Introduction

The 2017 Accounting Standards Update (ASU) by the Financial Accounting Standards Board (FSBA) was issued for greater clarification on the definition of a business with the purpose of issuing guidance for entities on whether transactions should be accounted for as assets or businesses. This change came after much criticism, particularly regarding business combinations, that the definition of a business was used too broadly, thus allowing transactions to be recorded as business acquisitions while being more familiar with asset acquisitions (Financial Accounting Standards Board, 2017).

Business combinations have been the core of accounting since the early 20th century and those standards have continuously changed. Defining a business as part of accounting standards is critical as it impacts many potential areas, including acquisitions, disposals, goodwill, and consolidation.

The lack of specifications, particularly for minimum inputs and processes which are necessary to define a business, led to general interpretations and led to assets being sold as businesses. Accounting practices between assets and business combinations differ, with business exchanges being more complex and involving different elements for the transaction that are not present in relatively straightforward asset transactions.

The clarification is also vital as the accounting difference can significantly impact account statements and in turn, tax implications for the entity. The Board justifies such impactful changes based on the feedback of stakeholders and those using financial statements, suggesting that it was difficult to compare financial results and accuracy since different methods of accounting were used for business combinations because of such a broad definition, while assets which are an increasingly economic resource for firms where overlooked (Jeter and Chaney, 2012). The new ASU standards for business combinations are a general improvement for real-world applications and industry implications as the new definition removes the complications of prior standards while issues clarifications on new considerations that are much less ambiguous and can benefit both stakeholders and consumers significantly.

Literature Review

Under ASC 805-10, when undergoing a transaction, entities must conclude whether it can be defined as a business combination, especially referring to net assets representing a business structure. Typically, a business combination occurs when the acquiring party purchases “the net assets or equity interests in a business in exchange for cash or equity” (Davidson, 2021). Prior to the 2017 ASU standards, a business was defined as an entity or group of assets that consist of inputs and processes with the ability to produce outputs with the purpose of providing a return to its owners or members (Jeter and Chaney, 2012).

So, a business is made up of inputs that can undergo a process to generate outputs. Under the old guidance, outputs were notably not required to be active at the point of acquisition. The new ASC 805 guidelines introduce a set of screenings to regulate when the activities and assets do not constitute a business (Davidson, 2021).

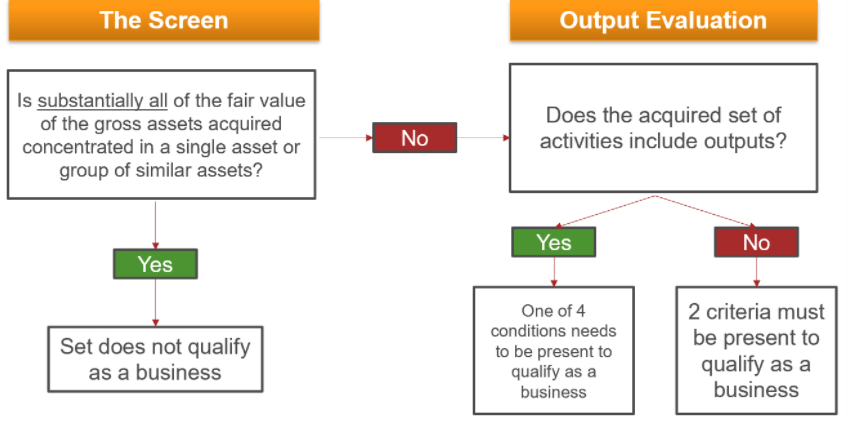

The new ASU 2017-01 standards create a dual approach to screen whether the transaction can be technically accounted for as a business. Seen below is a diagram simplifying and demonstrating the concept. Under the new guidelines, a business continues to be a set of activities that can provide a return. In order to be identified as a business, it must share the qualities of input and a relevant process to generate outputs with said inputs. Therefore, first, the screen is to determine if “the fair value of the gross assets are concentrated in a single asset or group of similar assets” (Financial Accounting Standards Board, 2017).

When purchasing an entity, it may have various elements, including contracts, potentially some physical assets, and intellectual property, but if the fair value is not spread out across multiple types of assets, then it is not a business. However, if the assets are diverse and spread out, it is then important to evaluate outputs. If they are present, one of the following rules has to be met to officially account as a business:

- Employees with the ability to perform the acquired process, which would convert inputs into outputs;

- A contract that would provide access to an organized workforce from the conditions above;

- The acquired process contributes greatly to output production and cannot be replaced “without significant cost, effort, or delay”;

- The acquired process contributes greatly to output production and is unique or scarce (Financial Accounting Standards Board, 2017).

