Introduction

Formed in the 1870s, Vaillant Group, Germany-based heating and water-cooling company, has grown to be one of the leaders in the field across Europe. Valliant’s group purchasing manager Frank Söhnchen has a tough decision on the recently acquired firm, DemirDöküm. In particular, it is necessary to choose the most suitable supplier for three-way valves. The current partnership of DemirDöküm and Membasan is established on respect and trust, however, the products of the latter company have a history of being lacking in quality.

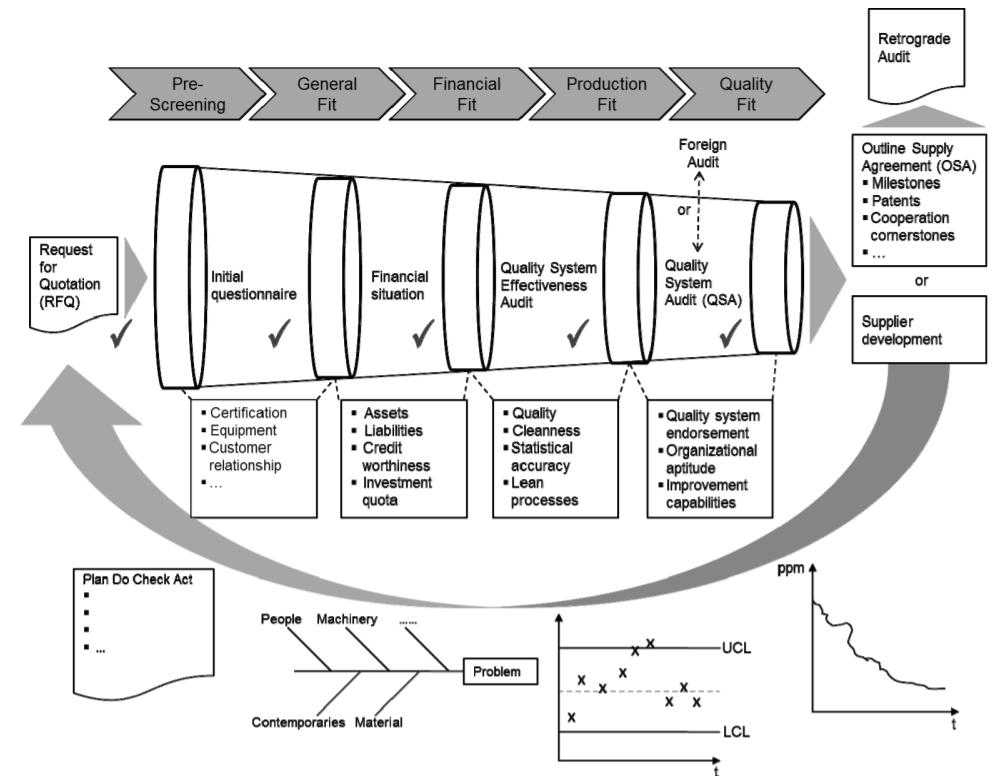

The quality of the three-way valves purchased directly impacts the Vaillant Group customers’ experience because they ensure the right temp at the right time. For this reason, the Group sets the highest maximum sourcing standards and gives utmost attention to its purchasing strategy. As displayed below, the organization employs a multi-stage process towards selecting its partners, ensuring the quality of components and stable partnerships.

Before making any purchases, Vaillant Group considers three key principles: quality, costs, and logical needs. In purchasing three-way valves, the Group has found a suitable supplier in Caroni Spa, an Italian supplier, and the two have been businesses since 2001. On the other hand, the subsidiary DemirDöküm is supplied brass three-way valves by Membasan. However, Membasan valves have had quality issues, although the supplier has promised improvements in the future.

Discussion and Conclusions

DemirDöküm uses slightly different brass three-way valves to those produced by Vaillant Group supplier Caroni Spa. The group purchasing manager Frank Söhnchen estimates an extra incremental cost of 2% on total production costs (Sposato et al., 2021). Poor quality standards cannot be ignored despite the potential for extra costs. It is necessary for the organization to decide on either changing the primary supplier, or optimizing the partnership with DemirDöküm. In terms of expenditure, the change would require Vaillant to spend at least 70.000 euros on helping Caroni Spa to acquire the necessary tools. Facing increased competitive pressure, the opportunity to reduce costs by working with an established partner is especially appealing to Vaillant. In addition, the transportation process and operation differ comparing the two suppliers. DemirDöküm, being based in Turkey, offers cheaper delivery opportunities compared to its Italian alternative.

Six Sigma DMAIC Application

To identify existing problems, examine solutions and determine the most appropriate course of action, the use of the Six Sigma method is necessary. The underlying DMAIC framework helps to understand businesses through the lens of comprehensive change.

- D – One of the companies purchased by Vaillant has significant quality issues with purchased three-way valves. Alternatively, quality control measures also require both managerial and financial interventions.

- M – Changing to another firm requires investment of at least 70.000 euros and incurs additional shipping costs. A major portion of three-way valves continues to be rejected. Continued issues of quality can lead to customer dissatisfaction and a decrease in customer loyalty.

- A – Previous attempts of alleviating the issue failed. Both Six Sigma and other approaches have not been appropriately monitored in order to ensure continued change or improvement.

- I – Ensure proper Six Sigma improvement at Membasan, emphasize continued standards of product excellence and quality.

- C – Vaillant Group has the ability to exercise overarching control over suppliers of its smaller companies, as well as the ability to implement structural solutions.

Recommendations

The best decision for the Vaillant Group is to integrate DemirDöküm purchasing. Both integration and failure have their unique advantages (Sposato et al., 2021). In this scenario, the best strategy is integration due to the existence of an already well-established partnership, coupled with cost-related concerns. Despite the existing flaws in the Membasan-manufactured parts, it is estimated that there are specific pathways towards achieving better product quality. The local purchasing director Zeki Kalaycilar suggests that monitoring its Turkish supplier will make them comply with the set standard. The acquiring company management is to be held accountable for the performance of the acquired business (Forman & Frankel, 2017). The Vaillant Group must accept the costs of strategic improvement of their partnership with DemirDöküm, as the costs of using faulty parts will be significantly higher than remedying the problem. To produce high-quality HVAC goods, encourage trust and loyalty from customers, and seek innovation, the organization should put its resources into improving every part of the production process according to their needs.

In order to stay competitive in an international market, it is necessary for the Vaillant Group to smartly utilize its resources.

The HVAC market is expected to see significant growth in the present decade, making it necessary for organizations such as Vaillant to maintain standards of production and service. By ensuring that the quality of goods supplied by Membasan is able to reach consistently high standards, the organization as a whole will be able to profit from their inclusion. Vaillant will be able to save a significant sum of money on both delivery and production. In addition, the existing familiarity and business relationships can open new ways of interaction and creation of better goods for the customers.

References

An introduction to Vaillant. Who we are | Vaillant UK. (n.d.). Web.

Forman, L. H., & Frankel, M. E. S. (2017). Mergers and acquisitions basics: The key steps of acquisitions, divestitures, and investments (Wiley Finance) (2nd ed.). Wiley.

Sposato, V., Berger, S., Hodgson, A., & Bahadur, N. (2021.). Read @kearney: To integrate or not to integrate? Kearney. Web.

Statista Research Department. (2022). HVAC market size globally 2030. Web.