Introduction

The efficiency of a company’s choice of strategies is apparent in its financial performance. Judging by a firm’s financial ratios, it is possible to identify the course set by its directors. In this case study, Microsoft’s financial analysis will be provided alongside a comparison with its direct competitor – Apple, Inc. Three ratios will be taken into consideration for both companies, including debt to asset, current, and cash ratios.

Microsoft’s financial analysis

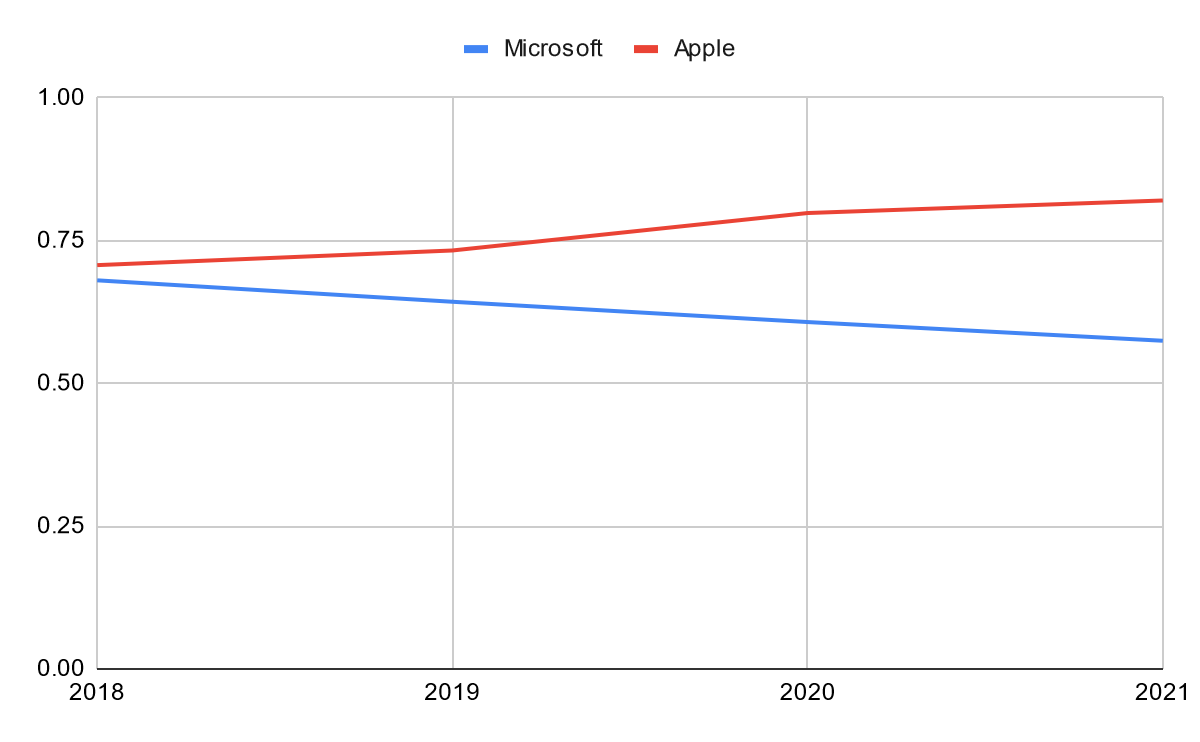

Over time, long-term decisions made by the company’s executives will either decrease or increase its stability. In the case of Microsoft, this leverage ratio indicates that the firm succeeds at expanding its total assets ahead of acquired debt. Its continuous technological breakthroughs are reflected in its total assets, and many acquisitions only accelerate the company’s growth (“Annual report 2019,” n.d.). Unlike Apple, Inc., Microsoft succeeds at gradually decreasing its financial risks, which is apparent in its debt to asset ratio (see Figure 1). It allows Microsoft to ensure that the company generates revenue for its investors with great success.

