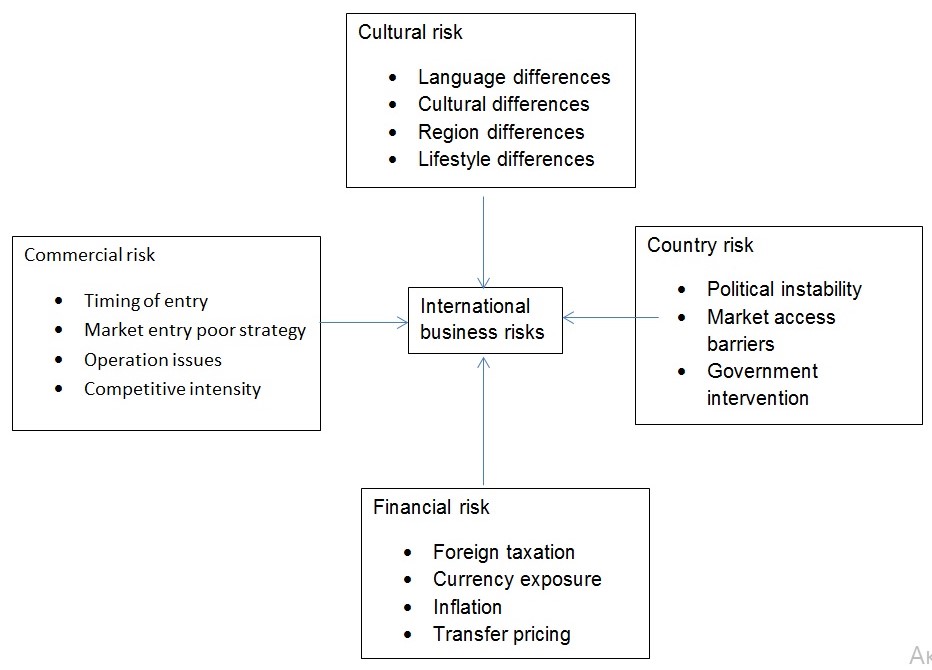

Cross cultural risk refers to the notable differences in lifestyle, language, customs, mindsets, and religions in target countries. Under this risk, the firms face challenges in understanding the important needs of the people which is important in making strategic decisions. In order to mitigate the risk, the firms should consider including host people in the workforce to ensure the necessary interaction.

Country risk refers to the probable adverse effects on firm activities as a result of developments in economic, legal and political environments abroad. Due to this risk, companies face challenges in marketing activities due to government intervention, inflation and poor infrastructure among many other economic conditions. Firms can overcome such risks through extensive research on relevant factors and avoid targeting vulnerable countries.

Financial risk is involved with adverse fluxes in currency exchange rates. In this regard, firms are faced with challenges in pricing strategy, sales and taxation. These challenges vary from country to country hence the firm can consider to target those with favorable conditions. The firm could also consider outsourcing activities in other countries that have low risk levels.

Commercial risk is the failure or potential loss that stem from business policies, procedures or tactics that are developed or implemented poorly. For instance, managers may make poor decisions in market entry, product development and pricing. In order to overcome such risks, managers must account for international competitors and competitive strength in the market when making decisions.

Fedorova and Vaihekoski (2009) state that market segmentation and exchange rate fluctuations are the main causes of risk in emerging economies (p.6). Indeed, market segmentation is usually larger in emerging markets when compared to developed markets. This suggests that local sources of risks in these markets are more crucial than international sources. Similarly, emerging markets are associated with developing countries and hence the risks associated differ from those in developing. Unlike developed markets, emerging markets have additional risks including exchange rate fluctuations, accelerated inflation, macroeconomic and political distress, and adverse repatriation regulations and fiscal measures. Moreover, these markets are politically riskier than developed markets.

References

Cavusgil, S. T., Knight, G., & Riesenberger, J. 2008. International business. Upper Saddle River, NJ: Prentice Hall.

Cavusgil, S. T., Knight, G., Riesenberger, J. & Yaprak, A. 2009. Conducting market research for international business. Upper Saddle River, NJ: Prentice Hall.

Dunning, J. H. & Lundan, S. M. 2008. Multinational enterprises and the global economy. London, UK: Edward Elgar Publishing.

Fedorova, E. & Vaihekoski, M. 2009. Global and local Sources of risk in eastern European emerging stock markets. Journal of Economics and Finance, Vol.59 (1), pp.1-19.