If there are no outputs present, both criteria below must be met to identify as a business:

- Acquired set “includes an organized workforce with the ability to perform” the critical process of converting input into outputs;

- The acquired set has an input that an organized workforce can convert into output (Financial Accounting Standards Board, 2017).

The FASB overseeing the U.S. generally accepted accounting principles (GAAP) and the International Financial Reporting Standards (IFRS) commonly work together and share similar if not identical definitions as they had with the previous large update to the business definition in 2007. An important element of the organization’s due process is the feedback loop. Once standards go into effect and have been active for a period of time, there is an evaluation process known as the post-implementation review (PIR). Although bringing significant benefits and improvements, the FASB review discovered that

- some practice issues remained unresolved,

- “comparability, reliability, and representational faithfulness” were not achieved,

- the biggest barriers to the application were measuring certain assets and liabilities, as well as with a significant emphasis on “determining whether the transaction is a business combination or asset acquisition” (Munter, 2017, p.73).

Similarly, the IASB conducted a PIR with the findings suggesting that the business definition was too broad with more guidance necessary, particularly if processes acquired are not significant or the entity does not generate revenue (Munter, 2017).

As a result of these reviews, the new ASU 2017-01 standards were established, providing a new definition and these elaborate criteria. The question remains as to why that is important. First, the identification of the transaction as a business or asset acquisition directly influences accounting practices in the organization. Business combinations accounting utilizes the fair value model where the acquirer determines the fair value of acquired assets, liabilities, and other, with residual cost being recorded as goodwill. Meanwhile, for asset acquisition, a cost accumulation model of accounting is applied where consideration paid is allocated to assets and liabilities based on a fair value basis (Munter, 2017).

Other differences in accounting that differ between business combination and asset acquisition include acquisition costs, contingent consideration, IPRD, deferred taxes, the workforce in place, and even critical factors such as disposition of a business (share interest, or for assets, exchanges of nonmonetary assets, conveyance of rights). As such, the distinction was vital to be made clear and to establish uniform standards of accounting practice (Stone, 2017). It becomes evident that the governing accounting bodies sought for a greater number of transactions to be accounted for as acquisitions/depositions of assets in generally accepted accounting practice.

Findings

Regarding convergence with the IASB, the body released an update in 202 to its business definition, exactly matching the FASB definition. However, that does not readily translate to common practice in reality, as previous iterations have shown. Particularly, since the emphasis will be more on asset exchange rather than business combinations with this update, the existing differences between the IRFS and the U.S. GAAP will become clearer and more distinct. These include how IPRD is capitalized, measurement of deferred taxes, and difference in recognition of workforce in place as an intangible asset (Munter, 2017). Assuming that the two-practice standard system will continue, the current and emerging differences will be unique differences to FASB and IASB, respectively, leading accountants to navigate the issue carefully.

There are split opinions on the new standards since their adoption, ranging from criticism to welcoming the changes, but there seems to be general acceptance. Criticism stems from the fact that the definition may have potentially created more confusion. First, it creates additional tasks for businesses in carefully evaluating each transaction, with many sectors working with complex transactions expected to see changes, potentially unwelcome in the industry. Second, despite U.S. GAAP being brought up to speed, the SEC financial reporting have completely different standards and definition of a business, which once again highlights issues for certain industries having to work with both GAAP and SEC. A transaction that is an asset acquisition under ASC 805 will be a business purpose acquisition under SEC (EY Accounting Link, 2020).

As mentioned earlier, several key sectors will be impacted by the new changes. Oil and gas are one of these. Publications from the industry suggest that the new standards will make accounting surrounding acquisitions of upstream oil and gas properties much simpler, as now some can be accounted for as asset purchases. In practice, upstream companies have to determine the risk characteristics of each reserve category to arbitrate if a group of similar identifiable assets is purchased, making it, not a business transaction (Weggman, 2018).

In general acquisitions, various types of reserve categories are identified, with each connecting to risk regarding outputs, and each has to be individually evaluated for the screening process. Another factor to consider for oil and gas companies is “when acquiring tangible assets to determine whether they are inseparably attached to other tangible or intangible assets” (Weggman, 2018). For example, drilling equipment and tangible costs to create a productive well are inseparable from mineral rights or working interests without accruing significant costs.

