Introduction

For many European countries, oil importation and refinement serve as one of the key components of the economy (Figure 1). The industry of oil procurement requires significant investments and is associated with several financial risks (Guliyev, 2017). Among the most widespread challenges, one can note the role of inflation, import prices, taxation issues, and so on. The actions of major oil market players can also impact oil prices by causing short-term price movements, which cannot be considered as actually reflecting the supply and demand situation. In the short term, oil price shocks can lead to impeded economic growth, oil import and refinement, and increased foreign direct investment inflows. In the long term, changes in oil prices increase economic growth and inflation. Therefore, it is important to explore what exactly impacts the processes related to oil refining and import from the financial perspective.

Purpose

The purpose of this report is to analyze the scholarly literature on the existing financial challenges that are encountered by European oil importing countries. Since the majority of European states are dependent on oil import, it is critical to pay attention to such aspects as the changes in oil prices and related impacts.

Scope

This report will be of interest to persons who are involved in exploring economics in the sphere of oil importation and refinement. Namely, both researchers and students who learn related disciplines are expected to benefit from this report. The findings of the paper are anticipated to set directions for further analysis and a better understanding of the financial challenges, as well as identifying potential solutions.

Statement of the problem

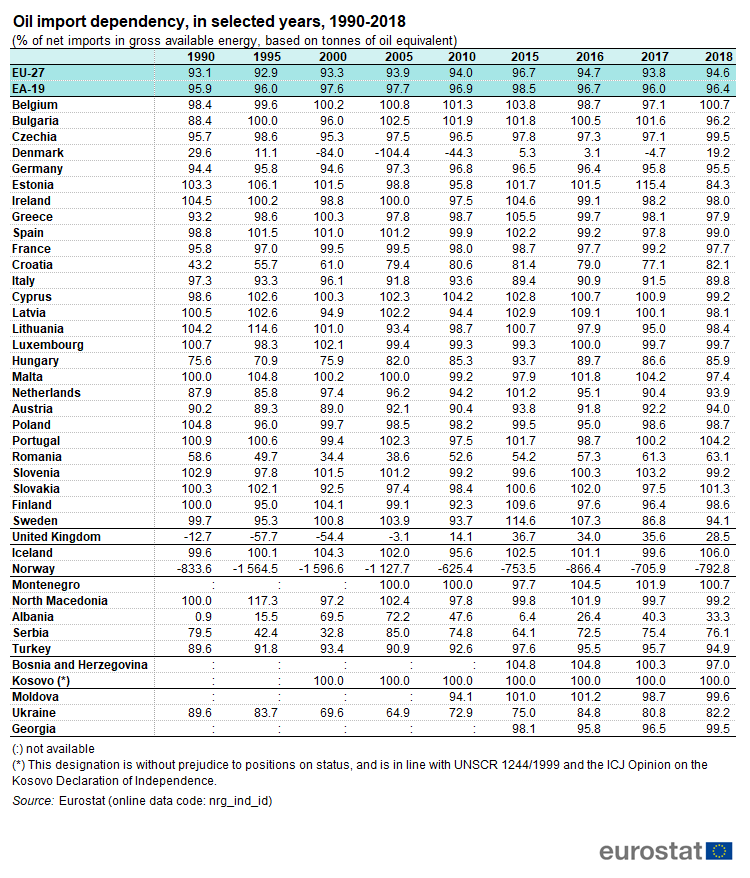

The European countries heavily rely on oil imports, which create oil import dependency. Namely, the European Union depended on oil product imports for 94.6 percent in 2018 (Oil and petroleum products – A statistical overview, 2020). Figure 2 presents the detailed dependency by countries. Such reliance means that the income of these countries is impacted by the financial challenges they face in the process of oil refinement and importation. Among the key financial issues, there are oil price volatility, inflation, and energy security concerns.

Financial Challenges in Oil Import and Refinement European Countries Face

Oil price volatility is one of the key financial challenges that are encountered by those European countries that are engaged in oil importation and refinement. In addition to seasonal oil demand changes, the existence of different actors in the oil market makes it sensitive to various events. For example, information about production-consumption chains, political advancements, and financial crises can be noted among volatility factors (Smyth & Narayan, 2018).

