This report provides an analysis of financial statements of the company. All the tables with analyses are provided in Appendix A. All the ratios mentioned in this section are smmarized in Appendix B in order of appearance in the report.

Asset Management Analysis

Lululemon has demonstrated an 18.1% growth in 2021 in comparison with 2020. However, the increase in assets was mainly due to an increase in liabilities, which is a sign of increased risk. Total shareholder equity grew by 7.1% in 2021 in comparison with 2020. In 2021, fixed assets were $2,328 million, which was 47.1% of total assets and above the benchmark (Under Armour) of 33%. While fixed assets increased by 12.95% in 2021 in comparison with 2020, the percentage of total assets attributed to fixed assets decreased by 2 percentage points. A summary of changes in Lululemon’s assets are provided in Table 1.

Property, plant, and equipment (PPE) in 2021 was $928 million, which was 18.77% of total assets. The percentage attributed to PPE increased by 1 percentage point, while net PPE increased by 24.41%. The percentage attributed to PPE was also above the benchmark value of 12%.

Right-of-use (ROU) assets were $804 million, which was 16.26% of total assets. It was above the benchmark value of 9%. While net ROU increased by 9.35%, the percentage attributed to ROU assets decrease by 1.3 percentage points.

In 2021, net goodwill remained virtually unchanged at $387 million. However, its percentage of total assets decreased by 1.41 percentage points. The percentage of total assets attributed to goodwill (7.83%) was below the benchmark value of 10%.

The management of inventories is associated with significant concern, as net inventories grew by 49.33%, which made the percentage of total assets attributed to inventories become 19.55%, which is above the benchmark value of 16%. As a result, inventory days increased from 122 days to 133 days, which was above the benchmark value of 104.

The receivable days (collection period) remained around 5 days, which is above the benchmark value of 36 days. Thus, Lululemon performs well in terms of collection period, while the inventory management may be a sign of concern.

Equity and Liability Management

The company experienced a significant decline in equity, and a rise in total liabilities. The summary of changes is provided in Table 2 below.

Net total equity increased by 7.1% in 2021 in comparison with 2020. However, the percentage attributed to equity (equity ratio) decrease from 61.13% to 55.44%. Asa result, the debt to equity ratio increased from 0.64 to 0.8, which was below the benchmark of 1.38. However, it is not a sign of concern, as the benchmark value of Under Armour was 41.85%. The majority of change in shareholder equity is attributed to the change in retained earnings.

The company’s debt (total liabilities) increased from $1,627 million in 2020 to $2,740 million in 2021, which is a 35.4% growth. The debt to assets ratio increased from 38.87% in 2020 to 44.56% in 2021. However, it is not a significant concern, as the debt ratio is below the benchmark of Under Armour, which was 58.15% in 2021. The majority of liabilities are attributed to the current portion of debt, which may cause problem with liquidity. However, it should be mentioned that the company’s days payable in 2021 (40 days) were below the benchmark of 77 days, which implies that the company ahs decreased capability of using the credited fuds for short-term investments. However, this allows increased trust from the creditors.

Liquidity Analysis

Liquidity analysis demonstrates that the company underperforms in terms of the ability to cover the current portion of debt without using the external capital. In 2021, the company’s current ratio decreased from 2.41 to 1.86. While the current ration above 1 demonstrates that the company has enough funds to cover the current portion of debt, the majority of current assets are attributed to inventories, which may be difficult to turn into cash. The company’s quick ratio decreased from 0.91 in 2020 to 0.75 in 2021, which was below the benchmark value of 0.87. Since the quick ratio is below 1 and the benchmark, the company’s liquidity is questionable.

Profitability Analysis

Lululemon Athletica demonstrated outstanding performance in terms of profitability in 2021. The company’s net gross profit increased by 46.45%, the operating profit increased by 62.61%, and the net profit increased by 65.61% in 2021 in comparison with 2020. Moreover, the company’s gross profit margin was 55.98%, which is above the benchmark of 50.35%. The company’s operating profit margin was 21.31%, which was above the benchmark value of 8.56%. The company’s net profit margin was 15.59%, which was above the benchmark value of 6.3%. The company’s success in profitability is attributed to excellent management of operating and administrative expenses.

