Executive Summary

BreadTalk, the bakery chain brand within the Singapore-based BreadTalk Group Limited company, is facing a risk of stagnation and subsequent decline. In this regard, potential expansion to a new international market may reverse the negative trend, giving a new impulse to the business. In particular, this report examined the risks and benefits of expansion into the South Korean food service market, following the results of the initial brand assessment.

The external macro analysis created a favorable image of South Korea. In particular, the demographic and macroeconomic data suggested that BreadTalk would reach a large market inhabited by consumers with high purchase power. However, the microanalysis revealed certain concerns, such as the high level of competition and the necessity for product adaptation in order to attract the targeted consumers. Overall, it is possible to recommend expansion in South Korea, provided BreadTalk adapts product aesthetics, prices, and promotion techniques to the demographic and psychographic portrait of adult middle-class Koreans.

Introduction

BreadTalk, the bakery chain brand within the BreadTalk Group, has become a prominent part of the food service industry in Asia. According to the 2018 BreadTalk report, the group’s premiere brand generated S$ 282 million, which accounted for 47% of the group’s total revenue (BreadTalk Group Limited, 2019). As such, BreadTalk can be considered a medium-sized business in terms of revenue, which opens an opportunity for international expansion (Indeed, 2021). This report examines BreadTalk’s potential entry into the South Korean food service market through the case interview framework. In particular, the case interview consists of three primary parts — a brief assessment of BreadTalk’s current condition, an external macro- and micro analysis of the South Korean market, and a market strategy definition. The final part of the report provides an informed evaluation of the expansion’s feasibility from the potential investor’s perspective.

Brief Assessment of the Current Situation

The BreadTalk brand has several distinctive strengths and weaknesses which can affect its future position in the food service industry. In terms of strengths, BreadTalk can be considered the group’s most profitable and recognized brand. In addition, BreadTalk has demonstrated an ability to adapt its business to various markets. For instance, Singaporean stores are more grab-and-go, whereas Chinese stores follow the classic café format (Bhasin, 2019). Furthermore, the brand has the necessary experience in establishing international partnership networks (Uewongtrakoon et al., n.d.). As such, the BreadTalk brand meets the requirements for an expansion into a new market.

However, BreadTalk is not free from weaknesses that can undermine its market position if no adjustments are implemented. In particular, the brand is overly reliant on Chinese customers, as almost half of its stores are located in Mainland China. In addition, the focus on Southeast Asia led to relatively low brand recognition in other territories (Bhasin, 2019). In this regard, the lack of international expansion puts BreadTalk at risk of potential stagnation and subsequent decline. Finally, Bhasin (2019) points to high production costs and product prices, which might threaten the brand’s profitability and popularity among price-sensitive customers. Given these circumstances, BreadTalk might benefit from additional internationalization since these measures could provide the business with a new impulse for development.

External Analysis of the South Korean Market

The process of expansion into the new international market requires a thorough external analysis. This section contains a detailed breakdown of macro and micro-environmental factors affecting the South Korean market and the food service industry in particular. Firstly, the macro analysis section offers comprehensive demographic, economic, social, and political information that determines South Korea’s investment attractiveness. Next, the micro-analysis evaluates the industry-specific factors, such as market size, growth, and active regulations. Lastly, both parts provide an insight into how BreadTalk could arrange its entrance into a new market.

Macro Analysis

The macro analysis of the South Korean market consists of four key variables. Firstly, the macroenvironment’s attractiveness depends on demographic and geographic characteristics. Secondly, expansion into South Korea might be affected by local political factors. Thirdly, various economic forces determine the feasibility and security of investments. Finally, the sociocultural forces also play a role in potential success or failure. The presented indicators and variables are summarized in the corresponding Appendices for the reader’s convenience.

Demographic and Geographic Data

- Total population: 51,815,810 (Macrotrends, 2022a);

- Population growth: -0,03% (Macrotrends, 2022b);

- Median age: 43.7 years (Worldometer, 2022);

- Surface area: 100,370 km2 (World Bank, 2018);

- Population density: 528/km2, 24th in the world (World Population Review, 2022);

- Urban population share (2020): 81,8%, or 41,934,110 people (Worldometer, 2022).

South Korea can be considered an example of a well-developed, highly urbanized, and densely-populated Asian country. The South Korean market is large in terms of population size, especially for a medium-sized business such as BreadTalk. The South Korean population is aging — the median age in the country has surpassed 43 years mark, which means that potential customers will likely have families. Overall, the demographic and geographic data indicate the presence of potential wealthy customers.

