Introduction

Apple is an organization in the United States specializing in creating, progressing, and selling electronic products such as cellphones and computers. Established in 1976 by Steve Jobs and his colleagues, this US-based corporation has encountered various strategic developments to become one of the most reputable brands in the world (Kim, 2020, p. 17). In its industry, the syndicate has been ahead of the competition from other multinational enterprises such as Samsung Electronics, Microsoft, Huawei, Dell, and many more. It is also a publicly traded corporation operating as AAPL in the NASDAQ stock exchange market (Kim, 2020, p. 17). This technology giant’s success is attributed to several factors, but, in this case, its corporate financial strategy has been impactful in its pursuit of growth and development. This paper discusses Apple’s corporate financial strategy’s significant concepts and proposes a new monetary approach while also offering a critical evaluation of it.

Cash Flow Strategy

Apple’s primary financial approach is to compress its profits as possible from every sale it generates. Therefore, its monetary strategy is to increase its margins, a commercial method it has followed since its establishment by the late entrepreneur, Steve Jobs (Kim, 2020, p. 25). This initial financial approach updates every other aspect of its business framework. Under Apple’s product development tactic, the company utilizes this intensive growth approach to develop appealing and profitable products to expand its market share and corporate performance (Harris and Roark, 2019, p. 395). This operation style also helps it facilitate its corporate financial method by maximizing margins which depend on its ability to offer differentiated products.

As a result, it involves an innovative design, unique, hard-to-copy features, and several aspects of marketing. Another strategy that supports its financial model is the custom to “always be launching” (Kim, 2020, p. 25). In marketing, early adopters are often ready to pay premium prices, thereby leading to the highest margins. According to Apple’s launch method, the American giant participates in intensive publicizing its products to create the largest group of early adopters. With this style, the business is able to promote its corporate financial strategy of maximizing margins.

Share Buybacks Strategy

A share buyback strategy is an approach that involves a corporation repurchasing its own shares from the stock market. Companies often make this decision to augment the value of the stock and to enhance their financial statements (Gupta, 2017, p. 45). In several occasions, organizations adopt this approach when they have cash on hand and the industry is facing financial downturns. Apple has used this financial archetype in the past due to some reasons. Initially, the company had no balance due and never assumed stock repurchase or paid dividends. Compelled by an investor uprising in 2013, the American giant has altered its approaches since it had an outstanding debt of $115 billion (Kim, 2020, p. 25).

However, it has disbursed approximately two hundred and eighty-eight billion US dollars to its stockholders in the past nine years, mostly through share buybacks (Kim, 2020, p. 23). The company has also repurchased its own shares worth $54 billion in the past (Kim, 2020, p. 24). Generally, the adoption of share buyback comes with several consequences, but the American giant has been able to avoid such in several ways.

While the approaches adopted by Apple might be risky, the company has undertaken its buybacks responsibly. It purchased shares when they were low, rewarding its shareholders in the long-run. Other corporations have not been practical, accruing debts to make inappropriate purchases of premium shares instead of investing in growth opportunities (Brondoni, 2018). Moreover, Apple’s financial archetype accentuates cash flow over profits, as seen in 2017, when it accumulated sixteen billion US dollars in cash flow from operating activities than profits (Kim, 2020, p. 23). Typically, a business has to rely on external sources of funding to support the process of stocking products and collecting revenue from the clients (Kim, 2020, p. 23).

However, Apple’s strategy disregards this since its retail stores collect money from consumers as quickly as possible. Today, the technology company has focused on keeping inventory low while also delays paying its suppliers. As a result, its operations are tremendously effective cash generators (Kim, 2020, p. 17). Apple’s strategy of delaying suppliers’ payments has been successful since the merchants are often ready to maintain their inventories and wait more than three months to receive payment, just for the privilege of doing business with the American giant.

Asset-Light Strategy

Apple has adopted the approach mentioned above to hold few hard assets allowing it to cut the need for external capital to run its operations. The company had $120 billion of operating liabilities and $105 billion of operating assets in 2018 (Kim, 2020, p. 17). This fact suggests that the organization does not rely on external sources of funds, justifying its supremacy in the technology industry (Brondoni, 2018). Apple has created this model by establishing a supply chain in Asia, operated by businesses ready to invest in projects with insignificant returns to manufacture its products (Harris and Roark, 2019, p. 397). In essence, this financial approach has been influential in the performance and profitability of American multinational enterprise in the long-run.

Critical Evaluation

Pros of Apple’s Current Financial Strategy

The American giant may have previously accrued debts by selling bonds. However, today, Apple remains one of the richest corporations ever to exist, with approximately eighteen billion US dollars in revenue in cash, as of 2016 (Kim, 2020, p. 17). This fact suggests that the company does not need to rely on external finance sources to support its operations and ensure its merchandise is stocked. The business has been able to do this by ensuring their inventory is low while collecting revenues as quickly as possible, and suppliers are also paid back slowly. This financial model’s significance is that it enables the American technology firm to have heavy cash flow with no need to depend on external sponsors (Gillan, Koch and Starks, 2021).