Inflation is another financial challenge that is related to the impact of oil price shockwaves on inflation in developing and developed economies. According to Živkov et al. (2019), inflation increases by 1-6 percent after the rise in oil prices by 100 percent. This spillover effect is regarded as more intensive compared to the direct impact of price volatility. The observation of the Eastern and Central European countries allowed the mentioned authors to found that Bulgaria and Slovakia are most prone to the highest pass-through effect.

Energy security concerns compose one more financial issue that is associated with political, economic, and safety spheres. As stated by Mukhammadsidiqov and Turaev (2020), it is important to consider energy safety in the context of overall security, which identifies the extent of quality and quantity of supplied energy. For example, the reserves of oil are the main component of energy security as it determines oil competition not only at the regional but also at the global level. The uncertainty regarding oil security of some countries and the growing development of import create the trend for rising oil prices and strengthening competition. Accordingly, higher prices on oil import serve as a sign of the upcoming crisis in the worldwide oil market.

Impact of Oil Importation

The importance of the oil factor for the domestic economy of European countries cannot be overestimated. Oil from geopolitically unstable countries and regions, including Russia, Iraq, and Libya, accounts for about 80 percent of European imports, according to a Cambridge Econometrics report. More than 40 percent of imports go to the countries of the Middle East, Azerbaijan, Africa, and Kazakhstan (Oil and petroleum products – A statistical overview, 2020). Crude oil import and refinement determines the dependency of European economies from the above countries.

Meeting energy needs of european countries

Processes and Costs of Oil Importation and Refining in European Countries

Oil importation involves transferring raw materials to the country of refinery. The main routes for delivering raw materials to refineries are trunk oil pipelines, an option for delivering crude oil is by rail using tank cars, and oil tankers for coastal refineries is another alternative. These operations require highly qualified personnel and investments to ensure high quality of oil production. European refineries, namely, advanced installations allow producing tens of thousands of tons of fuel per day, which is the only way to ensure the constantly growing demand. Oil is delivered to the oil terminal at the plant’s oil tanks, which is connected by oil pipelines with all the plant’s technological units (Klepikov, 2018). In addition to the refinery processes, the system of taxation is another factor that affects oil prices.

The oil refining process can be divided into three main technological processes. Primary processing is the separation of crude oil into fractions of different boiling ranges. Secondary processing refers to processing of primary processing fractions by chemical transformation of the hydrocarbons contained in them and the production of commercial oil product components. Commercial production implies the mixing of components with the use of various additives, with the receipt of commercial products with specified quality indicators (Klepikov, 2018). The key financial challenges in this case are the relatively high cost of the obtained fuels, the maximum impact of oil refining processes on the environment, a lack of ensuring industrial energy safety, and poor level of quality of oil products.

Competition with Other Oil Refining Countries in Other Continents

Competition among oil refining countries in the global market is growing, which is seen from the actions of the major market players. For example, Saudi Arabia is in fierce competition with its OPEC counterparts for a share of the world oil market, while the struggle is not in its favor in the largest markets (Guliyev, 2017). One of the strategies is Saudi Aramco’s heavy investment in refining to meet the demand for its oil. If in the United States the main competitors of the Saudis are local oil companies, which are actively increasing the production of shale hydrocarbons, the country has to compete with Kuwait, the UAE, and Russia in the Asian region.

Russia is another active player that focuses on the Asian market as well. For example, Rosneft bought a part of the Essar Oil refinery complex, which is the second largest privately-owned refinery in India. This acquisition allowed Rosneft to enter the promising Indian market and bring the activities of the trading division to the leading positions in the Asia-Pacific region. Among the markets for the products, there are Indonesia, the Philippines, Vietnam, and Australia (Guliyev, 2017). Competition is expected to become stronger as it depends on political decisions, trade wars, sanctions, and COVID-19 pandemic, as it follows from the forecasts for 2021-2025.

Structuring Finances to Meet Oil Importation and Refining

Changes in oil prices on the market have a quite indirect effect on the price of oil products. The share of raw materials in the cost structure of fuel is less than 10 percent. The largest part of costs, namely, about 70 percent, is state excise taxes, value added tax, as well as the costs of mineral extraction tax (Smyth & Narayan, 2018). In addition, an important component of the final cost is the cost of logistics, processing, and storage of raw materials. Therefore, it is necessary to structure finances with the aim of meeting oil import and refining needs.