Political Data

- Political freedom ranking: 83/100 – Free (Freedom House, 2022);

- Political/legal barriers between countries: Free Trade Agreement (FTA) with Singapore (International Trade Administration, 2021);

- Bribery/corruption: Corruption Perceptions Index — 62/100, ranked 32/180 in the world (Transparency International, 2021a);

- Freedom of the press: World rank 42/180 (Santander, 2022).

South Korea has a democratic political regime that offers sufficient freedoms for citizens and foreigners alike. The bribery and corruption problem is significantly more severe than in Singapore, which ranked 4/180 in corruption perceptions (Transparency International, 2021b). However, one still cannot call South Korea a corrupt country. Finally, the FTA facilitates bilateral trade between South Korea and Singapore. Therefore, South Korea seems to be a safe and stable market for Singaporean investments.

Economic Data

- Economic freedom index: 74.6 — 19th in the world (Heritage Foundation, 2022);

- Investment freedom index: 60.0 — world average in 2022 is 57.0 (The Global Economy, 2022);

- GDP, in 2021 (billions USD): 1,823.85 (Santander, 2022);

- GDP per capita: 34,757.70 (World Bank, 2021);

- GDP growth, %: 4.0 (Coface, 2022);

- Mean wealth (USD per adult): 211,369 (Credit Suisse, 2021);

- Median wealth (USD per adult): 89,671 (Credit Suisse, 2021);

- Economic integration: 17 active FTAs (International Trade Administration, 2021).

The economic data shows South Korea is considered a developed market economy. The economic freedom is high, the investment freedom is worse but still acceptable, and the population wealth data is favorable. Singapore might have higher GDP per capita and mean wealth; however, one should consider the fact that South Korea is significantly more populated. As a result, the median wealth is higher in South Korea (Credit Suisse, 2021). Therefore, the macroeconomic variables instill optimism since the South Korean population would manage to afford BreadTalk products.

Socio-Cultural Features and Trends

- Power distance index: 60, slightly hierarchical (Hofstede Insights, n.d.);

- Individualism index: 18, high collectivism (Hofstede Insights, n.d.);

- Masculinity index: 39, feminine, “enjoyment above success” (Hofstede Insights, n.d.);

- Uncertainty avoidance index: 85, unorthodoxy is not tolerated (Hofstede Insights, n.d.);

- Long-term orientation index: 100, total pragmaticism (Hofstede Insights, n.d.);

- Language: Korean (Commisceo Global, n.d.);

- Religion: Religious freedom, Confucianism, Buddhism, and Christianity are the main formal religions (Commisceo Global, n.d.);

- High importance of the family (Commisceo Global, n.d.);

The South Korean market is generally quite similar to Singaporean due to the relative geographic and cultural proximity. Korean culture values order, hierarchy, and long-term stability; however, Koreans strive to enjoy life, and tasty food can be considered one of the most accessible little joys. In addition, Koreans respect the family as a social institution, which opens additional marketing opportunities for BreadTalk.

Micro Analysis

This section is dedicated to a detailed evaluation of the South Korean food service industry, BreadTalk’s area of business. The external microanalysis is aimed to provide a more precise evaluation of the South Korean market’s attractiveness. In addition, the micro-analysis results present the data helpful in determining the optimal market entry strategy among the ones available to BreadTalk.

Key Microeconomic Variables

- Foodservice sector size: $113,5 billion in 2017 (Food Export, n.d.);

- Forecasted compound annual growth rate (CAGR) in 2022-2027: 4,63% (Mordor Intelligence, 2022);

- Market potential: significant since Korea is a fast-paced market where foodservice industry constantly expands (Food Export, n.d.);

- Customer segment availability: decent, based on the demographic and macroeconomic data;

- Buying power of customers: high, based on mean and median wealth in South Korea;

- Level of competition: severe, stemming from the surge in demand for fast food (Mordor Intelligence, 2022);

- Ease of market access: relatively easy, facilitated by the Korean-Singapore FTA and free market economy in South Korea;

- Market similarity: certain similar trends, such as digitalization and demand for healthier products (Enterprise Singapore, n.d; Singapore Newspaper, n.d; Read, 2022a);

- Product/business model compatibility: certain product adaptation is required;

- Strategic importance of the market: significant since the perfect competition in the Singapore foodservice industry limits BreadTalk’s opportunity for growth.