Another industry affected by ASU 2017-01 is real estate. Real estate often faces such situations when it becomes unclear whether the acquisition is an asset or a business. Properties often come a workforce, leases, existing contracts, and ongoing construction, among others. The clarification of business combinations under topic 805 has significantly benefited the industry in clarifying the contracts and how to proceed with the accounting for purchases (Nussbaum, 2017).

For example, a company acquires a set of real estate properties in the form of 10 single-family homes with in-place leases, with each home including land, building, and property improvements, but each is different. The company predisposes that single-family homes are assets, each including aspects of land, physical space, intangible lease, and home renovations. Despite each home having a different construction, the nature of the assets, risks of managing, and generating outputs are comparable. Therefore, “all the fair value of the gross assets acquired is concentrated in a group of similar identifiable assets”, making this acquisition, not a business (Deloitte, 2020).

However, if in the same scenario, an office park was also acquired and leased to capacity with vendor contracts for maintenance, it becomes a different issue. Offices and single-family homes are not similar assets, the offices have in-place leases and have outputs, while the outsourcing agreements may be viewed as providing an organized workforce. Therefore, the combination of both single-family homes and office buildings will be viewed as a business (Deloitte, 2020).

The biggest impact of ASC 805 is that it offers more clarity and insight. Both company executives and investors, they are presented with an accurate calculation of the value of the assets acquired in a given party transaction. Alongside goodwill impairment testing, the new standards provide a clear view of the fair market value of business acquisitions which positively impacts decision-making. The penultimate effect of ASC 805 is that it is able to separate identifiable tangible assets alongside intangible assets, which can depreciate from goodwill, which is recognized as the synergistic value of a business combination. With everything clearly identified and booked on a balance sheet, investors can more confidently engage in acquisitions and determine investment value beyond the original transaction (Valentiam Group, 2021).

Conclusion

The 2017 ASU introduced by FASB saw the reveal of new accounting standards, the most impactful of which was ASC 805, aimed at clarifying the definition of business. This came after both calls from stakeholders and internal reviews from FASB that identified confusion and inconsistencies related to the definition of businesses. Previously, the definition was simple, including that to identify as a business, the entity only had to have inputs and a set of processes, without outputs even being active. As a result, many transactions that were basically asset purchases were counted as business combinations.

This had profound and potentially unhealthy impacts on accounting records in firms as the principles and practices differ widely between asset acquisition and business exchange. The new ASU standards created an elaborate structure of defining a business, including establishing the fair value of all assets or groups of assets, evaluating their similarity objectively, and then the consideration of the outputs and workforce. Although the change was small, simply clarifying the definition, it had a substantial impact on general accounting practices and has served its intention from the FASB for more transactions to be accounted for as asset acquisitions.

The change was generally welcome across industries, simplifying the process of acquisition in many cases. There are some concerns regarding potential conflicts in definition and practice with the SEC filings and the international IRFS definitions. The change to the definition of business was highly targeted and largely justified as there are multiple scenarios where a simple purchase of assets such as physical property, intellectual property, and brands resulted in complex business acquisition accounting under the old rules. This had a long-term influence on company statements and taxation.

Overall, the implications were positive and substantial from ASU 2017 but not disruptive. It is recommended that governing bodies for accounting practice and official filings communicate clearly on their priorities and standards and attempt to unify to the best of their ability without contradictions some of these definitions and rules to ensure a common standard for accounting practice worldwide.

Reference List

Davidson, J. (2021) What is the difference between an asset acquisition versus a business combination? Web.

Deloitte. (2021) A roadmap to accounting for business combinations. Web.

Ey Accounting Link. (2020). Technical line. Web.

Financial Accounting Standards Board. (2017) Accounting standards update No. 2017-01. Web.

Jeter, DC. and Chaney, PK. (2012) Advanced accounting (7th ed.). Hoboken, NJ: Wiley.

Lukac, J. (2018) Is it a business (ASC 805)? ASU 2017-01 provides clarity! Web.

Munter, P. (2017) ‘FASB revises the definition of a business, The Journal of Corporate Accounting and Finance, 28(4), pp.73–78. Web.

Stone, E. (2017) ‘Definition of a business, Strategic Finance, 98(9), pp.15.

Valentiam Group. (2018) ASC 805 Valuations: What You Need To Know. Web.

Wegmann, E. (2018) Practical guidance on ASU 2017-01 and its implications to upstream companies. Web.