of countries.

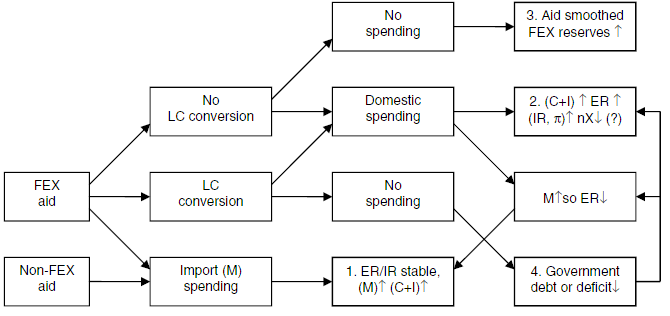

In the following figure it has demonstrated how mostly the government of Ghana could utilize foreign aid in the short-term. When foreign combination has defined as the degree to which the non-aid current account deficit of Ghana has expand in retort to boost the foreign aid inflows. The degree of direct and indirect raise in imports has financed by foreign aid rather than capital machinery and industrial financing.

The macroeconomics of Ghana has experienced that the increase in public and private expenditure responses as increases in the fiscal deficit next to the foreign aid. The national governments of Africa are willing to increase domestic spending but not to increased imports rather than export, when the donors are interested to increase import without emphasizing the national economic growth. On the other hand government and local policy makers willing to extend further expenditure to funding investment rather than consumption. As a result, the macroeconomic framework of Africa has to face more to presume in short-term benefits to a certain extent than more rapidly long-run growth.

Due to current financial downturn, the foreign aid can enlarge the real resource accessibility devoid of extensively shifting prices in more than a few ways. Firstly, it could increase the reserve of foreign exchange to the central bank. The government has the opportunity to increase spending and decrease revenues to bring substantial growth. There are some other way of influence through foreign exchange rate and making exports less competitive.

In the above figure M indicates Imports, nX has used point to net exports, C stands for Consumption, I specified Investment, FEX pointed out the or foreign exchange reserves, ER refer to Exchange rate; IR talked about Interest rate; π stands for inflation and LC used to clarify local currency. The figure has demonstrated that –

- When the foreign aid is an aid-in-kind and if the government has completely spent it on imports, then this type of foreign aid is straight away engrossed on consumption without any direct effects on ER & IR.

- When the foreign aid has converted into LC and exhausted domestically without increasing domestic expenditure and effectual demand for imports, then it would result expanding pressure on interest rates as well as foreign exchange rates

- When the foreign aid is neither captivated nor exhausted, the foreign aid has successfully saved and utilized to strengthen the reserve of foreign exchange.

- When the foreign aid is riveted but not spent, at that time the foreign aid could use to whichever decrease the government debt, or diminish the size of the current fiscal deficits.

Discussion

Transmission channels: both long and medium-term

Trade flows

the African trades all around the globe accredited to the growth in African economies between 2000 and 2007. However, the financial downturn affected the trade growth. The world trade had experienced an increase in volume by 6.3% in 2007, which declined to 4.4% in 2008, and it can assume to decline further to 2.1% in 2009. The reasons behind the story were shrinkages of commodity prices and demands around the world. However, the world trade outlook of 2009 forecasted that in 2009 the value of export and import of Africa might be at 3.6% and 10.5% respectively. The actual values of these in 2008 were 10.6% and 15.2% respectively. Such shrinkages could broaden up the foreign currency reserve deficits. Moreover, it was also thought that in 2009, the recent growth of primary commodities would suffer a decline of 45% of its export volume in Africa (Africa Progress Panel 2009, p. 10 & UNCTAD. 2009, p. 21).

Capital flows

Short-term private capital flows

Estimations suggest that short-term capital flows to developing countries was USD 253 billions in 2007 that declined to USD 141 billions in 2008. Africa experienced the same retrenchment. There were several reasons for the shrinkage including the deterioration of market conditions and the contraction in growing countries. Conversely, previous estimations assumed that Africa would not face capital flow shrinkages as the industrialised countries. The assumptions behind the notion were low share of capital flows, small number of foreign assets pledging countries, and inadequate correspondence between international and African financial markets. In 2008, there were no bond issues by African countries in international financial markets and its volumes were 6.5 billion dollars and 1.5 billion dollars in 2007 and 2005 respectively. This was the most important concern since countries such as South Africa usually relies on private capital inflows to decrease current account deficits (Moss 2009 p. 13 & Marais 2009, p. 8).

