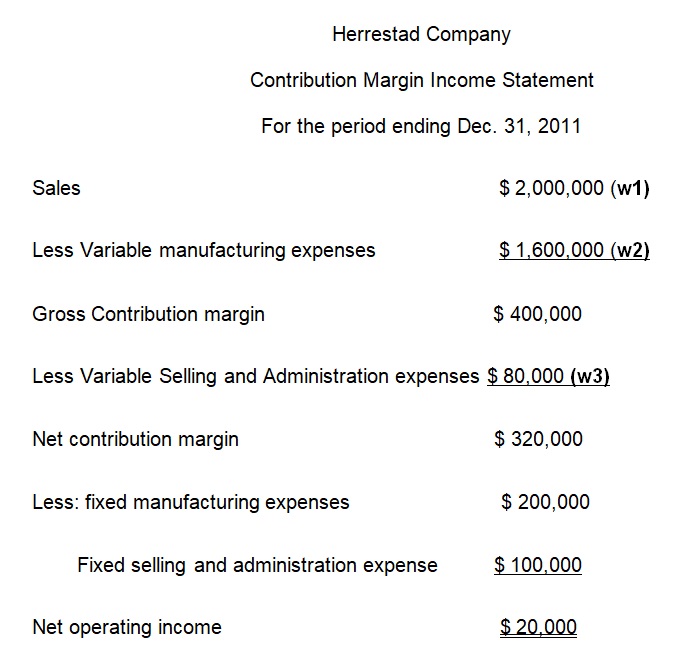

A contribution margin income statement is prepared with an aim of showing the amount of the margin of contribution in an income statement of an organization or a business. It is prepared for use by the internal management. All variable expenses (selling, administration and manufacturing) are deducted from sales to obtain the contribution margin. Thereafter, all fixed costs are deducted from the contribution margin to obtain the operating income.

Contribution Margin Income Statement

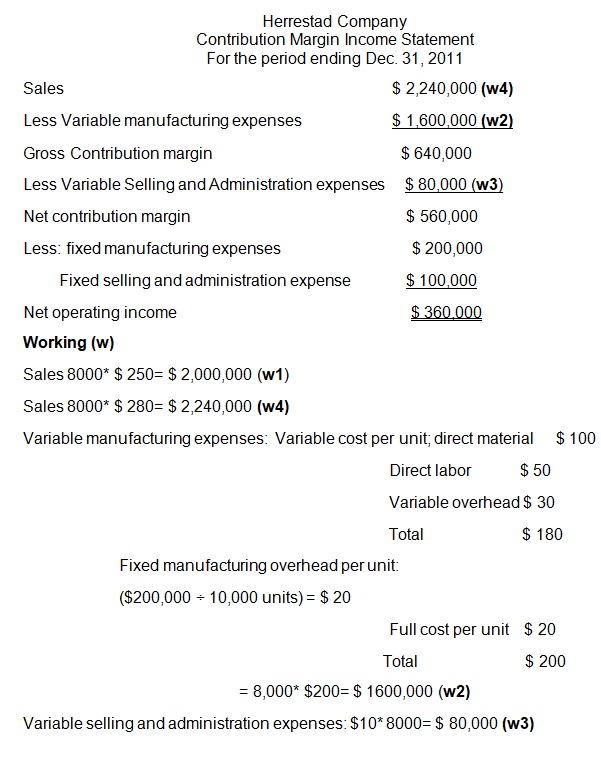

Assuming the selling price per unit increases to $ 280

In reference to the above contribution margin income statement, it can be concluded that when the unit selling price goes up, the net contribution margin and operating income increase. This means that the lower the price, the lower the contribution margin and operating income and a higher unit price means a higher contribution margin and operating profit.

Break-Even Analysis

The breakeven point is a point where a company/ business is neither making a profit nor a loss and this is done by comparing total variable and fixed costs with the total sales revenue of a company/ business. Fixed costs are costs that are never affected by the level of activity of the firm while variable costs are those costs that change with the level of activity of a corporation. The breakeven point is calculated using the following formula (selling price – variable costs).

Number of units sold to break even the year.

Breakeven point= fixed cost/ (selling price-variable cost) = $300,000/ $250-$190 = $300,000/$60 = 5000 Units

Breakeven point when direct material is $120.

Breakeven point= fixed cost/ (selling price-variable cost) = $300,000/ $250-$210 = $300,000/$40 = 7500 Units

In conclusion, when the direct material cost is increased, the breakeven point rises to a higher unit and if the direct material cost is lowered, then the breakeven point drops to a lower unit.