Company

Choosing a Publicly Traded Company

The selected publicly traded company is Amazon. Inc. Amazon is a multinational technology company based in the USA focusing mainly on e-comers, digital streamlining, cloud computing, and artificial intelligence. The company operates in the retail and Internet trading industry, which is highly competitive. Since Amazon is a multinational company, effective analysis of its financial statements and operations will help investors make investment decisions. Therefore, in this paper, the financial statements of Amazon Inc. will be analyzed using the financial ratios and critical analysis of the investment decisions.

Role Play as an Investor of the Company

Investors comprise the general public market participants who participate in the stock market. As an investor for Amazon. Inc., the primary role is to buy and sell shares using the public stock markets such as NYSE. The specified amount of money will be invested in

Management and Activities

Name of the Chief Executive Officer

The chief executive officer for Amazon is Andrew R. Jassy, who is an American businessman.

Location of the Home Office

The company was founded in 1994 by Jeff Bezos and set its headquarters in Washington, US, as the home location (Hatem & Alshmrani, 2021). However, Amazon Inc. has spread its stores in different nations to increase its sales.

Ending Date of the Financial Year

The ending date for the financial year of Amazon Inc. is 31st December, and at this period, all departments are expected to close their accounts.

Company Products

The products and services offered by Amazon Inc. comprise books, DVDs, videotapes, music tapes, musical instruments, sporting goods, and others (Hatem & Alshmrani, 2021). It offers delivery services, cloud computing, Amazon games, and book publishing as a retail company.

Main Geographical Area of activity

The main geographical area of productivity is in the USA. The company also focus on providing its products and services to the global infrastructure regions & AZs. This comprises South Africa, the Middle East, America, China, and Asia.

Industry

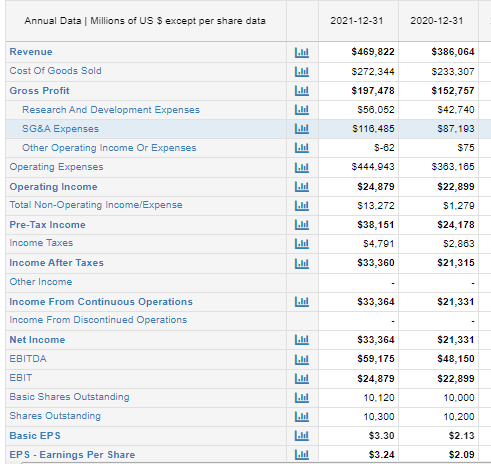

Amazon operates in the Retail and internet (E-Commerce) industry which deals with the supply of products and offers services virtually. The competitive profile comprises eBay, Walmart, Home Depot, and Etsy. Since the industry is much more competitive, Amazon needs to formulate strategies to help the company grow and prosper (Hatem & Alshmrani, 2021). Therefore, the company’s future plans aligned with strategies and goals comprise investing $1 billion in the deployment of technologies and logistics, safety, and supply chain management. Several strategies have been put in place to enhance the company’s future prosperity. The first strategy put in place is the product development strategy which is aimed at providing differentiated products in the market hence gaining a competitive advantage. The company has also ventured into investment platforms that encourage growth and expansion. The financial statements have been presented in Appendix 1, showing a net profit of $33,364 and EPS of$3.24 in 2021, and in 2020 net profit of $21315 and eps of $2.13. The recent price for amazon company limited is $127.51 as of 27th august 2022. The dividend per share as of 26th august is 0.0%, and the company does to issue dividends to its investors but promises them good future returns. Investors can use stock prices to predict future and viable investments.

Financial Ratios

Financial Management

Comparison of the Ratios Based on the Two Financial Years

Financial ratios of an organization help when comparing the performance between fiscal years. In this case, the computed financial ratios will be used in the evaluation of the stability of Amazon in the year 2020 when compared to 2021. Therefore, the four financial ratios used in this report to compare the company’s operations in the two years comprise the current, quick, profit margin, and return on invested capital ratio.