Impact on Remittances

The remittance is one of the most imperative foreign financing sources for emerging countries in the African region. The remittance financing in some countries is usually higher than that of the official aids. In 2007, the remittance of African countries was US$ 38 billion. However, the job cuts and less activity in mining sectors caused a swamp in remittances between African countries. Such shrinkage widely hampered the household consumptions and expenditures, as remittance is a direct household financing (Othieno 2009, p. 42 & AfDB & AfDF, 2009, p. 6).

Impact on FDI

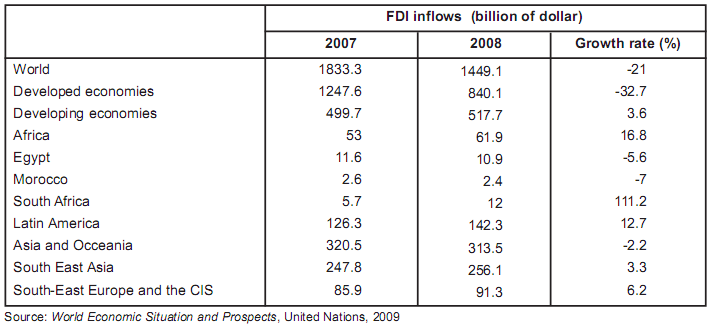

The global FDI experienced a sharp decline of 20% in 2008 that was assumed to further decrease in 2009. The FDI inflow to Africa in 2008 was US$ 61.9 billion with a steady growth of 16.8%. However, there were large gaps between different countries based on FDI. For instance, Egypt and Morocco announced -5.6% and -7% decreases of FDI correspondingly whereas South Africa reported almost 100% growth of FDI in 2008 (Louis et al., 2009, p. 11 & AfDB & AfDF, 2009, p. 5-6).

The fall in reserves and government budget

The rising commodity prices in 2007 let Africa to gain more foreign exchange reserve. The countries (specifically oil-exporting countries) were able to repay foreign debts and do large-scale public investment. However, since the prices of commodities after the period started shrinking, consequently countries those prepared their budgets based on scaling USD 70 were forced to scale their investment plan down. It is forecasted that the budget deficits of oil-exporting countries in 2009 would be -7.7% of the GDP, against a surplus of 5.1% in 2008 and 4% in 2007. On the other hand, the oil-importers would experience a budget deficit of -2.8% in 2009 against -1.6% in 2008. Moreover, the African countries might experience a deficit of -3.8% in GDP in 2009 at current account balance. The oil-exporters, on the other hand, will experience a deficit of -3.9% in GDP in 2009 due to the shrinkage in oil revenue. However, the North Africa was the only region to experience a current account surplus of 3% in GDP in 2009 withholding Morocco (10.7%) and Algeria (5.6%). It has also predicted that if the current situation runs further, many African countries would face twin deficits, i.e., both budget and current account deficits (Maswana 2009, p. 22 & ADB & ADF 2009, p. 6-7).

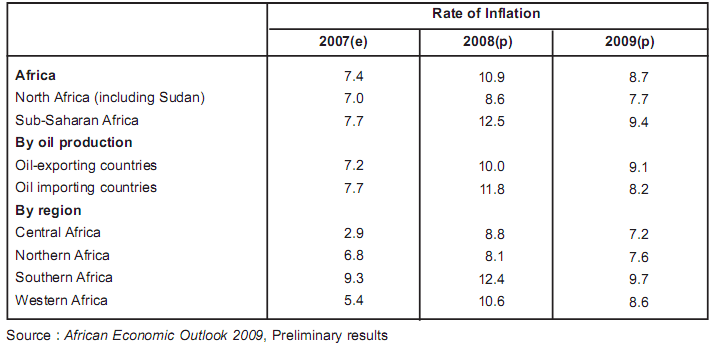

Inflationary impacts

The prices hike of oil and foods during 2008 increased the inflation rate up to 10.2% (projected) against that of 7.4% in 2007. Hence, the downward price movement was supposed to construct much lower inflation rate in 2009. It was expected on the ground that drivers of inflation hike of early 2008 would become drivers of inflation decline at the end of 2008 (e.g. the prices of commodities). Therefore, the big losers (e.g. oil-importer countries) of 2008 had assumed to gain in 2009. The inflation rate of these countries would lessen by 3% in 2009 that will correspond to the rate of 2007. However, the oil-exporting countries would experience the inflation rates of 2008 in 2009 (Louis et al., 2009, p. 13) and (AfDB 2009, p. 7).