Efficiency Analysis

The company demonstrated exquisite performance in terms of efficiency of assets use. The company’s ROA increased from 14% in 2020 to almost 20% in 2021. The performance was above the benchmark of 6.03% in 2021. The company’s ROE also increased from 23% in 2020 to 35.6% in 2021, which was above the benchmark of 17.23%. Thus, it may be concluded that Lululemon Athletica uses its assets efficiently to generate income.

Investment Performance

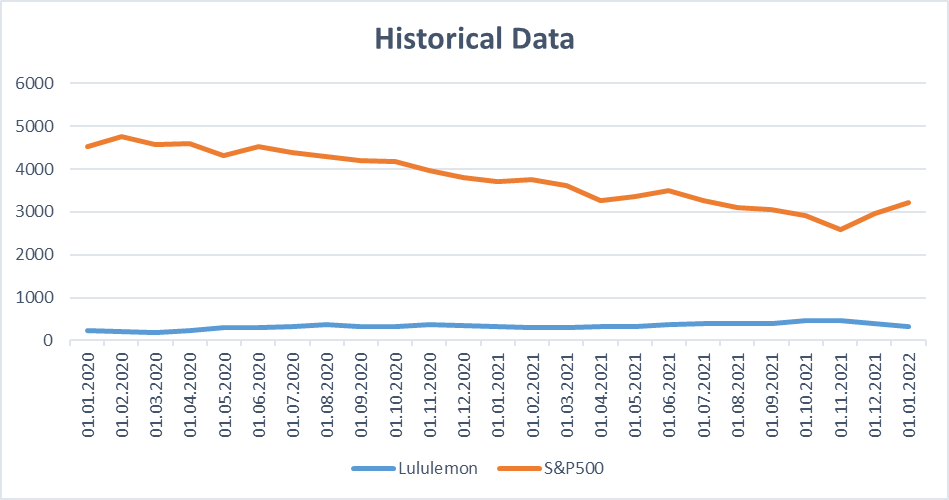

The company’s stock prices demonstrated a significant rise between 2020 and 2021, which may be attractive for the investors. The share prices increased from $239 per share in January 2021 to $334 in January 2022. Figure 1 below visualizes the changes in stock prices between 2020 and 2021 in comparison with the changes in the S&P500 index. While the S&P500 index demonstrates a steady decline, Lululemon’s performance demonstrated an opposite trend.

However, the company appears less attractive in terms of investment in comparison with the selected benchmark company, Under Armour. The attractiveness of investment is usually assessed using the earnings-per-share (EPS) and P/E ratio. The changes in the ratios are provided in Table 4 below.

The analysis demonstrates that the company’s EPS ratio increased from $4.52 in 2020 to $7.52 in 2021, which is a 66.28% increase. This ratio demonstrates that the attractiveness of the Lululemon for investors increased, as the company provided more value for each share.

The P/E ratio decreased from 72.72 in 2020 to 44.71 in 2021. A decrease is a positive sign, as the stock became less overvalued in 2021 in comparison with 2020. However, the P/E ratio of Under Armour was closer to 1, which implies that the share price is less likely to decrease. Thus, Lululemon is a less attractive stock when compared to the benchmarking company.

Dividends-per-share (DPS) is another common strategy for assessing the attractiveness of a stock. However, neither Lululemon nor Under Armour paid any dividends. Thus, this measure was not used.

Recommendations

- Improve Inventory Management. The company’s inventories have grown disproportionately. Therefore, it is crucial to decrease inventories to match the needs of the company. This arrangement will improve the company’s liquidity, which will decrease associated risks and attract more investors.

- Decrease Short-Term Debt. The liquidity ratio can be improved by decreasing current liabilities. However, this option is less desirable, as the company’s short-term debt is below the benchmark value.

- Decrease the Number of Shares. The company may choose to repurchase shares, which will increase EPS and improve the P/E ratio. Such an effort will increase the attractiveness of the stock.

- Increase Profitability. Another way to increase EPS is to improve the company’s net profit margin. However, this option is less likely to be achieved, as current profitability of the company is already very high.