Possible solutions

A Way Forward for the European Countries Importing and Refining Oil

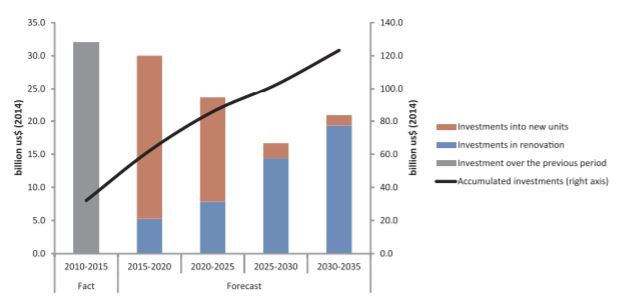

A set of strategies for better finance management in oil importation and refinement is critical for European countries that face different financial challenges that are discussed in the above sections of the paper. Kapustin and Grushevenko (2018) offer a Russian Energy Strategy project up to 2035, which implies $90 billion dollar to advance the industry and meet the needs of oil refineries (Figure 3). It is also suggested that additional target indicators should be involved in planning to make sure that the goals set by Russia would be met by 2035.

Efficient Oil Importation and Refinement Procurement in Europe

The governments can continue the actual state regulation of oil prices on a contractual basis with oil companies. In other words, it is suggested to keep prices under control, which would be another round of strengthening financial support for oil refineries from the authorities. Moreover, the final cost of importation and refinement should not heavily depend on changes in prices for raw materials, but on the level of tax burden on businesses and additional costs of production (Kapustin & Grushevenko, 2018). The cooperation between oil refineries and governments should become a priority as it determines the outcomes of oil import and procurement costs.

Strategies to Better Control Inflation as a Result of Oil Price Changes

Since oil is the main input in the economies of European oil importing countries, its inflation-related price changes are critical. Živkov et al. (2019) offer using a wavelet approach to control the level of inflation, which focuses on managing oil shocks in short-term and long-term periods. Namely, it should also be stressed that the authors found the correlation between the impacts of oil prices on inflation in short-time perspective. In addition, the Central and Eastern European countries are likely to be more committed to managing oil shocks in the case when the pressure of inflation is strong.

Conclusion

In conclusion, the key issue requiring a set of solutions for the European refineries is the creation of a developmental strategy in the face of ever-increasing competition in the market. To address such challenges as inflation, oil price volatility, and energy security concerns, it is proposed to improve the cooperation between governments and oil refineries and focus on the wavelet strategy to approach oil shocks. The necessity to better control inflation and develop long-term projects is prioritized.

Recommendations

In the context of the discussed financial challenges, structured trade finance can be recommended as a strategy that ensures risk mitigation and liquidity management for oil importing countries in Europe. Among the options, there is borrowing from the regional banking sectors and reducing the impact of government monopolies can be noted. As for oil importation and refinement, European countries should elaborate specific policies that are aimed to sustain oil prices, which should flexible to address the emerging threats.

References

Guliyev, I. A. (2017). Global refining industry in retrospect, and evaluation of Russia-European Union petroleum products’ trade perspectives., 1-9. Web.

Kapustin, N. O., & Grushevenko, D. A. (2018). Exploring the implications of Russian Energy Strategy project for oil refining sector. Energy Policy, 117, 198-207. Web.

Klepikov, V. P. (2018). Crude oil logistics, production and refining in Northern Europe, 1-12. Web.

Mukhammadsidiqov, M., & Turaev, A. (2020). The influence of the energy factor on modern international relations. The American Journal of Political Science Law and Criminology, 2(12), 5-15. Web.

Oil and petroleum products – A statistical overview. (2020). Web.

Smyth, R., & Narayan, P. K. (2018). What do we know about oil prices and stock returns? International Review of Financial Analysis, 57, 148-156. Web.

Živkov, D., Đurašković, J., & Manić, S. (2019). How do oil price changes affect inflation in Central and Eastern European countries? A wavelet-based Markov switching approach. Baltic Journal of Economics, 19(1), 84-104. Web.