Sector based impacts

There were various sectors those affected by the financial crisis specifically the following:

- Tourism: the tourism sector got hurt in this financial crisis due to the shrinkage in disposable income of people of developed countries. Thus, the total economy of various countries also became impacted since they highly rely on tourism sector as a large revenue source e.g. Mauritius. There was significant decline in both arrivals and receipt. For instance, Kenya reported 25%-30% decline in arrivals and Kenyan airways reported a revenue loss of 62% in 2008. Accordingly, Egypt announced 40% annulment of hotel provisos whereas Seychelles reported 10% fall in the tourism revenue (Louis et al., 2009, p. 14) and (African Union. 2009 p. 6-8).

- Textile: Louis et al. (2009, p. 16) expressed that in countries e.g., Madagascar and Lesotho, several textile industries had closed due to the financial shock. Again, external demand of textile of South Africa fell tremendously. Parker (2008, p. 9) mentioned that these estoppels essentially increased vulnerability of labour-intensive firms and large job lose.

- Mining: The financial shock resulted several breakdowns or withdrawal of investments in the extractive industries in several countries for example, Cameroon, Zambia, Ghana, South Africa etc. The Kafu Gorge Dam Project (USD 1.5 billion project), in Zambia, was kept postponed due to the reluctance of investors on the ground of copper price’s fall. There were several companies (e.g. Quantam Minerals, Albidon and Makambo Copper Mine etc.) abandoned or postponed their new extraction projects. The fall in prices of cobalt resulted cut short in opencast Mine Tilwezembe and the healing of ore at Kolwezi plant of Congo. According to the estimation of Ministry of mining in DRC, these estoppels caused trouncing of 200000 jobs. The Gabon, world’s second manganese producer had been suffering from 60% price fall of manganese. The price fall of iron affected Senegal and Mauritania so badly. Louis et al. (2009, p. 14-15) and AfDB & AfDF (2009, p. 8) published that the Niger suffered tremendous price fall of Uranium from US$ 140 to US$ 53 between 2008 and 2009 and thus export earnings of the country just exhausted.

- Other Sectors: Louis et al. (2009, p. 16) stated that the labour-intensive industries/sectors have been experiencing tremendous impact of the economic downturn along with large job loss and decline in living standards. According to the report of AfDB & AfDF (2009, p. 9), only in Madagascar, there was 8% to 15% demur in financial doings in a variety of sectors. These happened due to baulk of export demand and currency depreciation.

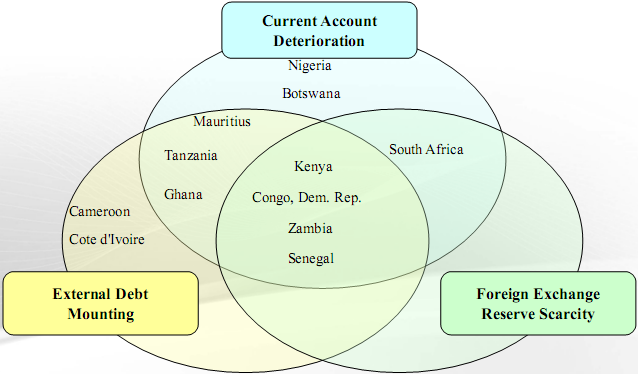

- Overall External Vulnerability: Maswana (2009, p. 26) argued that the African countries were facing triple band weakening namely foreign reserve shrinkage, deficit in current account balance and external debt. He also added that the countries such as Mauritius, Ghana, Tanzania etc. those had very high level of external risk ratios were gradually deteriorating risk perception and in reserve accretion.

Conclusion

Recommendations

The following actions should undertake very rapidly by the governments, international investors, and development partners of African countries:

- Enabling the conjugal growth drivers: the export oriented sectors (e.g. textile, extraction etc.) and high value sectors (e.g. tourism) have assumed as the conjugal growth drivers in African countries. Hence, the governments should establish macroeconomic policies to enable these conjugal growth drivers perform outstandingly.

- Assessment of Resources: To sustain and overcome the crisis, the existing resources will not be enough for African countries. For this reason, these countries should measure their existing resources and review the Debt Sustainability Framework. If any country is able to pay loan payments, it should pursue permission to less or non-concessional resources.

- Escalating infrastructure development: It is necessary for African countries to escalate its infrastructure development to allow private investments to rise. For the very purpose, macroeconomic and/or fiscal policies must be flexible enough, so that the African countries will find sufficient space to allocate more resources to improve infrastructures. Particularly, this kind of activities will help to enhance competitiveness in these countries and diversify its sectoral investments. The governments might allow private-public partnership in infrastructure development projects. The governments may also have cost for service approach to recovery cost of extracting and management of public goods.