Firstly, one can immediately see that the South Korean food service market is large and growing steadily, which presents an opportunity for a medium-sized business such as BreadTalk. The company’s high-quality bakery products would likely find a paying consumer group due to the high purchasing power in South Korea and its food service market size. In addition, the market entry would unlikely be associated with significant legal difficulties due to the FTA between South Korea and Singapore. However, the presence of such major players as Starbucks, Yum!, and McDonald’s would require finding a competitive advantage in order to win a niche for BreadTalk products. As a result, BreadTalk would need to adapt its products to the Korean setting. While certain similarities between the two food service markets exist, the highly competitive nature of the South Korean food service market warrants product adaptation so BreadTalk could capitalize on the opportunity for business growth.

Global Marketing Strategy

There are two parts to the global marketing plan for BreadTalk’s possible foray into the South Korean restaurant service industry. Firstly, an entry strategy is selected and justified on the basis of BreadTalk’s current condition and external analysis of the South Korean market. Secondly, the micro-segmentation section defines the target audience of BreadTalk’s products in South Korea. The consumer segmentation is based on demographic, macroeconomic, and socio-cultural information provided in the external analysis section.

Entry Strategy

Regarding the potential entry strategies, BreadTalk can select between two options. The “waterfall” strategy is used for gradual expansion, whereas the “sprinkler” strategy introduces products simultaneously in several different locations (Nijssen et al., 2019, p.3). Therefore, the waterfall strategy allows the company to understand the market and make gradual adjustments, while the sprinkler strategy helps to secure the market share rapidly. Given BreadTalk’s current condition and the state of the South Korean food service industry, expanding in a waterfall pattern is advisable. Firstly, the company’s medium size means that BreadTalk might have insufficient resources to cover the whole country at once. Secondly, opening stores in a few big cities, such as Seoul and Busan, would still introduce BreadTalk to millions of Koreans. As a result, BreadTalk would become able to gauge the marketing mix’s effectiveness while still enjoying significant market exposure.

In terms of market entry modes, BreadTalk should prioritize exporting and partnering. According to Uewongtrakoon et al. (n.d.), BreadTalk has previously succeeded in entering the global market through exporting. In addition, exporting offers a benefit of a relatively low-risk entry, which makes this mode favored by medium enterprises (Bridgehead, 2021). Partnering with one or several South Korean brands would facilitate the entry by making BreadTalk more familiar to local consumers.

Micro-Segmentation

BreadTalk positions itself as a bakery that offers customers good value for their money. Since the South Korean market has a customer base with substantial buying power, BreadTalk should maintain this positioning and target adult middle-class South Koreans who live in an urban setting and have a family. According to Read (2022a), South Koreans purchase products for status and quality reasons, making pricing less concerning. In addition, fine-quality bread and cakes would make a decent addition to a family table, an important factor given the significance of family in Korea. Lastly, South Koreans value enjoyment in life, which means that BreadTalk would need to make its products both tasty and visually attractive. These goals would require significant investment, so the company should target consumers who would be able to afford its products consistently.

Global Marketing Program

The global marketing program presents specific steps for adjusting BreadTalk products to the South Korean market. In particular, the program attempts to solve the standardization versus adaptation dilemma. While the Singapore market may be quite similar to South Korea in terms of consumer portrait, certain areas within the 4Ps (product, place, price, promotion) framework would require adaptation instead of standardization.

Standardization versus Adaptation

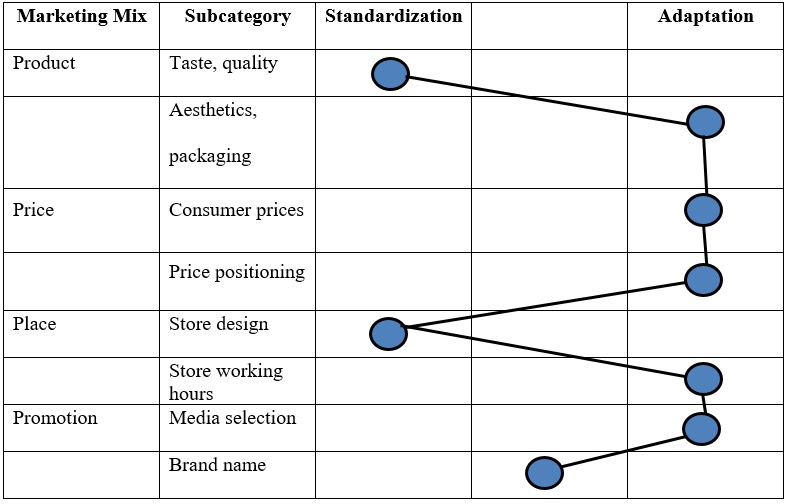

The visual representation of the pathway to BreadTalk’s products adjustment to the South Korean market can be found in a dot plot table. According to Sramkowski (2021), standardization means an undifferentiated use of marketing mix, whereas adaptation considers differences between such factors as customer base and competition. In the case of South Korea, it is possible to make the following proposals:

- Product: standardization for high quality, packaging adaptation for achieving better aesthetics;

- Price: adaptation of consumer prices in order to position BreadTalk as a premium bakery brand for the middle-class;

- Place: adaptation to long working hours, typical for South Koreans (Read, 2022b);

- Promotion: media selection should be adapted to South Korean conditions; the brand name should be adapted moderately since South Koreans expect to find the necessary information on the product in Korean language (Read, 2022b).

Conclusion

From the macroeconomic perspective, investment in the South Korean market can be considered a sound decision for BreadTalk. Most importantly, South Korea has a densely populated urbanized market inhabited by consumers with high purchasing power. Furthermore, the democratic political regime and relatively low corruption score of South Korea ensure that potential investments will be safe from external threats. In addition, the South Korean economy creates favorable conditions for middle-class adults with families, who would likely compose the backbone of Breadtalk products’ target audience.

The microeconomic analysis creates a less optimistic yet acceptable picture of the South Korean food service industry. On the one hand, this market sector is expected to demonstrate steady growth, which favors expansion. On the other hand, the competition level is high, which means that BreadTalk, a medium-sized company, would have to find a niche market in order to avoid uneven competition with major players. Therefore, expansion into South Korea would require a well-thought and cautious approach. The waterfall entry strategy through exports and partnerships with selected South Korean companies is recommended in such circumstances.

Finally, BreadTalk should consider target consumers’ demographic and psychographic portrait in order to ensure a smooth expansion. In particular, Koreans value family, work hard, use digital technologies competently, and strive to enjoy life in rare leisure hours. As such, BreadTalk would benefit from tailoring its products to the target consumer group — adult middle-class Koreans with families. Nevertheless, the growth perspective outweighs the potential expenses associated with marketing mix adaptation to a new environment.

Reference List

Bhasin, H. (2019). SWOT analysis of Breadtalk.

BreadTalk Group Limited. (2019). 2018 Annual Report.

Bridgehead. (2021). How to choose your international market-entry strategy.

Coface. (2022). South Korea: major macro economic indicators.

Commisceo Global. (n.d.). South Korea guide.

Credit Suisse. (2021). Global wealth report 2021.

Food Export. (n.d.). South Korea country profile.

Freedom House. (2022). Freedom in the world 2022: South Korea.

The Global Economy. (2022). South Korea: investment freedom.

Heritage Foundation. (2022). 2022 Index of economic freedom: South Korea.

Hofstede Insights. (n.d.). What about South Korea? Web.

Indeed. (2021). Business sizes: classifications and characteristics.

International Trade Administration. (2021). South Korea — country commercial guide.

Macrotrends. (2022a). South Korea population 1950-2022.

Macrotrends. (2022b). South Korea population growth rate 1950-2022.

Mordor Intelligence. (2022). South Korea foodservice market — growth, trends, COVID-19 impact, and forecasts (2022-2027).

Nijssen, E. J., Reinders, M. J., Krystallis, A. and Tacken, G. (2012) ‘Developing an internationalization strategy using diffusion modeling: the case of greater amberjack’, Fishes, 4(12), pp. 1–11. doi: 10.3390/fishes4010012

Read, K. (2022a). Entering the food and beverage market in Korea: part 3 — understand consumers.

Read, K. (2022b). Entering the food and beverage market in Korea: finding the right importer.

Santander. (2022). South Korea: economic and political outline.

Singapore Enterprise. (n.d.). Food services — industry profile. Web.

Singapore Newspaper. (n.d.). Singapore’s food industry and market trends in the F&B sector.

Sramkowski, L. (2021). Marketing mix: the standardization vs. adaptation dilemma.

Transparency International. (2021a). South Korea. Web.

Transparency International. (2021b). Singapore. Web.

Uewongtrakoon, P., Chotikarn, P., Jie, M. and Qianhua, K. (n.d.). Growth opportunities of BreadTalk in China.

Worldometer. (2022). South Korea Population (live).

World Bank. (2018). Surface area (sq. km)- Korea, Rep.

World Bank. (2021). GDP per capita (current US$)- Korea, Rep.

World Population Review. (2022). South Korea Population (live).

Appendicies