The current ratio measures the firm’s ability to pay its short-term obligations or creditors who are less than one year. Investors and financial analysts use the current ratio to determine how current assets on the balance sheet can settle the payables. The current ratio for Amazon Inc. is 1.05 in 2020 and 1.13 in 2021, as presented in table 1. The current ratio should be more than 1.0 to show that the assets are more than the current liabilities. When the current asset exceeds the current liabilities, the company will be in a position to settle the short-term liabilities. Therefore, the current ratio of less than 1 shows that the company is likely to face liquidity problems in the future. The current ratio for Amazon in 2020 was 1.05, which was lower as compared to 2021. This is a clear indicator that the company is minimizing risks related to liquidity problems. However, the company must increase its assets further to avoid liquidation

Another ratio is a quick ratio, which helps an investor identify how the company can pay its investors using the most liquid assets. This means that the current liabilities should be paid using the most liquid assets, such as cash. Therefore, inventory is obstructed from the current assets before dividing the result by the total current liabilities. From the computations, in 2021, Amazon recorded a quick ratio of 0.906, which had increased from 0.86 in 2020. A good quick ratio should be greater than 1 to show that the company’s most liquid assets could not meet the standards of paying all current debts. In the two fiscal years, the company was at risk of facing liquidity problems. Despite that the 2021 quick ratio had improved from the previous year, there is a need for the management of the company to increase its assets as a way of increasing its liquid assets to improve financial stability.

The gross profit margin ratio helps in determining the profitability of an organization. A healthy profit margin is attained at 10% and more. This will show that the company is getting a profit of more than 10% on the amount invested hence financial stability. Investors and financial analysts use the profit margin to determine whether the firm is viable for investments in other projects by referring to its profit. In 2020, the gross profit margin ratio of 39.57% increased to 42.03% in 2022. This clearly indicates that Amazon s financial stability is based on the firm’s gross profit. In 2021, the ratio will increase by almost 4%, which predicts that the company will make a good investment for the investors.

Comparing the return on the invested capital for the two years will also give an investor the information needed for decision-making before venturing into the investments. The ROIC expresses the recurring operating profits as a percentage of the company’s operational assets. The ROIC for Amazon Inc. in 2020 was at 0.228, which increased to 0.241 in 2021. From the two financial years, it is clear that the company is making value from its invested capital as the ratio is more than 2%. However, in 2021, the ROIC was more than in 2020, showing the company’s business is increasing.

Comparison with the Industry Average

Amazon Inc. is operating in the retail and internet industry. The company is in the same industry as Walmart. The current ratio of the industry stands at 1.16, meaning that the average companies in the industry can easily manage their current debts. However, the Current ratio of 1.136 for Amazon Inc. is less than the industry’s average rate, hence creating a need for improvement in assets management. The average quick ratio for the retail industry is 0.61, and this is lower than the 0.906 Amazon Inc. quick ratio. The quick ratio for Amazon suggests that the company effectively manages its liquid assets more than other companies in the industry. Furthermore, the average profit margin for the retail and internet industry in the USA is 10%, which shows that Amazon is generating huge profits as it has a gross profitability ratio of 43.04%. Lastly, the average ROIC for the industry is at 16.6%, indicating that Amazon is doing well as its ROIC is at 24.1%.

The Risk Facing the Company

The major financial risk facing Amazon based on the financial ratios is liquidity problems increasing competition, profit potential uncertainty, and share price Volatility. However, this is not true for the entire industry. With share price volatility, investors find it hard to invest with the company as they are not guaranteed future returns. Stiff competition from major competitors like Walmart minimizes the company’s investment. Being in a competitive industry, the management of Amazon should strategize ways to improve its financial investments.

Recommendations for Individuals who Invested in Amazon

From the computed ratio, an investor venturing into business with Amazon should expect good future returns as a result of the huge profits generated by the company. An investor will also enjoy lower capital expenditure in correspondence with good future returns. Therefore, a potential investor should consider investing in Amazon by buying shares on the stock market exchange. The beta of the company presents risk volatility when compared to within the industry. The beta of the company is at 2.2, and this exposes the company to financial risks since it deviates from the beta of the industry, which is at 3.2. Therefore, companies need to invest in promoting financial investments such as stocks, bonds, and treasury bills. This will facilitate diversifications of investments hence mitigating financial risk volatility.

Recommendations to Increase the Value of the Company

The value of Amazon Inc. can be increased by the actions of the company diversifying its products and services as well as increasing its investments. Through this, the company will be able to generate steady cash inflows, which prevents the firm from financial liquidation. From the ratio analysis, it is clear that the company is at risk of getting into liquidation problems hence a need to venture into investments that increase the assets of the company.

Project Projections

References

Hatem, E., & Alshmrani, M. (2021). An analytical view of Amazon success in the worldwide. Life Science Journal, 18(6).

Appendix 1