- Escalating policy gap and suppleness, hustling up aid deliverance: the foreign development partners and the donors must allow the countries by reforming aid policies. The donors should increase suppleness in their aiding policies to suit to the circumstances of the aided countries so that the aid may meet specific needs of these countries withholding technological expertise. The same objectives may also obtained by performing current performance based aid programs.

- Reason: Before attempt to take any step, it should require to find out the actual reason of economic downturn because this crisis has not occurred automatically or arbitrary but it happened due to over-investment by international bankers and other ventures’ therefore, it should differentiate between long-term secular improvements, the medium-term financial conjuncture.

- Additional bailout to promote trade: The African countries have learned that bail out is necessary in initial stage of recession to protect capital outflow, encourage trade, strengthen the economic segment, and enlarge lending for transportation, agribusiness, otherwise it may create more horrible situation in national economy.

- Internal controls in multinational companies: Internal conflict is the major issue which encourage the economic slowdown, so it should remove all internal conflict among inter-administrative groups, for example, Director’s remuneration is a most active concern in business world because many large companies have collapsed for the high payment to their executives, so it should make a restriction in taking huge amount of remuneration. Moreover, multinational companies should take into account the aftermath conditions of recession and reconsider configure the merger decision and they should maintain a strict inspection or monitoring process where it will exercise the recommendation of corporate governance theories.

- Banks’ immediate primed responses: Since the home-banking sector has not been highly affected by the crisis, now it is banking sector’s job to assess the vulnerability of the economic downturn to devise specific instrument a financial policies to rescue the economies.

Conclusion

The African economies experienced a very strong growth before the inception of the economic downturn. The financial crisis forced the economies to perform the worst. However, the projected and observed growth rate of these economies after the beginning of the financial crisis remains far better than that of advanced countries (e.g. UK, France), a 3.2% growth against a decline of.1%. However, such a growth rate is almost 3% less than that of 2007. In 2007, the financing amount to African countries was 4% of total global financing. The foreign owned banks (e.g. owned by France, Portugal) were highly affected by the economic downturn. However, the home banks had not much affected in the period. The over estimation of stocks price and the escape of portfolio investment were responsible in the highly liquid financial markets. The economic crisis climbed up the charges of external financing in the international financial markets for African countries. Due to the scramble in commodity prices and shrinkage in foreign exchange reserves, a large depreciation has experienced in local currencies. There were also experiences of negative expectation in the commodities future market those in turn swamped commodity prices. The natural resource driven countries were the most affected countries in this crisis. Moreover, the agriculture and food sectors had also seen a 20% decline in export revenues. The actual volume of exports and imports of Africa in 2008 were 10.6% and 15.2% respectively. Parker (2008) stated that the volume of private capital inflows has also declined for crisis that made it difficult for countries (e.g. South Africa) to decrease current account deficits. The remittance to African countries from outside the Africa accounted at US$ 38 billion in 2007. On the other hand, the job cuts and least activities in extracting sectors caused decline in remittances among these zone. The decline of FDI also became momentum but interestingly South Africa enjoyed 100% increase of its FDI inflows. The incidental price fall of commodities forced African countries to decrease their budget volume. Only the oil-exporters have assumed to face a deficit in budget, which estimated -7.7% of GDP in 2009. Moreover, it has also projected that if the financial crisis runs further, almost every African country will face both budget deficit and current account deficit. The inflationary rates were not much important since it adjusted itself. Furthermore, the most distinct sectoral impact of the crisis was the tremendous job loss (e.g., loss of 200000 jobs in DRC’s mining industry only). The most affected sectors were tourism, textile, and extraction. Therefore, the African countries are required to work effectively with the triple band deteriorating i.e. foreign reserve decline, deficit in current account balance and external debt.

Reference List

Abdulai, I. (2004) Sectoral Analysis of Foreign Direct Investment in Ghana. Web.

Acxiom. (2004) Ghana, country, Africa, Ghanan Political Geography. Web.

AfDB & AfDF. (2009) Impact of the Global Financial and Economic Crisis on Africa.

AfDB. (2009) Africa and the Global Economic Crisis: Strategies for Preserving the Foundations of Long-term Growth. Web.

African Development Bank Group. (2009) Impact of the Crisis on African Economies – Sustaining Growth and Poverty Reduction.

Africa Progress Panel. (2009) An Agenda for Progress at a Time of Global Crisis: A Call for African Leadership. Web.

African Union. (2009) The Impact Of The Current Global Financial And Economic Crisis On African Economies And Africa’s Common Position On Reforms Of The International Financial System. Web.