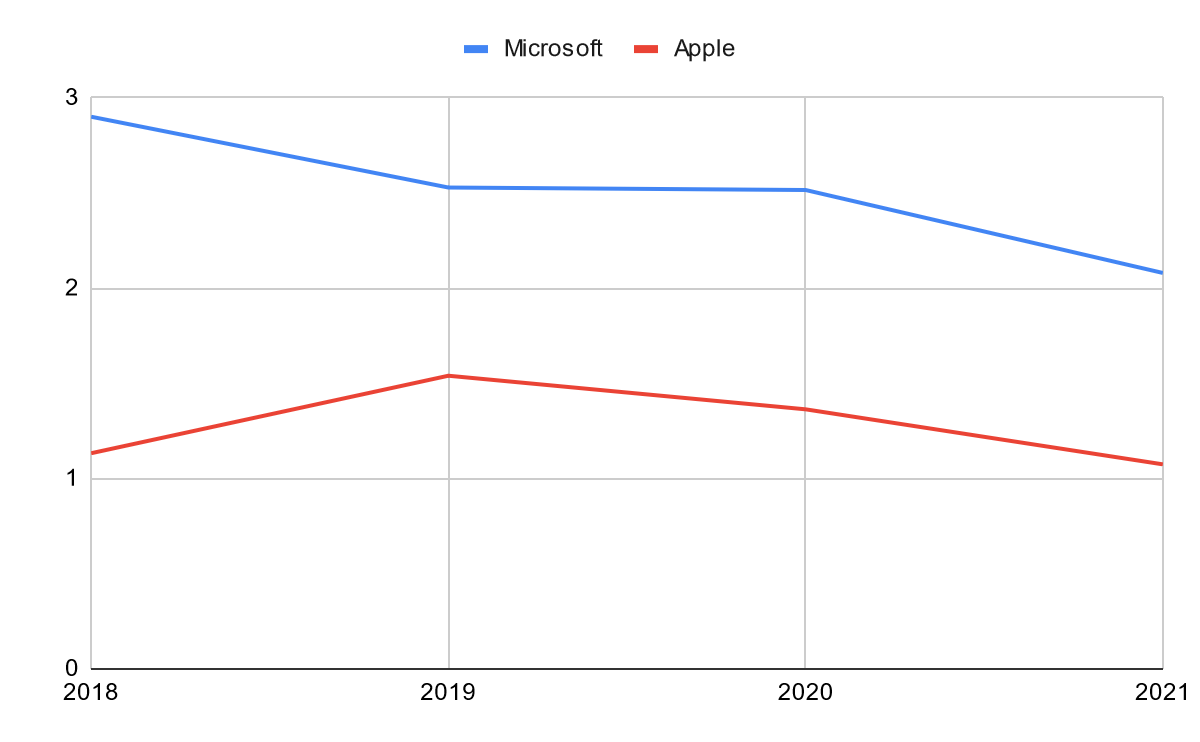

Short-term goals also play a crucial part in financial analysis. While Microsoft did acquire total assets that overshadow its total liabilities, it rapidly uses its earned cash to expand its operations (“Annual report 2021,” n.d.). Both companies are losing their liquidity, although Microsoft has made successful efforts to increase its total assets over the past four years (see Figure 2). At the same time, Apple, Inc. appears to be struggling to expand without accumulating significant debts.

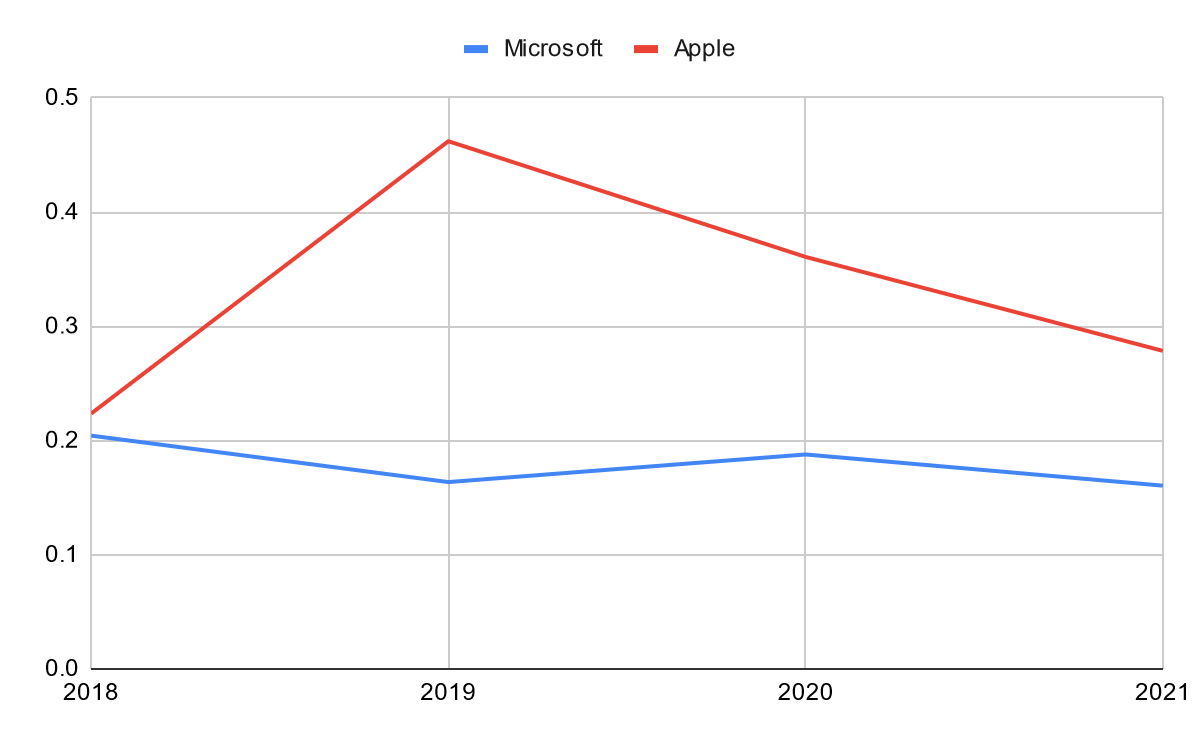

The last selected ratio to be analyzed is the cash ratio which also refers to a company’s liquidity. It takes into account only currency and easily convertible assets that a firm possesses to represent its ability to cover its debts rapidly. Both Microsoft and Apple, Inc. do not keep a significant amount of their respective assets in such form (see Figure 3). Moreover, the companies are apparently rapidly spending their cash assets to transfer their benefits to shareholders and further expand the firms’ operations.

Conclusion

In conclusion, judging from these ratios, Microsoft’s strategy grants it significant financial effectiveness, as the company rapidly puts its acquired assets back into work in an attempt to accumulate momentum. The share of debt-financed assets gradually decreases as the firm continues to make many successful acquisitions to the benefit of its stakeholders. Although Apple, Inc. also strives to achieve the same goal, its debt to assets ratio signifies that the firm underperforms in comparison with Microsoft.

References

Annual report 2019. (n.d.). Microsoft. Web.

Annual report 2021. (n.d.). Microsoft. Web.

Investor relations. (n.d.). Investor Relations – Apple. Web.