Moreover, the company’s high cash flow strategy and its asset-light model renders it a desirable enterprise that attracts suppliers and makes consistent income from its subscription segment (Brondoni, 2018). In essence, considering Apple’s contemporary commercial groundwork, this American brand is less likely to opt for third-party financial assistance in the future.

Another significant advantage of Apple’s solid capital structure is that if it were in an emergency and needed funds, the company would easily attain it. Its superior solvency would be a facilitating factor for accessing loans due to the low risks involved. Moreover, the company can effortlessly sell stock as they have a high rate of equity. Furthermore, the American giant has been repurchasing its shares without the need for external financing (Kim, 2020, p. 25).

However, if the company would have been in need to borrow money, they likely would do so considering the significant amounts of cash it has in cash flows. In addition, it has at least $40 billion in short-term liquid securities, suggesting that these figures can be changed to cash (Kim, 2020, p. 25). While Apple has been successful with this financial model, other minor, less marketable companies may not see the same results Apple has achieved.

Another advantage of Apple’s asset-light approach is that it has low-profit volatility. Generally, corporations with increased fixed costs depend on revenues to cover these expenses, so net income relies on utilization (Ritter and Schanz, 2019, p. 330). In contrast, Apple’s costs are more flexible relative to its revenues; therefore, earnings are less volatile. This fluctuation is encountered in multiple sectors, such as electricity and gas distribution, technology, utilities, and retail (Brondoni, 2018). Moreover, the strategy also allows Apple to have increased flexibility, allowing it to effectively respond to changing demand, market gaps, technology advancements, and supply chain disruptions.

Cons of Apple’s Current Financial Strategy

The milestones reached by Apple as a result of its business model are substantial. Although its financial archetype has brought favorable results, it is a risky approach for less capable businesses with minor strategic positions. Copying Apple’s strategies can easily result in debt burdens, unstable supply chains, and delayed investments opportunities (Kim, 2020, p. 25). Another disadvantage of adopting Apple’s asset-light approach is that it is subject to outsourcing links from reliable sources without compromising on the quality, or it may lead to failure (Harris and Roark, 2019, p. 397). It implies that a company intending to use this strategy requires huge capital spending, which requires extensive financial resources to initiate and succeed.

Apple’s share buyback strategy may sometimes be flawed due to the presence of sinking dividends. Occasionally, companies spend much money purchasing shares and then cut their dividend in the process. Therefore, this approach is not effective for less capable companies because after buying back their shares, the business may have less cash to distribute in a quarterly dividend. Another problem associated with this business model is the poor use of capital. It is because enterprises invest considerable portions of finances to purchase stocks at the expense of hiring, promoting, and developing new products.

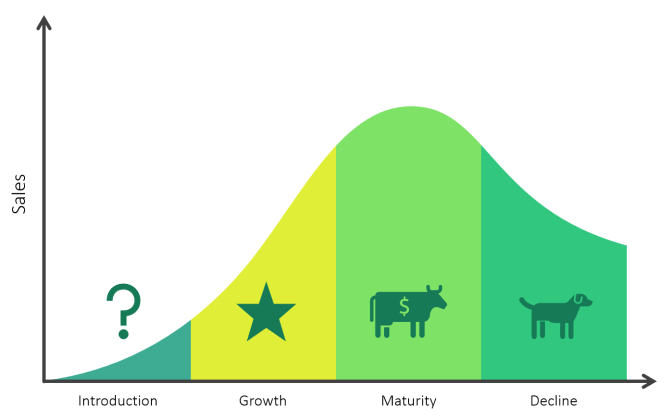

BCG Matrix

This strategic template catalogues multiple business units into four compartments: Dogs, Cash Cows, Stars, and Question Mark. These sections are identified as per the market’s growth and share of a particular company relative to the leading rival company present. This strategic instrument is crucial for executives, specifically in business economics, because it aids in long-term planning, further notifying organizers for growth opportunities by examining their product portfolio to decide investment and divestment areas.

Dogs

Dogs are a representation of products present in markets with low growth or market share. Such products have fewer probabilities of growing, and as such, companies need to be highly cautious with their investment approaches (Brondoni, 2018). In Apple’s case, its famous iPods were considered high potential products during their introductory phase, but the industry failed to create a substantial impact due to aggressive competition and low customer demand. In essence, the American giant has faced several challenges in an attempt to market its iPod brand; however, with the advent of cutting-edge technologies, competing corporations were able to offer exceptional products.

Cash Cows

Cash Cows are a representation of commodities that are present in markets with low growth but have a significant market share. Therefore, companies with such products are not expected to experience any considerable growth in future. In Apple’s case, it has two product lines that fall in this category, the first being its MacBook and iMac brands, and the second being iTunes. However, as the computing industry continues to grow with the arrival of advance products, Apple iMac and MacBook will soon be added to the Dogs category.