Arieff, A., Weiss, M. A., & Jones, V. C. (2009) The Global Economic Crisis: Impact on Sub-Saharan Africa and Global Policy Responses.

Anon. (2009) Quantitative and Qualitative Research. Web.

Anon (2009) Intervention and Exploitation: US and UK Government International Actions Since 1945.

Bank of Ghana. (2007) Global Crisis will Hit Poor Hardest. Web.

BBC News. (2008) Financial crisis ‘worries Africa’.

Borg, W. R. (1963) Educational Research: An Introduction. London: Longman.

Burney, S. M. A. (2008) Inductive & Deductive Research Approach. Web.

Cohen L., Manion, L. & Morrison, K. (2007) Research Methods in Education. 6th ed. New York: Routledge.

Ghanim, I. (2008) The Global Financial Crisis and International NGOs. Web.

Ghauri, P. & Gronhaug, K. (2005) Research Methods in Business Studies. 3rd ed. England: Prentice Hall

GNA (2009) Changes needed in Ghana’s economic structure for global downturn- Experts.

Gottschalk, L. (1951) Understanding History. New York: Alfred A. Knopf GSE, 2009. Review of 1st Quarter 2009 Stock Market Performance. Web.

Hansen, H. & Headey, D. (2007) The Short-Run Macroeconomic Impact of Foreign Aid to Small States. Research Paper No. 2007/38, United Nations University. Web.

Hill, J. E. & Kerber, A., (1967) Models, Methods and Analytical Procedures in Educational Research. Detroit, MI: Wayne State University Press.

Laishley, R. (2009) Global economic downturn: Africa walking a tightrope.

IMF. (2009) World Economic Outlook Update. Web.

Kyereboah, A., and Agyire, K. F. (2008) Impact of macroeconomic indicators on stock market performance the case of the Ghana Stock Exchange. The Journal of Risk Finance. Vol. 9 No. 4, 2008, pp. 367-375, Emerald Group Publishing Limited. Web.

Louis, K., Leonce, N., & Taoufik, R. (2009) Impact of the Global Financial and Economic. Crisis on Africa.

Marais, H. (2009) The Impact of the Global Recession on South Africa (ARI). Web.

Marshall, C. & Rossman, G. (1999) Designing qualitative research. 3rd ed. Thousand Oaks – CA: Sage.

Maswana, J. C. (2009) Global Financial Crisis and Recession: Impact on Africa and Development Prospects. Web.

Miles, M. & Huberman, M. (1994) Qualitative Data Analysis. 2nd ed. Beverly Hills, CA: Sage.

Moss, T. (2009) How the Economic Crisis Is Hurting Africa— And What to Do about It. Web.

Mouly, G. J. (1978) Educational Research: The Art and Science of Investigation. Boston, MA: Allyn & Bacon.

OECD. (2009) Measuring the Pulse of Africa in Times of Crisis. Web.

Osei, R. (2009) The Global Economic Crisis: Challenges and Opportunities for Ghana. Web.

Othieno, T. (2009) The Global Financial Crisis: Risks for Fragile States in Africa. Web.

Oxford Analytica. (2008) Africa: Economic growth is strong but constrained. Web.

Parker, L. (2008) South Africa and the global economic downturn.

Prout, T. (2009) Economic Downturn Hits Africa. Web.

Quartey, P. (2005) Financial Sector Development, Savings Mobilization and Poverty Reduction in Ghana. Web.

Samuel, J. (2008) Africa: From Great Depression to Deep Recession.

Siegle, D. (2009) Qualitative Designs. Web.

USAID. (2009) Impact of Global Economic Crisis on Health in Africa.

UNCTAD. (2009) Africa Competitiveness Report.

Velde, D. W. (2009) The Global Financial Crisis and Developing Countries, DFID & ODI. Web.

Yin, R. K. (2003) Case Study Research: Design and Methods. 3rd ed. Beverly Hills, CA: Sage.

Zikmund, W. M. (2006) Business Research Methods. 7th ed. Orlando: Harcourt Publishers.

Appendix

- Notation/Abbreviations used

- ABS: Asset-backed Securities

- AfDB: African Development Bank

- AfDF: African Development Fund

- DRC: Democratic Republic of Congo

- FDI: Foreign Direct Investment

- GDP: Gross Domestic Product

- IMF: International Monetary Fund

- MBS: Mortgage-backed Securities

- OECD: Organisation for Economic Co-operation and Development

- UK: United Kingdom

- US: United States of America

- USD: American Dollars

Footnotes

- Ghana News Agency.

- Ghana Stock Exchange.