Stars

Stars are considered commodities present in markets with high growth rates and have significant market share. In Apple’s case, the iPhone has been a revolutionary device since the late Steve Jobs introduced it in 2007 (Kim, 2020, p. 25). Therefore, according to the BCG matrix, this product is certainly a star. Moreover, with every new launch of the commodities, the company often set new sales records. Apple iPad and Smartwatches are also regarded as stars and are currently in the changeover to become Cash Cows for the American giant.

Question Mark

These are wares present in the emporium with significant growth rates but have less market share. For corporations, these products can either become a revenue maker by becoming stars or decline and bring future losses. Apple TV is considered a Question Mark because it helps the company generate income but has not reached its full potential. Therefore, if the American giant manages to solve some ecosystem problems, they can dominate the TV space.

Table 1. BCG Financial Information on Apple

Proposed Financial Strategy

Apple has achieved every bit of success that other companies still intend to accomplish. However, the American technology giant can consider decreasing its dividend payouts rate as a way of conserving cash for reinvestment. While this approach may come with several consequences, a company as dominant as Apple will benefit in the long-run. In 2012, the American giant started paying dividends and exceeded Exxon’s figures as the leading dividend in the world (Kim, 2020, p. 25). As of 2018, Apple’s stockholders received 73 cents per share from their investment in the multinational firm (Kim, 2020, p. 25). Therefore, by minimizing the amount of cash it offers to its investors, the company will create more cash reserves and be able to invest in its Apple TV plus and the iPhone brand as indicated in the BCG matrix (Figure 1) and Product Life Cycle below.

Critical Evaluation

Advantages of the Suggested Approach

Since Apple’s subscription service is represented by Question Mark and has a high potential for market growth, the dividend policy will play a vital role in helping it grow since there will be more funds for research and development. Moreover, Apple’s iPhone has been the leading revenue generator for the company since its inception. With the current rate of technological advancement, the American giant is set to continue experiencing aggressive competition.

As such, the decreasing dividend approach will play an imperative role in allocating more funds for Apple’s technological program to develop the iPhone series. Furthermore, according to the BCG matrix and PLC model, Apple should consider divesting from the production of iPods and channel these funds to its cash cows. The company reportedly discontinued this line of products due to several factors such as their obsolescence and lack of internet features to access iTunes and other services. The proposed financial strategy is also significant because it will complement Apple’s cash flow approach to continue maintaining cash reserves for investment in growth opportunities.

Disadvantages of the Recommended Approach

Irrespective of the importance of lowering dividend payouts, Apple will encounter multiple consequences. For example, by cutting the amount of money investors earn from their portfolio, they will lose assurance and ultimately withdraw their funds from the company’s stocks (Gupta, 2017, p. 46). Moreover, dividend cuts may also impact Apple’s cash outflows, suggesting that the American giant will find it hard to pay its employees and suppliers. Its stock price will also be negatively affected since the market will react unfavorably to the financial approach adopted since investors and analysts fear the worst (Gupta, 2017, p. 46). Over the years, Apple has been a good stock for investors, as seen in the figure below.

Conclusion

This paper has discussed the primary aspects that constitute Apple’s financial strategy and a new monetary model considering its pros and cons. Over the years, the American technology giant thrived because it implemented an asset-light, cash flow, and leverage share buyback financial strategies.

This method has enabled it to establish industry dominance by keeping significant amounts of cash in reserves for reinvestment in its core operations, such as the development and research of the iPhone and Apple TV subscription business unit. However, the proposed financial framework suggested for the company involves taking dividend cuts to increase the finances in cash reserves as a means of supporting its strategic business units represented by stars and cash cows. While this approach will be of significance to the technology company, it comes at a cost. For example, Apple’s stock price will considerably fall since investors and the market in general fear worst-case scenarios.

Reference List

Brondoni, S. M. (2018) Competitive business management: a global perspective. Oxfordshire: Taylor & Francis.

Gillan, S. L., Koch, A. and Starks, L. T. (2021) ‘Firms and social responsibility: a review of ESG and CSR research in corporate finance’, Journal of Corporate Finance, 2, pp. 1-41. Web.

Gupta, M. (2017) ‘Share buyback and announcement effects: an industry wise analysis’, FIIB Business Review, 6(2), pp. 43–50. Web.

Harris, C. and Roark, S. (2019) ‘Cash flow risk and capital structure decisions’, Finance Research Letters, 29, pp. 393–397. Web.

Kim, H. (2020) ‘Comparison of strategic leadership: Steve Jobs and Tim Cook’, Business and Management Studies, 6(3), pp. 17–25. Web.

Ritter, M. and Schanz, H. (2019) ‘The sharing economy: a comprehensive business model framework’, Journal of Cleaner Production, 213, pp. 320–331. Web.